Arno Güllering, DRÄXLMAIER

How Arno Güllering wants DRÄXLMAIER Group to harness shopfloor visualisation and genAI in production and maintenance

The tier-1 supplier has established a highly connected production and logistics network, with a strong emphasis on data visualisation and a roadmap for AI. But to stay competitive and resilient, COO Arno Güllering wants to ensure both plants and HQ have a mindset ready to embrace change.

Since joining the tier-1 supplier in 2024, Güllering has been impressed with the level of connectivity and data visualisation in production, especially in key developing markets such as Mexico and Tunisia

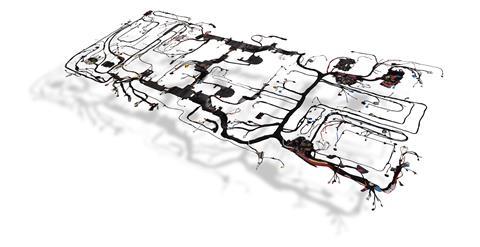

Soon after Arno Güllering joined the Dräxlmaier Group as chief operating officer in summer 2024, he set out on a global tour across many of the automotive supplier’s 60 factories in more than 20 countries. Güllering, who is responsible for manufacturing and logistics across the group’s four business units in wiring harnesses, interior, electrical component and battery systems, was immediately struck by the operational quality at the company (which is officially written as DRÄXLMAIER Group but will be referred to as Dräxlmaier Group as per AMS editorial style).

Underpinning this success, according to Güllering, has been a concerted focus on digitalisation at the company, including high levels of material and inventory transparency, digital cockpits to visualise data and track shopfloor operations and a growing focus on root-cause analysis in areas like quality and maintenance.

“Walking around the plants you see data panels and monitoring boards across workstations, which show how deeply digitalisation is embedded,” says Güllering. “It’s one of the advantages of being a family-owned business with a strong innovation culture.”

Güllering, who has worked nearly 30 years in manufacturing roles including at automotive suppliers Schaeffler and ZF, has also been impressed by the advanced levels of cloud and data integration across all its plants, which has helped the company to leverage machine learning and artificial intelligence applications. As of today, for example, the Dräxlmaier Group has more than 30 active use cases for AI in its production, including in error detection and machine optimisation.

Across these early plant tours, Güllering found some of the most innovative and engaged digitalisation efforts among plant leaders in emerging markets like Mexico, Tunisia and eastern Europe, which are important locations for the group’s labour-intensive wiring harness production. These managers have set benchmarks for the company in areas like shopfloor visualisation and integrating digital tools into processes.

“These plant managers tend to be very receptive to digitalisation, and you can see it on the shopfloors with fewer paper-based processes and more user-friendly interfaces for monitoring production data and machines,” says Güllering.

It’s a mindset and openness which he wants to instil across the company, including at the Dräxlmaier Group’s headquarters in Vilsbiburg, near Munich. For Güllering it is essential to combine a “bottom up” approach to digital innovation together with a centralised investment and technology roadmap across the company. “We have good visualisation tools for high-level data, but we’re still working towards full digitisation of day-to-day operations and creating a truly digital mindset,” he says.

The change in approach is not just a matter of keeping up with the latest trends. For Güllering, digitalisation initiatives are now competitive imperatives for automotive suppliers like Dräxlmaier. He expects efficiency gains from technology and automation to help mitigate rising costs and manage market and supply chain disruptions, from lower-than-expected production for electric vehicles and batteries, to risks from tariffs. To remain profitable, competitive and resilient, automotive suppliers will need significant efficiency and performance gains from digitalisation – otherwise they will need to make plant and operational cost reductions that could impact quality and customer service.

A roadmap for digitalised operations: networked, visualised, automated

Across end-to-end processes, the Dräxlmaier Group is undergoing a wide digital transformation programme, including for planning, finance, procurement and sales. There are system changes across operations, including migrating its legacy ERP to the cloud with a phased shift to SAP S4/HANA at plants, a new manufacturing execution system (MES) based on SAP requirements, as well as an integrated product lifecycle management (PLM) tool from Siemens.

Dräxlmaier started to connect its plant equipment to the cloud as far back as 2016, and has since achieved consistent data semantics across facilities, as well as adding Power BI self service across the shopfloor

Alongside this enterprise upgrade, the company has been implementing a comprehensive, practical set of digitalisation initiatives across specific groups with defined business capabilities across shopfloor appearance, data management, AI, quality, logistics planning and maintenance. Individual specialists lead each area with a focus on accelerating rollouts across the company.

