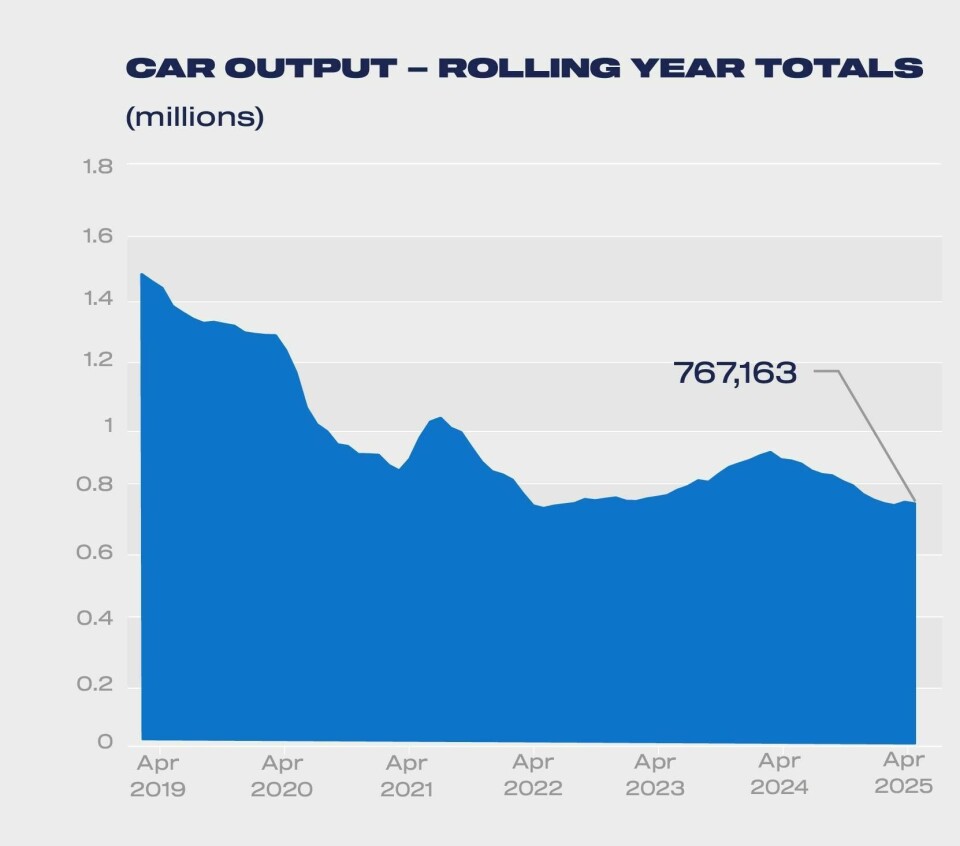

UK automotive production hits lowest April level since 1952 as exports falter and policy uncertainty clouds EV transition

UK car and commercial vehicle production fell sharply in April, marking the worst start to a year since 2009. As exports decline and policy uncertainty looms, the industry calls for urgent action to restore competitiveness and support the EV transition.

“To take advantage of these trading opportunities we must secure additional investment which will depend on the competitiveness and confidence that can be provided by a comprehensive and innovative long-term industrial strategy”

In April 2025, the United Kingdom’s automotive industry experienced its lowest vehicle production for the month since 1952, excluding the pandemic-impacted April 2020. According to the Society of Motor Manufacturers and Traders (SMMT), total car and commercial vehicle output fell by 15.8% year-on-year to 59,203 units.

Car production declined by 8.6% to 56,534 units, while commercial vehicle output plummeted by 68.6% to 2,669 units. The SMMT attributed these declines to a combination of factors, including the later timing of Easter, which resulted in fewer production days, model changeovers, and reduced demand in key export markets.

Exports were particularly affected, with car exports falling by 10.1% and commercial vehicle exports dropping by 75.8%. Shipments to the EU and US, the UK’s largest export markets, decreased by 19.1% and 2.7% respectively. Conversely, exports to China and Turkey saw increases of 44.0% and 31.2%.

Mike Hawes, SMMT Chief Executive, stated, “With automotive manufacturing experiencing its toughest start to the year since 2009, urgent action is needed to boost domestic demand and our international competitiveness.

”Government has recognised automotive manufacturing’s critical role in driving the UK economy, having successfully negotiated improved trading conditions for the sector with the US, EU and India in the space of a month.

“To take advantage of these trading opportunities we must secure additional investment which will depend on the competitiveness and confidence that can be provided by a comprehensive and innovative long-term industrial strategy. Get this right and the jobs, economic growth and decarbonisation will flow across the UK.”

The EV transition is has not been a smooth one

The industry’s shift from petrol cars to electric vehicles (EVs) has also temporarily reduced output. The UK government’s recent decision to relax sales targets for EVs and reduce fines for cars that do not meet certain emissions standards has added to the uncertainty, making planning more difficult for carmakers.

Jaguar Land Rover (JLR) is among the manufacturers feeling the impact. The company is paying 27.5% tariffs on everything it ships to the US, which it said is costing it “a huge amount of money.”

JLR sends cars from its UK business to its US business, meaning it pays both export and import taxes on any cars it sends across the Atlantic. The company also expressed frustration that the new deal agreed in early May between the UK and US to reduce tariffs on cars to 10% up to a quota of 100,000 vehicles is taking so long to come into effect.

It is worth noting that some of the global pressures may be stronger in the UK, such as fewer trade barriers against Chinese imports compared to the EU and US. The UK’s change in policy over encouraging more manufacturing of EVs had also made planning more difficult for carmakers.

UK has seen some critical shutdowns but there are still signs of potential growth

In recent years, the UK has seen producers such as Honda and Ford shut down plants. Last year, Stellantis, which makes Vauxhall, Citroen, and Peugeot cars, warned it may have to halt UK production due to uncertainty over the government’s approach to EVs.

Despite these challenges, there are signs of potential growth. Toyota, the world’s largest car manufacturer, is planning a £41 million investment at its Burnaston plant in Derbyshire to establish a new production line for the GR Corolla. This move could introduce the GR Corolla to the European market for the first time and reflects Toyota’s continued confidence in UK manufacturing.

With the UK automotive industry navigating turbulent times, the need for a comprehensive and innovative long-term industrial strategy becomes increasingly critical to restore competitiveness, attract investment, and support the transition to electric vehicles.

From UK Lows to Detroit Decisions: The Future of Vehicle Production

As UK vehicle output hits historic lows and global OEMs recalibrate for an electric and protectionist age, the stakes have never been higher.

Join executives from Ford, GM, Toyota, Stellantis and others at Automotive Manufacturing North America, 22–23 October 2025 at The Henry Hotel, Detroit—where the future of production will be decided.

Miss it, and risk falling behind…