Demand down under

More or less untouched by the global financial crisis, the Australian economy continues to power on – its new vehicle market touching near record highs in 2011. But might there be clouds on the horizon for the three local manufacturers?

Like other medium and indeed large economies in 2008, Australia was in enormous danger of a major economic slowdown as the US and UK banking crises started to cross international frontiers. The federal government in the country’s capital city, Canberra, decided it must act and unleashed a huge stimulus package which, after a brief pause, revitalised Australian GDP.

So much of the reason for the continued expansion of one of the Asia Pacific region’s leading economies is the ongoing boom in mining exports. In short, China’s construction industry simply cannot get enough of the iron ore and other natural resources that the Australians keep pulling out of the ground at record rates. Indeed, far from looking at Indonesia to its north or any other Asian neighbours (a relative term given its isolated geographic position) as its regional rivals, Australia is competing with Brazil in sending resource exports to China.

While the mining industry continues to expand at a breakneck pace (the multi-billionaire Gina Rinehart, head of Hancock Prospecting, is now the country’s wealthiest individual) much of that surge is based in the giant state of Western Australia (WA). Here, the skyscrapers command a clear-day vista of the edge of a dusty, red desert that can be found not too far from the state capital of Perth. It’s a boom town but the wild West has also seen many busts over the 200-plus years of European settlement. Many Australians in the more heavily populated states and cities thousands of kilometres to the east – Brisbane in Queensland, Sydney in New South Wales, and Melbourne in Victoria – look on enviously as Perth and WA roar ahead but just as many fret that the music might stop one day soon, should commodity prices ever plummet.

The strong economic growth is driving a non-stop rise in material consumption, with the new vehicle market now regularly flirting with average annual sales of one million units. This is from a population of only 23 million souls – around the same size as Canada. Australians are also increasingly turning away from the traditional big sixcylinder sedans and wagons that have been built by both GM Holden and Ford, as rising petrol prices and a national near-obsession with environmental concerns take hold.

Toyota

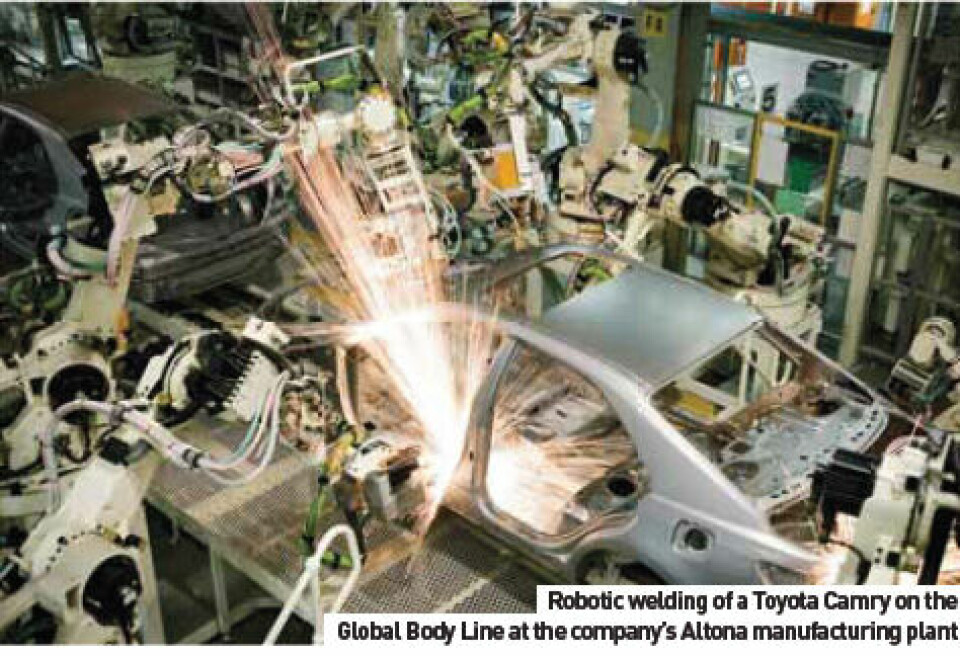

Long the market leader, Toyota Australia continues to invest in its local manufacturing operations, though recently therehave been some adjustments to previous expansionary plans. The division launched production of the new-generation Camry sedan at the Altona plant in suburban Melbourne in late 2011, with the Camry Hybrid replacing the outgoing car on the same line from early 2012. A successor to the Toyota Aurion (a Camry V6 with restyled front and rear panels) will follow later in the second quarter.

