How Farasis will bridge the EV battery gap in Europe

The Chinese battery manufacturer’s new European general manager, Marcel Brömlage, will lead an evolving strategy in the region including increasing engineering and acquisition capabilities, and targeting automotive as well as non-automotive customers to support the growth strategy for the Siro joint venture and Farasis group.

This year will be a pivotal one for the operations at Farasis Energy Europe, the European division of the high-performance battery maker. Farasis, headquartered in China where it has most of its R&D, manufacturing and supply chain, is accelerating the ramp up of its Siro joint venture gigafactory in Turkey, where it started producing battery modules and packs in March 2023 and expects to produce battery cells by 2026 in pouch designs. Together with Turkish electric vehicle manufacturer Togg, its JV partner at the planned plant in Gemlik, in the Bursa region, the gigafactory will be an important step in scaling output and serving local and wider European customers.

Whilst Farasis has engineering, maintenance and service facilities in Germany and the US, its plant in Turkey is its first major production site outside China, where it currently has two major plants and two more planned or under construction, including a joint venture with Geely. Another production site is planned in Tuscaloosa, USA.

Farasis, which is the largest manufacturer of pouch cells in China, and the third largest globally, benefits from this base in its manufacturing and supply chain efficiency. Despite the industry facing supply chain disruptions over recent years – including most recently volatile global shipping lanes as well as complexities in transporting batteries – the company has maintained a stable distribution from China to Europe, leveraging its manufacturing and engineering knowhow.

However, to better serve regional customers and to meet rising local content requirements, Farasis is regionalising manufacturing in Europe. The plant in Turkey began production in March 2023 with an initial 8 gigawatts hours (GWh) annual capacity to produce battery modules and packs, which will increase to 20 GWh by 2026, when local battery cell production is planned to start. The plant is expected to scale growth in Farasis pouch cells and battery packs thanks to shorter lead times and better access both to its JV partner and other OEMs in Europe. The plant is also next to a seaport to support inbound flow of materials and exports, and will have access to renewable energy, whilst featuring advanced production technology and automation.

With this project and other important developments underway, the company is also starting the year with a change in leadership to help drive its strategy in Europe. As of February 1st, Marcel Brömlage takes over as general manager at Farasis Energy Europe, leading the division based in Nuertingen, near Stuttgart, Germany. The European head office includes around 150 employees in engineering, service and commercial operations, and the company’s customer centre and module/pack prototype line. It will also include collaboration and support of the Siro joint venture as it increases production. The engineering team in Nuertingen, for example, designed the battery modules and packs that are now produced in Turkey.

Brömlage joined Farasis in November 2020, working as head of operations in the US and Europe, which included helping to setup the company’s operation in Tuscaloosa, Alabama, where it has supported Mercedes-Benz assembly at its nearby plant in Vance. He will retain his role as head of operations in the US, and reports to Feng Zhang, vice-president of overseas business unit at Farasis Energy.

Diversifying customers and supply in Europe

Marcel Brömlage tells AMS that expanding production of batteries in Turkey will be a key pillar in the company’s growth strategy in Europe. Farasis wants to increase battery cell output whilst reducing inventory and working capital in its operations, better serving customers and reducing emissions in its production and supply chain.

The plant in Turkey will be at the heart of a reorientated strategy for Farasis in Europe. In 2019, the company originally announced plans to build a gigafactory in Bitterfeld-Wolfen, in eastern Germany. Mercedes-Benz was set to be an anchor customer, taking a 3% equity stake in Farasis and a seat on its supervisory board. However, Farasis eventually pivoted away from the German plant project, citing higher demand and partnerships in new areas, which led to the shift in its localisation strategy. Today, Mercedes-Benz remains a key Farasis customer for certain high-performance cells – Farasis has supplied more than 70,000 batteries to it globally – but the carmaker has diversified its battery partnership, including its Automotive Cell Company battery cell JV with Stellantis and Total with plants planned in Germany, France and Italy, as well as a large contract with CATL for its upcoming factory in Hungary, and an agreement with AESC to supply cells for battery production in the US.

