As carmakers strive to reach the more stringent CO2 emissions targets being phased in across the EU next year, we predict that many are likely to put more pressure on their supply base to help reduce emissions

Whilst this push will bring opportunities for automotive suppliers – such as the further development of electrified powertrains and implementing lightweight materials – many may struggle under the cost and investment requirements.

At Automotive from Ultima Media, our latest report, “Climate Change vs. Carmakers”, outlines the fines and compliance costs that automotive manufacturers will face as the EU tightens its CO2 fleet targets. But we also highlight the challenges this will bring to tier suppliers, which provide a large proportion of a vehicle’s powertrain components and value.

Daniel Harrison, automotive analyst at Ultima Media and author of the report, suggests that suppliers will be compelled to invest more in existing and new technologies, as well as to bring down prices, resulting in margin compression and reduced returns for shareholders.

The extreme logistical complexity of the automotive supply chain makes these changes even more challenging for OEMs and suppliers, both in coordinating development and production, and in making in sourcing and cost analysis. For example, one vehicle can require as many as 30,000 parts from hundreds of different suppliers across many different countries.

Balancing weight and performance

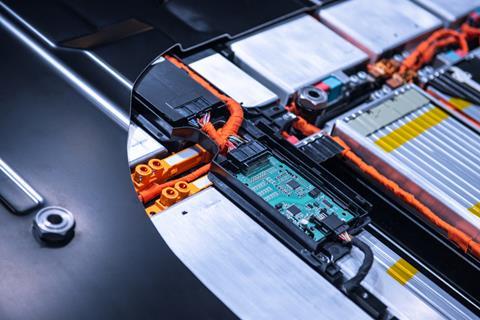

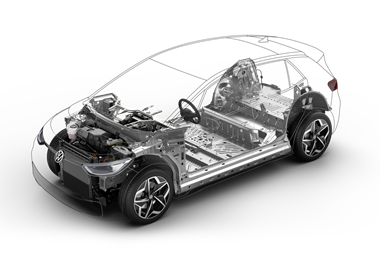

Vehicle powertrain design is a good example of this complexity, including how OEMs must balance the parameters of performance, weight and price as it makes decisions across its suppliers. The high cost carbon fibre platform of the BMW I3 electric vehicle, for example, was justifiable on the basis that the resulting weight saving required a smaller, less expensive lithium battery, making the overall vehicle cost comparable to using a cheaper, but heavier steel platform with a larger more expensive battery.

Clearly as battery prices fall, the cost-benefit equation between weight and performance will evolve further.

Supplier opportunities ahead

While some automotive suppliers will lose out in such decisions, we outline new business opportunities across the supply chain as the automotive industry transitions from internal combustion engines to an electric future. These include:

- Hybrid, plug in and fully EV powertrain specialists

- Battery pack, cell and module suppliers

- Mining companies, especially the vital minerals of lithium and cobalt used in batteries

- Embedded software developers

- Charging infrastructure providers

A full copy of the report, ‘Climate Change vs. Carmakers’, is available for download below for registered and logged-in users of Automotive Manufacturing Solutions

Downloads

Ultima_Media_Climate_Change_Vs_Carmakers_23_September_2019

PDF, Size 8.74 mb

No comments yet