The launch of the new Camry and its derivatives previews the next step in Toyota Australia’s ongoing localization plans – new four-cylinder petrol powertrains for the Altona complex. The firm is investing AU$300 million (€245 million) in the project, which will see a new generation of engines manufactured from the second half of 2012.

“Securing the investment to produce the next generation engine is a huge vote of confidence for our local manufacturing plant and our employees, who have worked tirelessly to improve operational performance to demonstrate our ability to compete with Asia Pacific counterparts,” Toyota Australia president and CEO Max Yasuda stated as he announced the new investment. “Toyota operations around the world are constantly vying for new investment to ensure local manufacturing operations can participate in the global car making industry,” Yasuda added.

“The support provided by the Federal Government’s Green Car Innovation Fund and the Victorian Government was a major factor in this project proceeding. A partnership between local car makers, the government and suppliers is fundamental for ensuring we evolve our industry to deal with the challenges of a carbon-constrained world,” Yasuda noted, emphasising the particular importance of the Camry Hybrid powertrain to the division’s sales and export plans. Engine production at Altona began back in 1978 and was the parent company’s first such powertrain manufacturing plant to be built outside Japan. The facility, which has since been expanded many times, currently produces the AZ fourcylinder engine for the current generation Camry and is operated by 320 employees. It is expected to build more than 100,000 engines in 2012, many of which will be exported to other Camry plants in the ASEAN region.

Toyota has 4,700 employees spread over the Altona complex and other locations such as a corporate head office in Port Melbourne, warehouses, sales and marketing operations in Sydney and regional offices in all states. Unfortunately for Toyota’s Australian workforce, while the local market continues to show strong growth, the strength of the country’s currency is causing problems. The difficulties came to a head in January with the shock announcement of a programme of 350 compulsory redundancies at Altona, just three months after production of the new Camry had got underway. The cuts affect just over 10% of the workforce and follow the resolution of a long-running dispute which saw employees awarded a 13% pay rise during 2011 to settle their grievances. “Toyota Australia is facing severe operating conditions resulting in unsustainable financial returns due to factors including the strong Australian currency, reduced cost competitiveness and volume decline, especially in export markets,” Max Yasuda states.

The country’s federal government expressed regret at the news, especially given that the Toyota plant is located within the prime minister’s own constituency in suburban Melbourne. The view from Canberra is that manufacturing will be supported at both a national and state level, but the strength of the dollar is a by-product of the ongoing mining-led boom.

Union membership remains strong at all Australian vehicle plants and there is an existing comprehensive range of support measures for displaced workers. This included the Labour Adjustment element of the Automotive Industry Structural Adjustment Program. In the case of displaced Toyota workers, money from this program will be used to assist workers to retrain to find alternative employment. Toyota car production at Altona has fallen by 36% since 2007 – from 149,000 that year to only 94,000 in 2011. Of that total, some 60,000 cars went to the Middle East. For 2012, the company is now forecasting production of a combined 95,000 cars (Camry, Camry Hybrid and Aurion sedans). The Japan-based firm was the third of Australia’s three car producers to bring its concerns about the cost of building vehicles to the attention of the federal and state governments during 2011: Ford and GM Holden each sought grants and other assistance last year to help secure investment in future models.

In 2010, Toyota secured AU$63 million (€51.2 million) from the federal government’s now discontinued Green Car Innovation Fund as part of its major refurbishment of the four-cylinder engine plant at Altona to build the new 2.5- litre AR engine for the Camry series. Toyota Australia’s two best selling vehicles in 2011 – the Corolla sedan and the Hilux pick-up – are made at plants in Thailand, a country which has a free-trade agreement with Australia. For this reason, the firm says it has no plans to replace the Camry as its main locally-made model for the Australian market. In January, Toyota Motor Company announced that it was planning to build its fourth Thai plant. This will lift production to 760,000 units annually by mid-2013.

