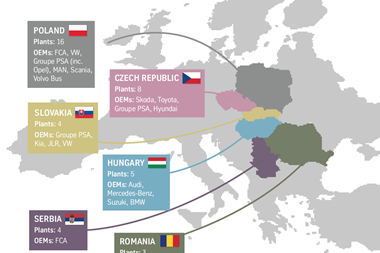

The impact on tariffs and especially of uncertainty in key trading regions including the US, China and Europe are having real impacts on decisions regarding automotive investment and production, according to a new report by Automotive from Ultima Media’s new business intelligence unit.

Ongoing sanctions by the US government on China, Iran and Russia are escalating a global trade war that has hit consumer confidence and contributed to falling demand for new vehicles and reverberating across OEM and automotive supplier manufacturing footprints.

The impact on China, which is heading for its second straight year of declining vehicle sales, is significant for the global automotive sector, including the profits of major vehicle manufacturers.

Tariffs are also making raw materials, components and ultimately finished vehicles all more expensive for the consumer, which is impacting sales volumes.

From the OEMs and automotive supplier perspective, all of this is impacting confidence to invest in new models, production capacity and new products. The spectre of a no-deal Brexit, for example, and its impact on tariffs and just-in-time supply chains, has essentially shut down automotive investment in the UK.

According to Daniel Harrison, automotive analyst at Ultima Media, the real issue is one of uncertainty, as he outlines in a new forecast and report on the state of the global automotive sector.

“Industry could plan if it knew for certain what the trade tariffs were going to be,” writes Harrison. “The business risk therefore comes, not from the tariffs per se, but from the erratic, unpredictable outlook of a trade war with a trajectory determined by the whim of President Trump’s latest tweet.”

Harrison’s report, ‘Automotive headwinds align into a perfect storm’, is the first in a series of analysis and research from Ultima’s new global automotive business intelligence unit.

A full copy of the report is available to download for free below for signed in users of AMS.

Downloads

Automotive headwinds align into a perfect storm_Ultima Media

PDF, Size 8.61 mb

No comments yet