PARTNER CONTENT

This content was paid for by SSAB and produced in partnership with Automotive Manufacturing Solutions

Industry awareness is high, but challenges remain around cost effectiveness, recycling targets, and terminology

Automotive manufacturing, as with all other industry verticals, is on a long journey to sustainability. Steel remains the dominant material utilised in automotive manufacturing, and steel production is a highly energy intensive process. Therefore, one of the major challenges in decarbonising automotive manufacturing is developing sustainable steel production processes.

AMS and leading sustainable steel supplier SSAB partnered in this industry-wide survey, which invited AMS’ global audience of over 54,000 automotive manufacturing specialists to contribute their industry expertise.

The goal of the survey was to identify the key issues faced by automotive OEMs, tier suppliers, and other stakeholders within the automotive supply chain in transitioning to sustainable steel. The survey not only focuses upon the immediate challenges for sustainable steel, but also examines a range of other factors including manufacturing processes, sustainability initiatives, recycling and brand awareness.

Key findings

Sustainability: More than half (57%) of the respondents are prioritising sustainability when selecting a steel supplier.

Sustainability objectives: ‘Lowering carbon footprint’ (48%) was the leading objective, followed by ‘Recycling/scrap content’ (33%), and ’Environmental regulations’ (32%).

Sustainability initiativesawareness: ‘Fossil-free (direct reduction with green Hydrogen)’ had high levels of awareness, while ‘Allocations/mass balancing’ had low levels of awareness.

Sustainability initiatives interest: ‘Fossil-free (direct reduction with green Hydrogen)’ had a high level of interest, with ‘Allocations/mass balancing’ a low level of interest.

Recycling targets: Around half of those surveyed (54%) did not have any recycling targets or target year in place.

Recycling agreements: Only 29% had made any recycling agreement, compared to 46% which had not, and 30% ‘Don’t know’.

Challenges: ‘Cost effectiveness’ (74%) was by far the dominant challenge.

Benefits: All factors were fairly similar when choosing a steel supplier.

There are many positives to be taken from this survey. First and foremost, sustainability is clearly being prioritised amongst most automotive industry professionals. Furthermore, the level of awareness and interest around sustainable steel is generally very good, however there are clearly areas for improvement, such as defining and communicating sustainable steel terminology, improving recycling targets and agreements and communicating that sustainable steel is cost effective.

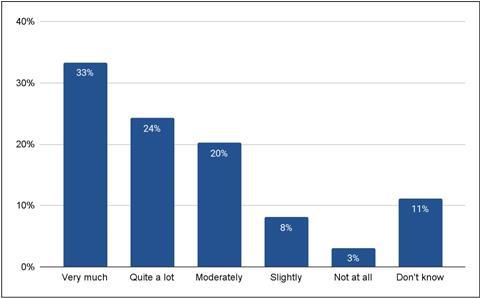

When we asked our audience how much their company considers sustainability aspects when choosing a steel supplier, the leading response (33%) indicated that they were ‘very much’ considering sustainability aspects, with 24% saying they were considering it ‘quite a lot’, 20% ‘moderately’ and 8% ‘slightly’.

What these results clearly indicate is how high up the agenda sustainability has already become and is an encouraging sign for the future development of sustainable steel within the automotive industry. In fact, for most of the industry, a combined total of 57% of the respondents were prioritising sustainability when selecting a steel supplier.

Figure 1: ‘How much does your company consider sustainability aspects when choosing a steel supplier? (Please select from 1 - 5)’

Sustainability objectives

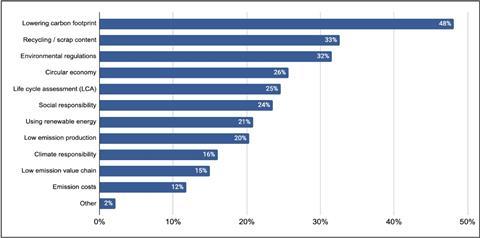

When it comes to sustainability, we asked respondents which three objectives are most important for their company. Most respondents (48%) said that ‘lowering carbon footprint’ was the priority, followed by ‘recycling/scrap content’ (33%) and ‘environmental regulations’ (32%).