General Motors Holden

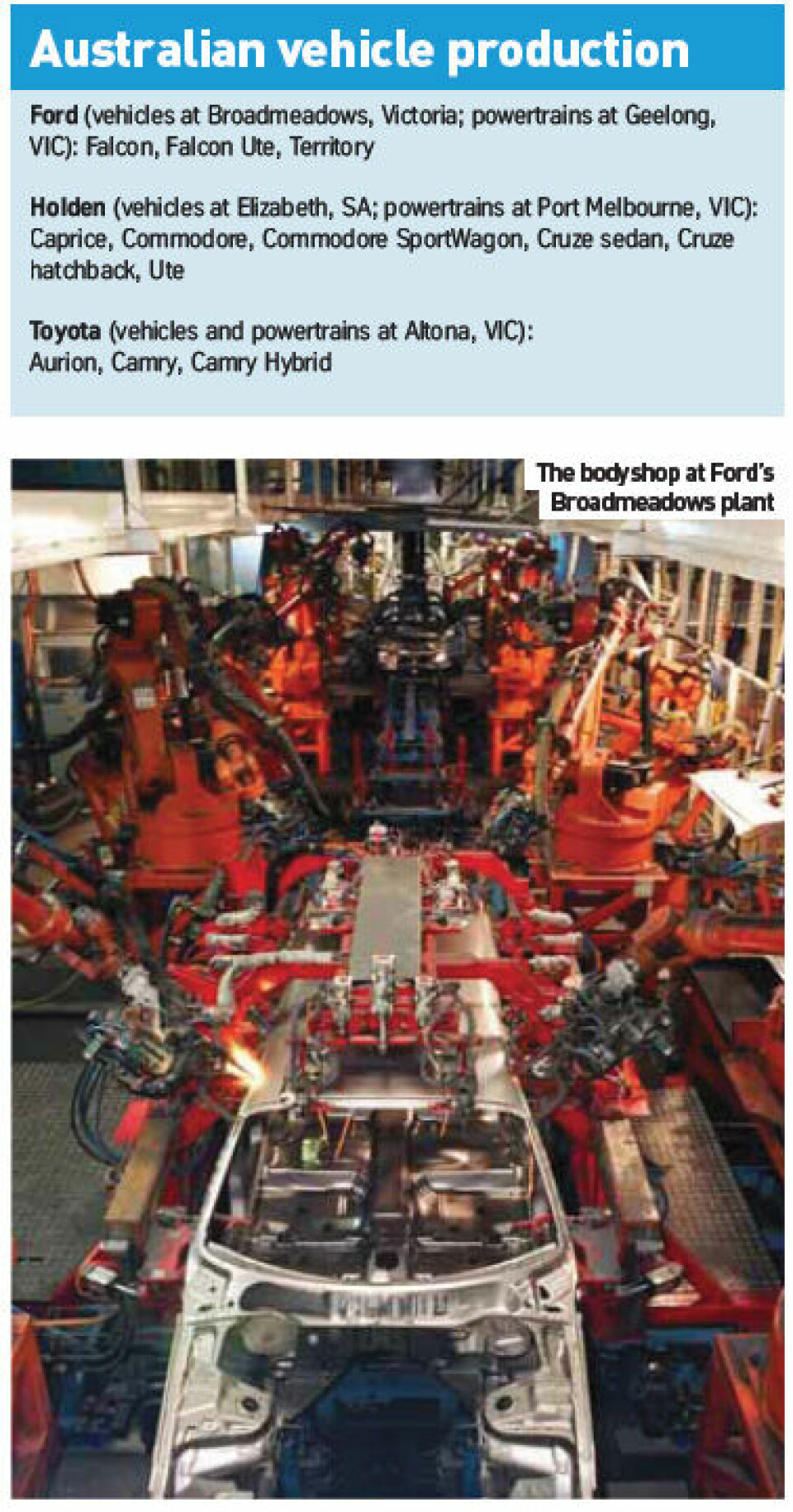

After many decades of building large six- and eight-cylinder family cars, General Motors’ Australian subsidiary, Holden, is now finding much success with a second smaller model line, the Cruze. Interestingly, both sedan and five-door Cruze models go down the same line as the big rear-wheel drive cars at Holden’s Elizabeth plant. Holden, in fact, operates the only car plant in the state of South Australia, Mitsubishi Motors having shuttered its own suburban Adelaide operations in 2008 after poor sales of the Galantbased 380 sedan.