“We are seeing a strong trend towards electrification in buses in particular, as well as in lorries for inner-city distribution”

Battery cell designs and chemistries also continue to evolve at a fast pace. Whilst many OEMs and cell producers are using pouch cells, others are turning to prismatic and cylindrical designs, which Tesla uses. BMW will switch from prismatic to cylindrical for its next generation batteries, while OEMs including GM and Mercedes-Benz have indicated at least some models would use the cylindrical format.

There are other macroeconomic and political challenges to navigate, too. Whilst electric vehicle and battery demand continues to rise in Europe, the growth rate in certain segments has slowed, with some OEMs delaying or slowing some EV model launches. The region is facing a slowing economy and shifts in government policies and incentives. Last year, the UK government pushed back its plans to ban the sale of new combustion engines, for example, from 2030 to 2035. This year, the German government abruptly ended certain purchase incentives for buying EVs.

Despite these uncertainties, Farasis has continued to expand its business in Europe and the outlook is for further expansion. The company’s revenue in the region was more than €40m ($44m) in 2023 across customer deliveries and service. Brömlage expects increases in deliveries in 2024 and a peak in volume for existing contracts.

Farasis is also further diversifying its business in Europe. Its R&D team continues to develop a range of battery cells, modules and packs, with the focus on pouch cells but also specialist offerings in prismatic forms, and developments in other chemistries in China, such as lithium-ion phosphate (LFP) and lithium-ion manganese phosphate (LFMP), sodium-ion and others. The company has also been broadening its customer base, which already includes Chinese OEMs, motorcycle companies and industrial manufacturers. But Farasis is now actively developing its technology and manufacturing to grow with non-automotive companies, notably for commercial vehicles, which is seeing significant development in bus and certain truck segments.

“We are seeing a strong trend towards electrification in buses in particular, as well as in lorries for inner-city distribution,” Brömlage says. “The electrification of a 40-tonne truck travelling from Berlin to Barcelona without long charging breaks is a challenge technically as well as from an infrastructure standpoint.”

The company is also focused on electrifying other industrial equipment, such as material handling and non-road mobile machinery (NRMM), such as cranes, excavators and mining vehicles – segments in which Brömlage sees big opportunities.

“Electrification is already on the rise in the material handling sector, especially for forklift trucks. The aim here is to further expand this trend,” says Brömlage. “The NRMM segment is certainly the area that is still the least electrified and has great potential for growth.”

Bringing advanced EV battery manufacturing from China to Turkey

The automotive sector will nevertheless be a pillar for Farasis in Europe, with the Siro JV battery plant the long-term power source for new deliveries and business. Over the past year the plant has produced more than 20,000 battery packs, the cells for which are currently imported from China. The joint venture employed more than 800 by the end of 2023, generating several hundred million euros in revenue, according to the company.

”We expect to produce more than 50,000 battery packs this year”

Farasis expects to reach its phase one annual capacity of 8 GWh per year this year, while by 2026 it will expand to 20 GWh capacity as battery cell production begins across 60 hectares of land.

Developing a local and regional supply chain will also be important. The supply chain for current pack production has around 40% local battery components, which the JV plans to increase as cell production is localised. A supplier park is located close to the plant for component and other processing; there is also access to local nickel and cobalt raw materials. Along with its location next to Gemlik port for fast shipments, Turkey’s free trade agreements qualify it for tariff-free exports to the EU and UK. Carmakers with vehicle manufacturing based locally in Bursa include Togg, and other joint ventures for Stellantis and Renault.

“[Ramping up the Turkish plant] is one of our priorities in 2024 and we expect to produce more than 50,000 battery packs this year,” Brömlage says.

This expansion is in parallel to tremendous investment in China, where Farasis draws on considerable battery manufacturing expertise. The battery producer, which was originally founded as a cell specialist near to Silicon Valley in California before its founders shifted to China, has plans to double capacity in the country from its current levels to more than 120 GWh. The Shanghai-listed company currently has 5 GWh of capacity at its base and headquarters in Ganzhou, in the south in Jiangxi province, where it has also several expansion projects in the pipeline, including a plant with Geely. Farasis has also increased capacity to 24 GWh at its plant in Zhenjiang, in eastern China south of Shanghai in Jiangsu province, on the Yangtze River. Other plants are also planned in Anning, in the southwest in Yunnan province, and Guangzhou, north of Hong Kong. Earlier plans for a factory in Wuhu were cancelled with funds reinvested in other facilities.