SEE THE FULL SURVEY RESULTS ON THE AMS WEBSITE USING THE QR CODE:

However, beyond the top three answers, there was also a broader range of objectives cited by the respondents, including the circular economy, life cycle assessment, social responsibility, using renewable energy and low emission production. This wide range of responses would seem to indicate that respondents all viewed sustainability from a slightly different perspective, suggesting that when promoting sustainability, the choice of words, terminology and meaning will be critical in getting that message across.

Figure 2: ‘When it comes to sustainability which objective is most important for your company? Please select the top three issues.’

Sustainability initiatives awareness

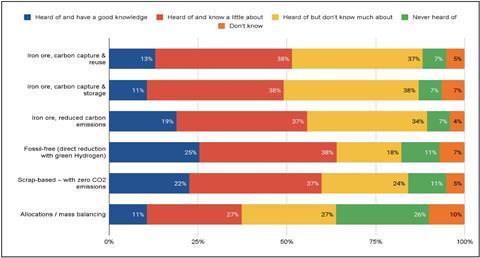

When it came to the level of awareness of the various types of sustainability initiatives,

‘fossil-free (direct reduction with green hydrogen)’ had the highest level of awareness, with ‘heard of and have a good knowledge’ accounting for 25% of respondents, and ‘heard of and know a little about’ accounting for 38%.

However, ‘allocations/mass balancing’ had the lowest awareness levels. The mass balance method is used to assign emission reductions or a share of sustainable product (such as recycled scrap metal) to a portion of the entire production. Only 11% of respondents said they ‘heard of and have a good knowledge’ of the approach, with 27% of respondents reporting they knew little about it and 26% having never heard of it.

Figure 3: ‘Which of the following sustainable steel process technologies do you have knowledge of? Please rank each.’

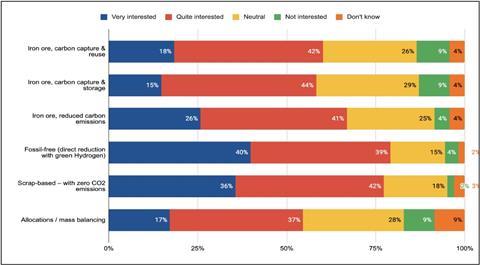

Sustainability initiatives interest

We then asked a similar question, but this time seeking to understand the levels of interest in the various sustainability initiatives.

Once again, ‘Fossil-free (direct reduction with green hydrogen)’ had the highest level of interest, with 40% saying they were ‘very interested’ in the initiative, and a further 39% responding they were ‘quite interested’.

However, confirming the previous results, ‘allocations/mass balancing’ had the lowest level of interest, with only 17% saying they were ‘very interested’, 9% saying they were ‘not interested’ and a further 9% who said they ‘don’t know’.

TO ACCESS THE FULL SURVEY REPORT CLICK here

Figure 11: ‘What is your level of interest in the following initiatives? Please rank each.’

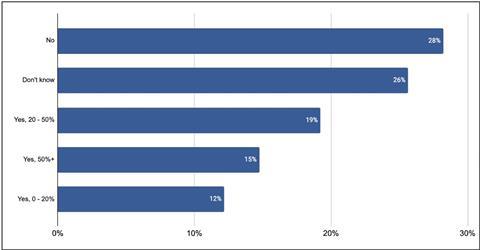

Recycling targets

More than half of respondents (54%) said they either hadn’t set up a target for recycled steel content (28%) or didn’t know if they had set one. Of those who had set up targets, most (19%) were targeting 20-50% recycled steel content. Perhaps of most concern is that only 15% of those with targets have recycled content targets of 50% or more, indicating that there is still a long way to go before automotive steel can become majorly or even fully recycled.

