As automotive manufacturers make the transition to electric propulsion, the challenges they face from compressed development timescales, ever tightening regulatory limits and technology churn, mean they must adapt very quickly to change. Automotive Manufacturing Solutions spoke to Patrick Matthews, ABB Robotics head of powertrain for their OEM automotive division, on how ABB’s approach can help support OEMs through the transition process while retaining the ability to accommodate changes in production requirements

The entire industry is focussed on the transition to EV. What are the main difficulties to overcome for an existing manufacturer?

In our experience the main challenge is being able to scale up from just a few thousand to much bigger numbers - 250,000 or 300,000 units per year. EV production up until now has seen relatively low numbers, yet for this technology to become mainstream, scale needs to be achieved with low costs, good productivity and consistently high-quality manufacture.

The integration of EV production into existing assembly sites can also present challenges. Most manufacturers are trying to retain common facilities such as paint or body shop in order to minimise capital spend, so optimising the integration is very important - otherwise the all-important scale up won’t be achieved.

Do any of the manufacturing changes ‘back-flush’ into vehicles with ICE powertrains?

Absolutely they do. To cut costs and reduce vehicle weight, auto makers are taking innovative approaches to the whole vehicle, such as increasing the use of cast components, reducing pressing and welding operations. We are finding automation is reaching into new areas, such as final assembly and trim or the body painting process – ABB is developing PixelPaint for waste-free automated painting requiring no masking. Often these changes reduce the process footprint, freeing space for other purposes. And of course, in nearly all cases these innovations apply equally to both EV and ICE powered vehicles.

Green field or brown field – which is the better way to start EV production?

Green field sites allow a clean slate approach, but at some considerable cost. ABB’s estimates are that traditional automakers will move from c.5% EV production to 30% globally by 2030, so since we believe that traditional auto makers will dominate in the future passenger car market, brown field sites will most likely take on the largest share of EV manufacturing.

Either way, for quite a while we believe we’ll see EV and ICE-equipped vehicles being made side-by-side or even on the same lines in facilities which will retain the flexibility to adjust output. As green field sites specifically designed from the ground up for EV manufacture start to emerge, the layouts, feeds and supply networks into the lines can be optimised for the size and weight of EV components, and EVs will be manufactured on dedicated lines.

How do OEMs ensure their facilities are future-proofed against changes in automotive technology?

We believe the key is to start small and scale up when ready. Real agility means a manufacturer will be able to accommodate changes in volume and product/technology mix, as well as changes in operations and sequence, as new propulsion technologies emerge that affect the design of the vehicle.

This degree of flexibility is unlikely to come from conventional ‘long line’ assembly lines, which are badly disrupted by such changes and offer little scope for re-design without significant down-time. The industry is seeking ‘zero loss’ re-tools, whereby a line can be re-tooled for a model change without any loss of production. But designing-in speed and flexibility often means paying a little bit more now as an investment for the future. While 5 years ago this might not have been possible, now we are seeing manufacturers taking this decision in order to retain a competitive advantage in the future.

Can this level of flexibility be built into an efficient manufacturing facility?

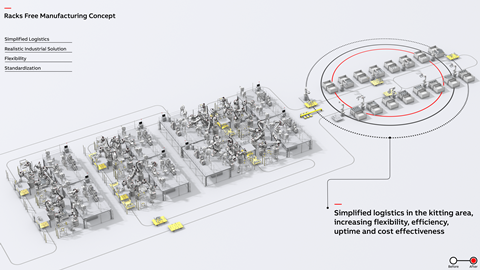

ABB’s cellular robotised manufacturing structure is ideal - we provide smart solutions based upon a combination of applications for each cell. The first cell can be used to validate the approach and set production standards, and then replicated as many times as necessary to keep pace with the required rates of production as EV demand increases.

This approach helps both with ramp up and ramp down, and ensures flexibility is retained throughout the plant’s life, since cells can be decommissioned, moved or repurposed. Put simply, ensuring the production facility can adapt may make the difference between corporate success or failure - the best solution today may not be the ideal one for the future. Such is the degree of change in technology, legislation, purchase incentives and consumer demand that manufacturers must be able to react.

Do the support systems vary from ICE to EV, such as warehousing and materials handling?

While many parts are shared between ICE and EV vehicles, EVs have less parts, so in fact the likely long-term outcome from a move to EV manufacture is to free up space within a brown field site. However, EV components are generally big and heavy, such as motors and batteries, so storage and transportation will need to be ready for this change.

Where do you expect to see batteries assembled?

Because batteries are becoming an integral part of the underside of the vehicle, we are already seeing battery packs being assembled on-site or very close to the assembly plants. The battery pack itself is highly customised for each type of vehicle, and we expect the trend towards batteries being built up close to the production line will continue. This is a highly automated procedure nowadays – reduced assembly cost has certainly contributed to the reduction in overall battery costs over the past 5 years or so. The era of dedicated powertrain plants will perhaps therefore come to a close.

The pace of change in electrified powertrains is relentless. How is this affecting manufacturing?

The pace is so rapid that manufacturing solutions chosen for a powertrain may have to be re-visited frequently to maintain competitiveness. Such revisions to fundamental workings of a production facility can have serious knock-on effects. Manufacturers need to be able to understand the impact of any changes before they happen.

We use ABB’s RobotStudio and other digital applications to help with this process, by simulating every aspect of the auto maker’s operation in a virtual environment. By constructing a ‘digital twin’ of the facility and then studying the effects of any changes, the manufacturer can understand the impact each change will have. This accelerates the process of calibrating and commissioning a new facility, allowing the customer to bring their product to market quickly and seamlessly. In partnering with our customers, we are helping to square the circle between speed and product quality in a way which would have seemed impossible say only 10 years ago.

In your career working with the auto industry, have you ever seen a time like this?

These exciting times will continue, I hope. For the future I think we will see a great deal more computing power and control rolled out into production lines to improve quality and performance, and one benefit is the level of customisation available to the consumer as a result. I think it really could be the case that no two cars will be the same.

I’ve been in the automation industry for 40 years and have seen many developments over that time – the use of the computer, the growth of the robot and of course the internet. But the current pace of change seems to me like it’s exponential, and the pressures placed upon vehicle manufacturers are far greater, from all sides. By partnering with auto manufacturers, at ABB we are doing our level best to help them not only cope with this new world, but to thrive within it.

No comments yet