While the Commodore sedan, Commodore SportWagon, long-wheelbase Caprice luxury derivative and Ute pick-up are uniquely Australian vehicles, Holden’s Cruze shares much with the Chevrolet-branded model of the same name that is built by GM Korea at its Gunsan plant. A Cruze wagon is expected to follow later in 2012.

Like Toyota, Holden has recently decided it needs to slow production in response to falling sales of large sedans. The company stated in January that it would axe 100 jobs at Elizabeth, adding that it would “improve productivity and manage the impact of the high Australian dollar”. The company presently employs around 5,000 workers at its various operations in South Australia as well as its Fisherman’s Bend headquarters and V6 engine plant, 600 kilometres to the east in the state of Victoria. introduced a single shift in general assembly, though it has retained two shifts for most areas of vehicle operations. By May, a new 60-second production cycle will have been introduced, giving the Elizabeth plant daily capacity of 400 vehicles: the company notes that it intends to maintain production levels but believes it can reduce both costs and production time per vehicle.

“The new production schedule will also assist the line operators to better manage complexity and help improve build quality,” Holden said in a statement. “Holden has set a very clear business strategy to grow sustainably, lower its cost base and make a small car in Elizabeth to ensure we are profitable on domestic production,” Holden chairman Mike Devereux stated. He added: “Our results show what a success this has been for the industry. In 2011 Holden made around 90,000 vehicles – up over 35% or 24,000 units compared to the previous year – with the growth driven largely by the Cruze hatch and sedan.”

GM Holden, which formerly shipped a modified version of the Commodore to North America-badged as the Pontiac G8, was forced to axe the car when GM discontinued the Pontiac brand in 2009. This wreaked havoc with Holden’s then-thriving export business but the situation has improved somewhat thanks to shipments of the Chevrolet Omega and Caprice sedans to certain right- and left-hand drive global markets (South Africa, New Zealand, US, Canada and countries in the Persian Gulf). Small numbers of this sedan also go to the UK where they are sold as the 6.2-litre V8-engined Vauxhall VXR8.

“With these tough economic conditions it’s our obligation to our people, and those that invest with us, to build a sustainable business and to continuously improve productivity. At the current exchange rate we won’t be able to realise further growth in our export programmes so the shift changes allow us to maintain production levels and do it more efficiently,” Mike Devereux told the Australian media in January 2012.

General Motors, which took an AU$200 million (€163 million) loan from the Australian government in 2009 to keep its Australian operations running during its own bankruptcy proceedings, warned the Canberra-based federal manufacturing minister Kim Carr, in January, that closing the Holden car plant in Elizabeth, South Australia was an option. Like Ford and Toyota, GM believes that an Australian dollar close to its present levels of parity with the greenback is undesirable. The currency is also historically one of the world’s most volatile.

The unpredictability of the dollar continues to bedevil GM’s future investment decisions, though the company nonetheless stated in May 2011 that it would launch a new generation of its big-car series from 2014. The replacements for the Commodore and Ute (the slow-selling Caprice might not have a successor) are expected to use GM’s Alpha architecture, as recently debuted by the Cadillac ATS. For the first time in an Australian-made car, extensive use of aluminium for the body panels will feature, Holden has hinted.

One of the reasons why the Commodore and its Ford Falcon rival have seen their sales fall in 2010 and 2011 is the perception of such big sedans being gas guzzlers. Ford is addressing that with a four-cylinder engine for the Falcon, but Holden is for now sticking with its standard 3.6-litre V6 and optional 6.2-litre V8 engines in the Commodore series. The V6 is manufactured in Victoria, with the unit now exported in various cubic capacities, mainly to GM plants in Korea and China.

Holden’s other locally built model, the Cruze, is due for a mid-life update later in 2012. The former GM Daewoo built the sedan in South Korea until early 2011, with the Holdenbadged car switching to Holden’s plant in South Australia from March 2011.

The five-door Cruze began rolling off the line at Elizabeth in November 2011. The replacement series, which should again be based upon GM’s global GCV/Delta D2XX architecture, is due in 2015. Other Holden models, such as the Captiva, Malibu and Barina & Barina Spark are sourced from GM Korea or GM South Africa, while the Colorado pick-up is an import from Thailand and the Holden Volt will come from the Detroit- Hamtramck plant in Michigan.