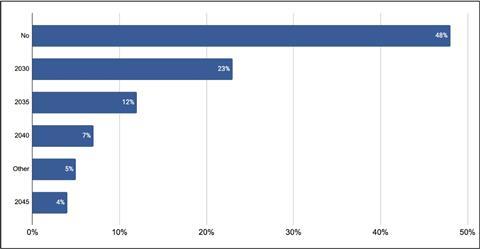

Following on from this question, we asked respondents who had set a target if they had specified a year to reach their goal, and most replied ‘no’ (48%), which suggests that there are real challenges ahead in recycling the steel content within automotive manufacturing. Of those who had set a target year, 23% said they were aiming for 2030, 12% for 2035, 7% for 2040 and 4% for 2045.

Figure 12: ‘Have you set up a target for recycled steel content?’

Figure 13: ‘And if so, have you set a year for that target?’

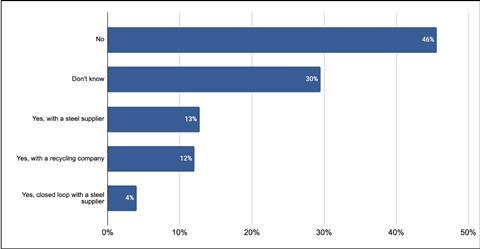

Recycling agreements

When we asked survey respondents whether they had made an agreement for recycled steel, the resounding response was negative, with an emphatic ‘no’ (46%), followed by ‘don’t know’ (30%).

Only a combined 29% had made any recycling agreement, with 13% having made one with a steel supplier, 12% with a recycling company, and 4% in a closed loop agreement with a steel supplier.

This highlights that recycling agreements are one of the key areas of weakness with real scope for improvement as we attempt to transition to sustainable steel within automotive manufacturing.

Figure X ‘Have you made an agreement for recycled steel? Select all that apply’

Challenges

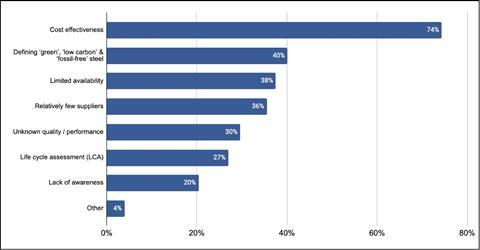

When it comes to the challenges in adopting sustainable steel, ‘cost effectiveness’ (74%) was by far the dominant issue, scoring nearly twice as much as all other issues.

In a distant second place was the issue of ‘defining green, low carbon and fossil-free steel’ (40%), followed closely by ‘limited availability’ (38%), ‘relatively few suppliers’ (36%), ‘unknown quality/performance’ (30%), ‘Life Cycle Assessment (LCA)’ (27%), and ‘lack of awareness’ (20%).

This result very clearly signals that cost is the overwhelming factor in constraining the transition to sustainable steel within automotive manufacturing.

Figure 14: ‘What are the perceived challenges in adopting sustainable steel? Please select the top three issues.’

Benefits

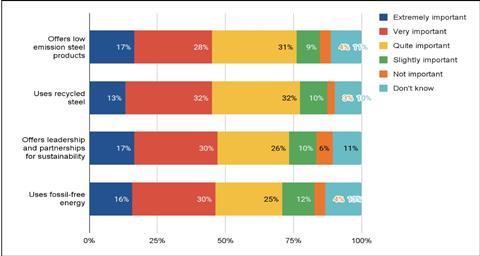

Moving on to how important the benefits are when choosing a steel supplier, overall, the responses were quite similar and indicated that all benefits including low emissions, recycled steel use, leadership and partnership opportunities for sustainability and use of fossil-free energy were all important.

Figure 16: ‘How important are the following benefits when choosing a steel supplier? Please can you rank each.’

DOWNLOAD THE FULL SURVEY REPORT HERE

Interested in learning more about the topic? Join our “Sustainable Steel Automotive Manufacturing Survey 2024 Webinar” on June 13 for a cutting-edge discussion on the key manufacturing and other challenges faced by automotive OEMs, tier suppliers and other stakeholders across the automotive value chain.

No comments yet