Globally, the company plans to grow capacity to 145 GWh over the rest of the decade.

Farasis has developed advanced manufacturing processes in China, including a homegrown manufacturing execution system (MES), and high traceability of data across cell and pack production. The company also claims to have an automation rate of 98.5%, including more than 800 robots in use across China. Several of its production lines in Zhenjiang have achieved CO2 neutrality in battery production. All battery cells and packs delivered to customers in Europe are certified as carbon neutral through carbon offsets.

Farasis plans to implement these high-tech processes in Turkey and to expand its focus on sustainability, including reuse of materials and resources.

Increasing European engineering process

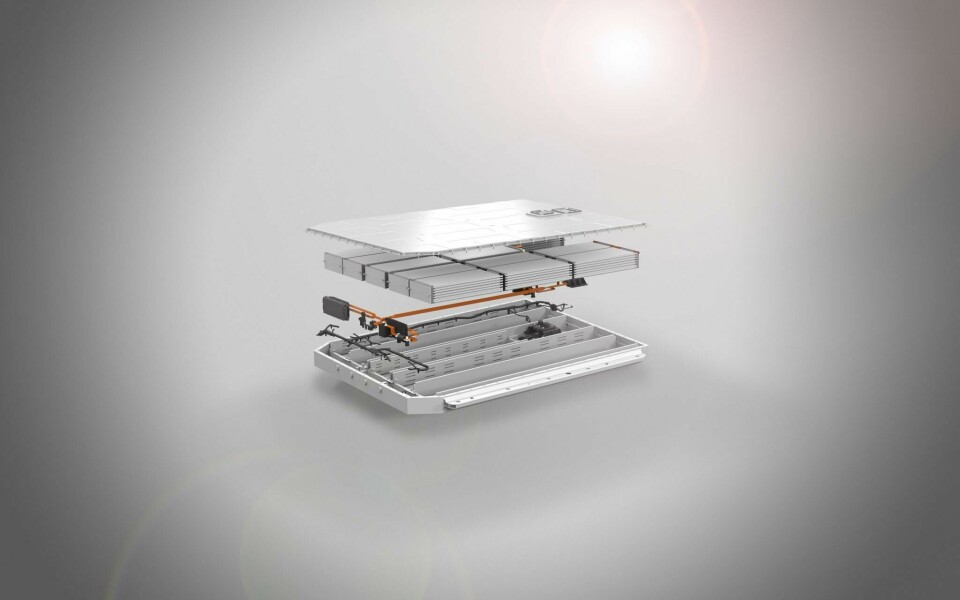

Along with manufacturing, Farasis is also expanding its technology and supply offering to meet specific customers’ needs. Globally, Farasis boasts more than 1,400 engineers, of which around 10% are based in the US and Europe. Farasis already offers a range of cells, including unidirectional and bidirectional pouches. For battery packs and modules, it offers applications across automotive, commercial vehicles and non-automotive standards, specialised in flat pack systems with a height of 85mm to 145mm, which fit a range of car designs. The company’s engineering team has strong in-inhouse simulation capabilities, including for cell chemistry, cell quality and thermal management, and manufacturing.

The company’s European engineers are also involved in research initiatives across battery cell development and pack engineering. Since last year, for example, the company is part of the PEAk-Bat research initiative focused on how to simplify battery pack structures, and to improve virtual validation that would reduce the number of tests needed in the battery development process. The programme, which will last three years and is partly funded by the German government, includes other organisations in battery development and research including RWTH Aachen University, Ford and Trumpf.

Brömlage adds that Farasis is increasingly focused on providing “off the shelf” battery packs in Europe, for example in specialised vehicles and in high-performance segments. The company’s engineers and teams in Europe are working closely with R&D and plant teams in China, as well as in building up strong capabilities in Turkey.

By the second half of the decade, Farasis plans to be a major player in the European battery industry, with advanced, sustainable production and supply chains to match. Turning those plans into reality won’t be easy, but the manufacturer is charging ahead.