Ford Australia built its first plant in 1925 in the city of Geelong. The company has remained based in the southeastern state of Victoria, with its headquarters now located at Broadmeadows, along with an assembly plant, a research centre, a national parts distribution centre and training centre.

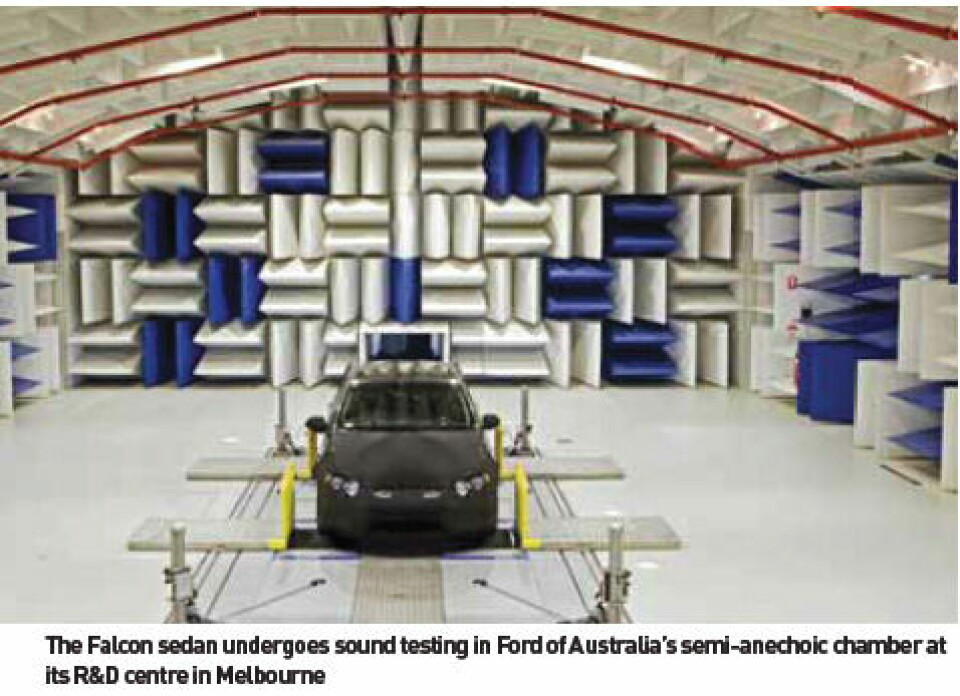

Ford Australia built its first plant in 1925 in the city of Geelong. The company has remained based in the southeastern state of Victoria, with its headquarters now located at Broadmeadows, along with an assembly plant, a research centre, a national parts distribution centre and training centre.The Broadmeadows manufacturing plant was constructed in 1960 and the first car to roll off the line there was a Falcon sedan, in 1960. The latest generation model is claimed to be the only wholly designed and built Australian car, but Holden might dispute that, its Commodore rival having little in common with other global GM products.

With its long history of building six-cylinder and V8 Falcon sedans, wagons and pick-ups, Ford Australia has in recent times struggled to take in just how much the local market has changed as buyers become richer and eschew the cars and brands that their parents once defaulted to. During 2011, and despite a strong overall home market, the big Australian sedan suffered its worst sales year since the introduction of the Falcon nameplate in the 1960s: only 18,741 Falcons were sold in Australia. The best selling vehicle last year was the Mazda3, an import, though luckily for Ford, the Focus and Fiesta have proved popular – these two are sourced from low-cost Thailand, as is the Ranger pick-up. Ford has, however, seen the light and now believes that a four-cylinder engine for the big Falcon should soon help the car back into the top-ten best sellers’ list. It will be a steep climb: in January, fewer than a thousand units of this model were sold, a record low for the Falcon nameplate.

