UK vehicle production slips behind global leaders as China and North America accelerate EV manufacturing, trade alignment and industrial policy

AMS explores why the structural forces behind Britain’s vehicle production are in decline, contrasting it with the strategic clarity and industrial momentum driving EV investment across North America, and preeminently.

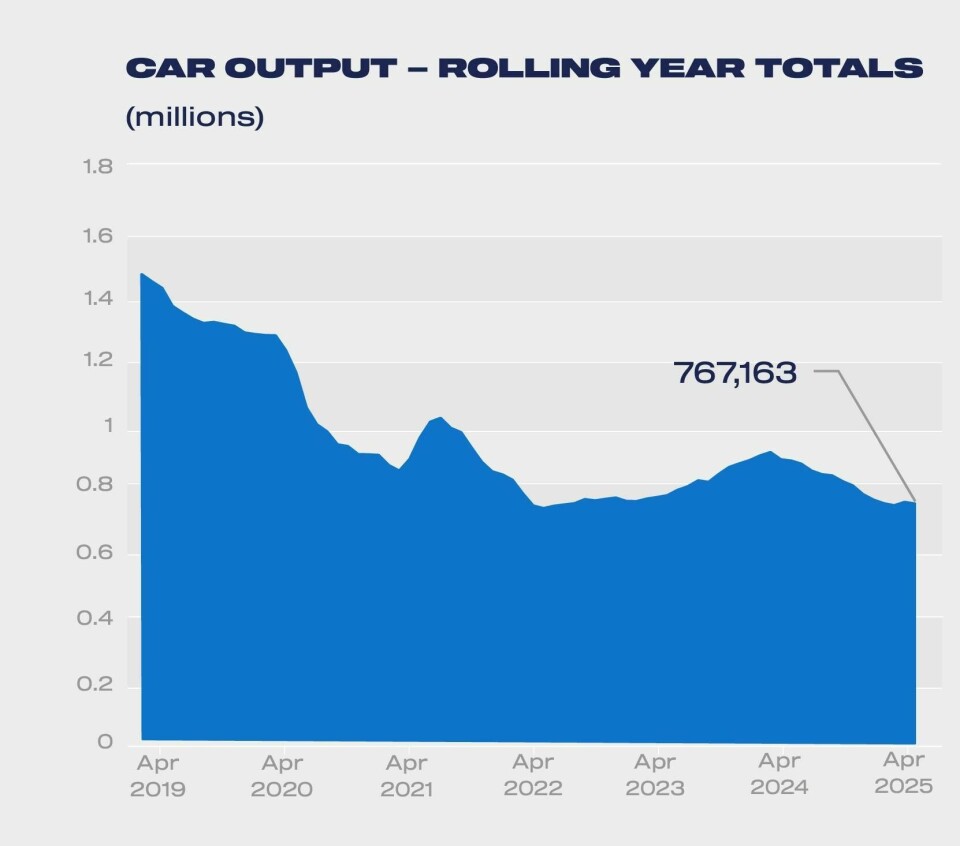

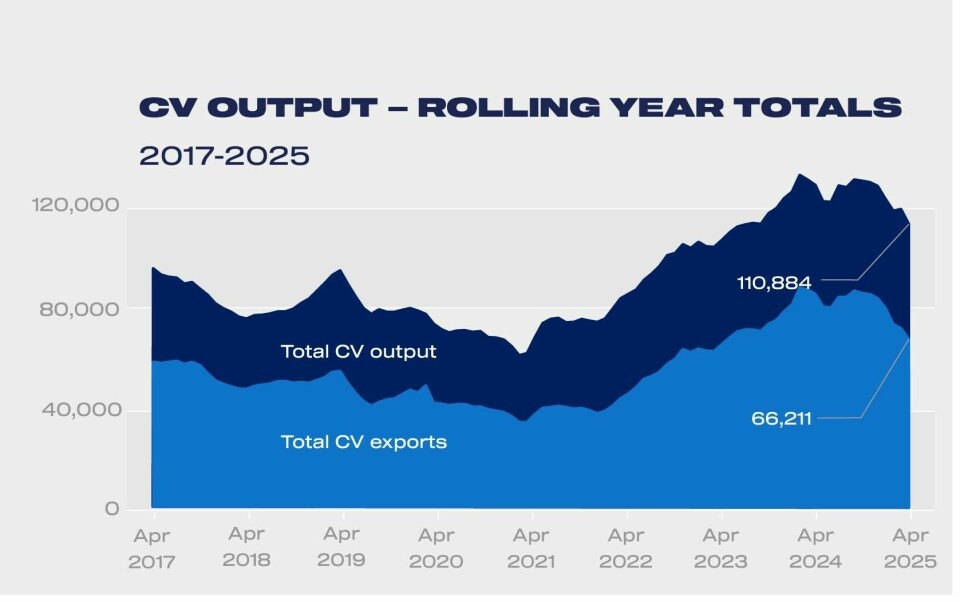

The latest slump in British vehicle manufacturing is not simply a domestic concern, but a global warning signal that the automotive centre of gravity is shifting. As UK car and commercial vehicle output fell to its lowest April total since 1952, its manufacturing peers across North America and China continued to expand production and investment. These contrasting trends reflect deeper structural forces - government strategy, trade policy, technological adoption and, increasingly, geopolitical fault lines.

