Re-tooling of manufacturing plants and supply chain for EVs pose investment risk for OEMs

By Automotive from Ultima Media2019-09-23T06:00:00

Tooling and conversion of automotive plants are significant costs for OEMs as they invest in electrification, which some may struggle to afford, according to a new report by Automotive from Ultima Media.

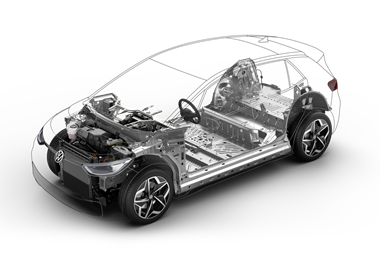

As vehicle manufacturers invest in new electric vehicle models and powertrains, many are reconfiguring their production and supply chain footprints, including re-tooling existing factories to build EVs or multiple powertrain variants.

The question for many is whether these investments – which run well into the billions of dollars – will provide returns, or weigh even heavier on OEMs’ increasingly weak profit margins.

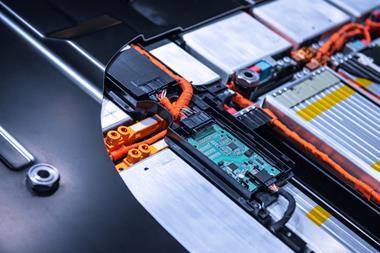

A new report by Automotive from Ultima Media, which publishes Automotive Manufacturing Solutions, highlights the investment challenge for OEMs and automotive suppliers in re-tooling factories and, in many cases, redrawing the maps of their supply chains. Among the fastest developing, but also costliest areas, is the manufacturing and supply of batteries, which will be a key factor given the regulatory issues that surround their materials.

This investment complexity is all taking place whilst the majority of consumers are still as of yet unconvinced about buying an electric vehicle, according to the report, title ‘Automotive headwinds align into a perfect storm’.

The manufacturing and supply chain costs represent another investment risk for the OEMs, who are also facing global declines in vehicle sales and increasing regulatory costs. The returns for electric vehicles and batteries are likely to be had over the longer term, but not until EVs can be manufactured and, more importantly, sold at high volumes.

More insight into the complexity of vehicle electrification can be found in the report, which is the first in a series of research and analysis by Automotive from Ultima Media that will include analysis of the EV and battery production and supply chain footprint.

Login or register below for a free copy of the report, ‘Automotive headwinds align into a perfect storm’.