The imported EcoBoostbranded engine, which will be fitted to the Falcon as it comes down the line at Ford Australia’s Broadmeadows plant, is a specially modified version of the engine that appears in Ford of Europe’s Mondeo as well as North America’s Fusion sedan. Its appearance in the Australian sedan marks the first application of this 2.0-litre direct injection turbocharged engine in a rear-wheel drive vehicle. Much of the reason for the Ford Falcon’s recent fall from grace has been due to government fleet sales having slowed dramatically – the slightly smaller Camry and its Hybrid derivative are seen as more fuel-efficient by those charged with deciding which models will be bought on behalf of the many thousands of civil servants who ply the byways of Canberra and the states’ capital cities.

It might seem that the future of Ford’s local manufacturing operations is in doubt, particularly if buyers fail to take to the Falcon EcoBoost, which goes on sale in April. Yet the firm recently made quite a show of announcing a fresh AU$103 million (€84 million) investment in what it terms “clean technology and additional upgrades across the locally-produced Falcon and Territory lines”. Tellingly, the news of the cash infusion was revealed by the parent company at the Detroit motor show in January, Ford making a point of highlighting its Australian operations as an example of its global vision whereby all divisions must pay their way and seek export opportunities.

The new investment at Broadmeadows will go towards one last update for the Falcon and its SUV derivative, the eight-year old Territory. Upgraded versions of both are due for launch in 2014 but Ford also noted at Detroit that there are as yet no plans for additional investment beyond 2016.

No doubt negotiations for new incentives from the state government in Victoria as well as the authorities in Canberra are being sought, especially when a currency that reached US$1.07 (€0.87) in February is thrown into the mix. Ford might not have much of an export programme out of Australia but the strength of the currency only makes premium brand cars more attractive to local buyers, thus driving down sales of the Falcon and its derivatives.

The newly announced AU$103 million investment is in addition to AU$230 million (€187 million) for a so-called “sustainability initiative”. Under the latter programme, Ford is seeking ways to get weight out its larger vehicles, improve their aerodynamics and upgrade their automatic gearboxes to a low-friction design, thus improving fuel efficiency. “There’s no doubt the large car segment is challenging, but it can remain viable if we continue to provide buyers what they want – fuel efficiency, design excellence, and features that enhance safety and the driving experience,” Ford Australia president and CEO Bob Graziano stated in January. “This $103 million investment is also good news for jobs, as it will provide direct employment for around 300 people during the design and engineering stages as well as supporting jobs and investment across our supply chain,” Ford’s chief added.

Announcing the news of new investment for Broadmeadows, Graziano noted that Australia is one of only 13 countries where cars are designed, developed and built and that such a capability must not be lost. “Every car manufacturing country in the world receives Government support – most far more than Australia receives – and there are many other countries that are desperate to develop their own auto industries because they know the flow-on impacts it has on education, R&D, skills and jobs, and revenue,” he said.

“We appreciate the support of the Federal Government and the Victorian State Government for this initiative and believe the flow-on benefits across the industry will deliver a positive return for all parties.” Speculation continues over what will replace the current Falcon, Falcon Ute and Territory models at Ford’s Broadmeadows plant. It might be a new, smaller SUV in the style of the just-launched Escape but it seems unlikely to be the Focus as previous plans to build that car in Australia were cancelled. What seems certain is that if a new big car programme were indeed approved, it would have to sit on a global Ford platform, most likely the new CD4 architecture that underpins the Fusion sedan that is presently being launched in North America.

What lies ahead?

The Australian passenger vehicle market finished 2011 with a tally of 1,008,437 registrations, down 2.6% on 2010 and below original FCAI projections of 1.05 million sales. For 2012, most forecasters see another million-plus market but Toyota, GM Holden and Ford won’t necessarily be reaping bumper sales crops – the strength of the dollar and the move away from large sedans with big engines both pose sizable threats.

As for the medium to longer-term outlook, question marks remain over new investments for next-generation vehicles, despite some of the assurances that have been made by government and the Big Three local OEMs. In short, Australia has become an expensive place to build cars, plus the country’s sheer size and remote location each makes logistics fairly challenging.

The negatives remain, but a highly skilled workforce and generous incentives for low-emissions vehicles are both in place. Meanwhile, unemployment is near record lows and the population is well educated, younger than in most advanced democracies and growing at a rate that is also above the norm of Europe or the large economies of Asia. These positive factors might just be enough to keep tempting the existing three manufacturers to continue investing, provided of course, that the currency issue can be resolved some time soon.