While UK factories turned out just 905,000 vehicles in 2024, a drop of nearly 12%, North America assembled some 15.5 million, regaining lost ground after chip shortages and labour strikes. Mexico alone broke production records, driven by strong exports to the US.

China, by contrast, remains a class apart. It built more than 31.3 million vehicles last year, and now produces roughly one in every three cars globally. The disparity is no longer cyclical; it is systemic.

Global EV race production pains and market realities

The transition to electric vehicles (EVs) further magnifies this divide. Britain has struggled to convert policy ambition into production reality. In 2024, UK EV output fell by more than 20% amid policy backtracking, inadequate battery capacity and consumer caution.

Automakers hesitate to commit long-term capital when political targets shift - as they have with the UK’s recent decision to delay the ban on new petrol and diesel cars to 2035. It is a mixed signal in a capital-intensive industry that thrives on predictability.

North America has moved with more purpose. The Inflation Reduction Act, laden with tax credits and subsidies, has unleashed over $250 billion in EV-related investment, from cell plants to gigafactories. Yet production has outpaced demand. General Motors, Ford and others have been forced to revise down their near-term EV targets as buyers prove more sceptical than the legislation assumed. The result is a curious imbalance: abundant investment, uncertain returns.

Should UK production take a leaf out of China’s playbook?

Domestically at least, China faces no such hesitation. In 2024 it built nearly 13 million so-called new energy vehicles - battery electric and plug-in hybrids - accounting for more than 40% of its total output. Nearly half of all passenger cars sold in China last year were electrified, an astonishing shift achieved through consistent subsidies, tight regulatory quotas and industrial scale.

China now dominates the global EV supply chain, from refining battery minerals to producing complete vehicles. Western carmakers operating in China find themselves marginalised by local firms that are faster, cheaper and increasingly technologically superior.

”Without policy consistency, infrastructure investment and strategic clarity, Britain risks becoming a peripheral player in a transformed automotive world”

Geopolitics is reshaping the automotive production industry

Trade, once an enabler of efficiency, is now a battleground. British manufacturers are still reeling from Brexit-related rules of origin and US tariffs. Jaguar Land Rover, for instance, continues to pay nearly 30% in combined duties on its UK-to-US exports - hardly a recipe for global competitiveness. Although a new trade deal promises to lower that burden, its delayed implementation underlines the UK’s fragility on the world stage.

North American automakers, meanwhile, are benefiting from a ringfenced ecosystem. The US-Mexico-Canada Agreement has reinforced regional sourcing, while the Inflation Reduction Act effectively ties EV incentives to domestic content. Foreign firms are following the money, opening factories on American soil to qualify for subsidies.

Join Us In Detroit This October To Find Out How Strategy Becomes Scale

As North America accelerates EV investment and regional supply chains, the Automotive Manufacturing North America summit offers a front-row seat to this industrial realignment.

Join leaders from GM, Ford, VW, Stellantis, Toyota and others on 22–23 October 2025 at The Henry Hotel, Detroit, to understand how the region is converting policy into production - while others, like the UK, struggle to keep pace.

Yet as geopolitics intrudes - especially in the US-China relationship - the risk of retaliatory tariffs and fragmented supply chains looms larger.

China, again, is ahead of the curve. In 2024, it exported nearly six million vehicles, more than any other nation. It has quietly become the world’s largest exporter of EVs, including to markets that once seemed impervious to its brands.

As protectionist sentiment rises, particularly in Europe and the US, Chinese firms are pre-emptively localising production overseas. BYD, Chery and others are building plants in Thailand, Brazil and potentially Europe to hedge against future trade barriers. Where China cannot sell freely, it will build locally.

The UK rebuilds slowly and North America rapidly onshores while China leads production

Against this backdrop, investment is the ultimate test of strategic intent. The UK, after years of stagnation, is beginning to see the green shoots of reinvestment. Tata’s planned gigafactory in Somerset, Nissan’s retooling of Sunderland, and Stellantis’ transition to electric vans at Ellesmere Port all signal renewed industrial purpose. But these are modest steps in a race that rewards speed and scale. By contrast, North America is in the midst of an investment super-cycle. From Ford’s BlueOval City in Tennessee to VW’s battery plant in Ontario, the continent is racing to onshore the EV supply chain.

Nearly 80% of EVs sold in the US last year were assembled locally - a figure that will rise as new capacity comes online. Canada and Mexico are positioning themselves not merely as low-cost appendages, but as strategic partners in a more regionalised industry.

Read more Automotive Production Analyses

- ‘Restructuring’: Volvo cuts 3,000 jobs as EV demand continues to falter

- AMS/ABB Automotive Manufacturing Outlook Survey 2024 results

- Despite industry fears, global EV sales reach record highs

- Why Statevolt is building a gigafactory in the UAE instead of Europe

China, meanwhile, remains the workshop of the world, particularly for EVs. It not only produces the vehicles - but also the batteries, semiconductors and software that power them.

The region’s costs are low, its scale vast, and its brands learning fast. As Western countries attempt to de-risk and decouple, they must do so without losing the internal optimisations, the cost-efficiencies and technological momentum that China currently provides.

The message for UK policymakers and manufacturers is stark. Without policy consistency, infrastructure investment and strategic clarity, Britain risks becoming a peripheral player in a transformed automotive world. The shift to electrification is no longer hypothetical. It is happening, and at speed, and some countries are building the future, while others are watching it pass them by.