“It’s about a mindset shift, from ERP-driven to digital-first,” says Güllering. “Ten years ago, digitalisation was an IT topic managed centrally in some ivory tower in the headquarters. We still need centralised IT and ERP, but we also need decentralised teams in the plant network. Innovation must flow from plants to HQ and back.”

The progress visible today in operations, especially in areas like AI, began nearly a decade ago with efforts to better connect IT and OT at plants. In 2016, the company started to implement the OPC Unified Architecture data exchange standard to better network factories and machines to the cloud. An in-house development team at the company also created standard interfaces for machines without OPC UA exchanges, which helped it to achieve consistent data semantics across its plants by 2019.

With this strong baseline for data storage and analysis, the Dräxlmaier Group deepened visibility and monitoring of its operations, implementing tools to visualise logistics, production and product data, and developed a standardised shopfloor appearance across all its plants. In 2022, it rolled out a Power BI self-service tool across operations, which has helped plant leaders to track and monitor operations, such as quality, inventory and equipment analysis.

“People across the world in our plants can develop their own dashboards and use the data to improve productivity,” says Güllering.

For example, a production visualisation tool, which employees can access by tablet or smartphone, features four levels of insight: an overview of all factories, individual plant layouts, specific shopfloor layouts and individual equipment and equipment details based on the product portfolio, with information that helps teams to carry out more root cause analysis of performance and equipment issues.

“It’s about a mindset shift, from ERP-driven to digital-first. Ten years ago, digitalisation was an IT topic managed centrally in some ivory tower in the headquarters. We still need centralised IT and ERP, but we also need decentralised teams in the plant network. Innovation must flow from plants to HQ and back.”

The data displayed varies based on the product and levels of automation. Fully automated plants, including those for battery system assembly, will show more information on machine condition, efficiency and downtime monitoring; less automated plants, including those for wiring harnesses, focus more on end-of-line quality data, including rework and scrap levels.

With common datasets and greater data visualisation across plants, the Dräxlmaier Group has turned to machine learning and AI applications to assess quality and carry out root cause analysis, with active examples in error detection and machine conditioning.

The next phase of initiatives is in ‘autonomous automation’, as the group explores generative AI (genAI), including AI agents to assist in data sorting and real-time analysis of equipment patterns to identify potential quality or maintenance issues.

Watch Arno Güllering in conversation with Christopher Ludwig

AI in manufacturing: a diamond among the flowers

Güllering sees greater potential for efficiency by deepening data visualisation and analysis for shopfloor operation, as well as scaling up AI tools in planning, quality and maintenance. The company now has two work streams running, including in classic machine learning and AI, as well as for genAI.

The Dräxlmaier Group began implementing classic AI applications in its operations in 2021, including several now in serial production. In one notable example, called ‘Daisi’, a machine using computer vision scans images of interior parts at the end of production and uses an AI-based algorithm to detect potential errors and variation in surface quality.

Dräxlmaier currently has use cases for AI in production in areas including surface quality checks, and is testing platforms to use generative AI to help manage and predict repair and maintenance

In another application, called ‘Diamont’, the group uses AI to monitor an injection moulding machine, assessing quality cycles and predicting future outcomes. “As our premium customers expect 100% quality, these applications help us to detect potential errors or faults without being reliant on human judgement,” Güllering says.

The company plans to expand the use of both applications across its factories over the next two years, along with other machine learning and AI applications to its digital shopfloor boards.

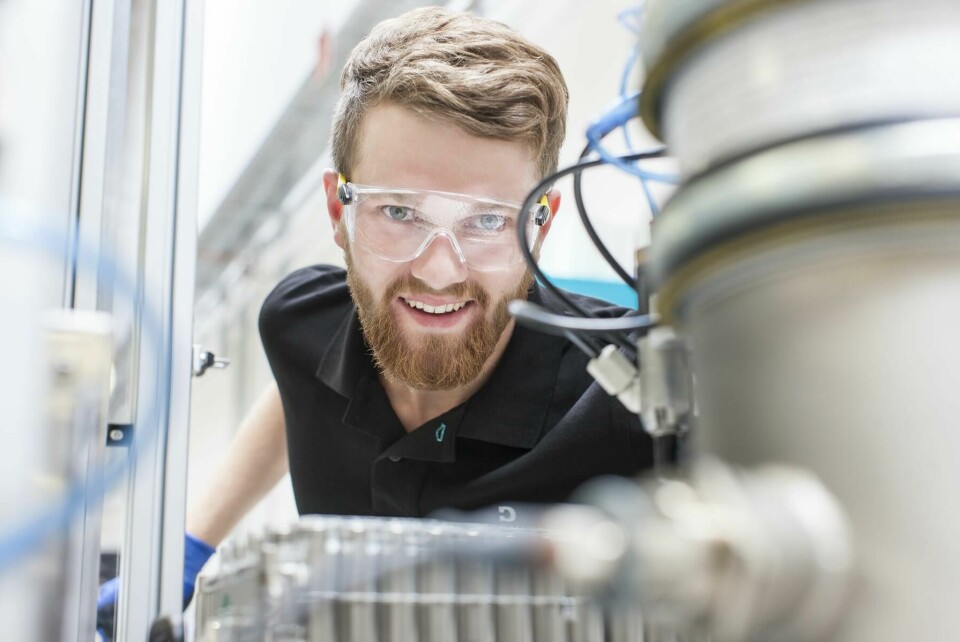

The Dräxlmaier Group has also deepened its exploration of genAI applications and platforms in production. It has kicked off studies this year to test and evaluate how tools like Microsoft Copilot and ChatGPT can assist employees, including the use of AI-based agents and chatboxes for document scanning and work orders. Although early in this analysis, Güllering is excited by genAI’s potential for predictive maintenance for manufacturing equipment, for example in analysing complex data and documentation, and identifying patterns ahead of potential faults.

In one pilot at a battery systems plant, for example, staff are using genAI to check the repair history of machines and to access datasheets. Eventually they will be able to use voice commands to open maintenance orders, assign specialists and complete documentation. “It’s early days but the results are promising,” says Güllering.

The company aims to implement a genAI platform for maintenance, which would replace existing manual processes and run on tablets and smart phones. Güllering envisions a system that would show all repair history, downtimes and recent changes, and make recommendations to prevent breakdowns.

Overcoming fears of AI in data and job security

Even with a structured roadmap for production technology and AI, Güllering admits that there is still trepidation in how the company should use tools like genAI. Many cite concerns in data and IP security, for example. There may also be gaps in understanding and what to prioritise in terms of AI tools.

Arno Güllering points to initiatives at Dräxlmaier Group to overcome barriers to scaling AI and genAI, including sharing more use cases with the management board to help evaluate costs, benefit and prioritisation of projects

Güllering sees regular exchange and coordination with central management as essential to better understanding technology and making strategic decisions. He is confident that, with the right platform and security measures, data privacy and security can be maintained, and that use cases will further help to allay such fears.

It is also essential to ensure that new ideas and innovations are shared across the network, including with top management. Whilst he cites a good exchange between plants, a newly launched ‘Digitalization Podium’ aims to prove dialogue with the management board. Plant and operations teams present AI uses cases to the board, including evaluations on cost, benefit and experience. “With this exchange we can best share the best examples and experiences, as well as better prioritise use cases,” he says.

Güllering also acknowledges that some employees on the shopfloor may fear that their roles will be put at risk by rapid advances in genAI and digitalisation. On the contrary, he thinks that it will help to enhance quality, output and employee satisfaction on the shopfloor.

“At the Dräxlmaier Group, we work closely with premium OEMs who continue to require very high variation in production, and variety remains the enemy of the type of standardised automation, robotics and digitalisation that would have a big impact on jobs.”

“Even in highly automated plants, up until now we often don’t really know the root cause of a downtime event, and we rarely store that information for future use. GenAI can help with that.”

Dräxlmaier aims to accelerate AI and digitalisation advances by ensuring a ‘critical mass’ of specialists in plants, from PLC programmers, IT experts as well as specialists in tools and data visualisation

Instead, he expects genAI to help with data evaluation, including for material flow, inventory and downtime reduction. “Even in highly automated plants, up until now we often don’t really know the root cause of a downtime event, and we rarely store that information for future use. GenAI can help with that.”

But these gains won’t be realised without education, training and support from plant and top management. That is why the Dräxlmaier Group wants to empower subject matter experts as leaders across its initiatives, who in turn will help to train and encourage specialists at every plant. “We’re working on building a standard ‘critical mass’ of local specialists who will be able to implement and support others in using new tools,” says Güllering.

Further training and development in technical and equipment experts will also be important, and the company has been increasing staff and in-house competences in equipment manufacturing, as well as PLC (programmable logic controller) programmers who write code for industrial automation. He also wants to see wider industry and education focus on technical training in mechatronics and IT.

Ultimately, Güllering stresses the urgency for companies to embrace change and technology more readily – citing plant leaders as one of the most essential drivers. “Realising the potential of AI in operations and hitting our efficiency targets won’t come top down, but will need local champions,” says Güllering. “Plant managers are big players and will need to embrace these new approaches. We are already seeing a lot of success.”