Flexible Production

The flexible assembly line: How vehicle production learned to hedge its bets

Market uncertainty has forced manufacturers to abandon fixed production lines. Honda, BMW and Volkswagen are investing billions in systems that can switch between combustion, hybrid and electric vehicles by the hour.

The billion-dollar question facing automotive producers today is not whether electric vehicles (EVs) will dominate the future, but when - and what to do in the transition. The answer, increasingly, lies not in prediction but in preparation: flexible production systems that can pivot between powertrains as swiftly as markets shift between preferences.

Consider the paradox confronting vehicle manufacturers as we speak. EV sales are indeed growing, yet not at the meteoric pace once forecast. Geopolitical tensions threaten production and supply chains. Tariffs loom unpredictably, and consumer incentives fluctuate by both region, and political cycle.

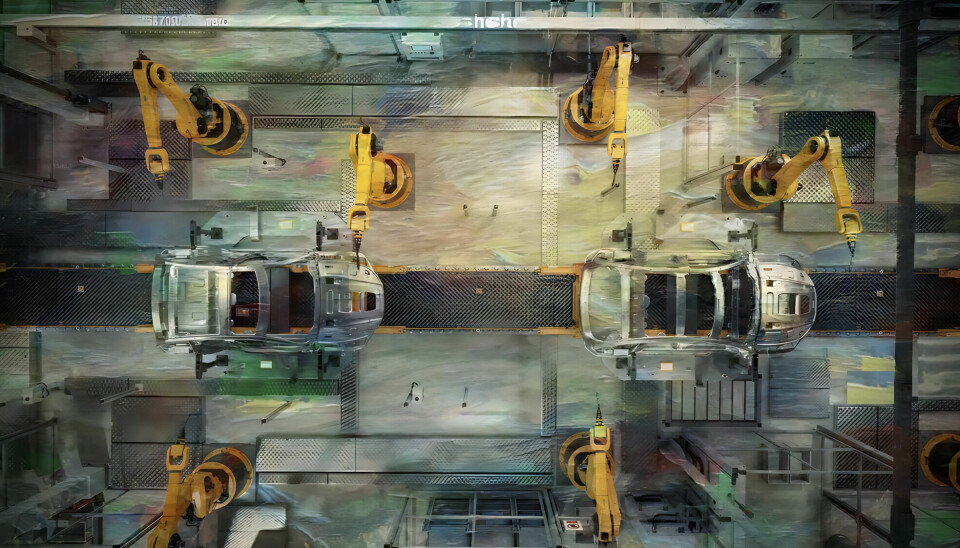

Where manufacturers once changed over entire production lines at considerable expense and downtime, they now aspire to build combustion, hybrid and electric vehicles on the same assembly line, switching between them not by the month, but by the hour.

Traditional automotive manufacturing, built on the economies of scale that Ford perfected a century ago, suddenly looks dangerously rigid. Fixed production lines optimised for a single model now represent not efficiency, but vulnerability.

The industry's response has been to resurrect an old industrial concept - flexibility - and reimagine it for an era of uncertainty that would have been unthinkable even a mere decade ago. Where manufacturers once changed over entire production lines at considerable expense and downtime, they now aspire to build combustion, hybrid and EVs on the same assembly line, switching between them not by the month, but by the hour.

The unavoidable architecture of adaptability

Honda's billion-dollar retooling of its Ohio facilities illustrates the technical gymnastics this requires. The company's Marysville, East Liberty and Anna Engine Plants now form what Honda terms an "EV Hub" - though the name undersells the ambition. These plants produce internal combustion, hybrid-electric and battery electric vehicles on identical lines, a feat that demands rethinking manufacturing from first principles.

Bob Schwyn, senior vice president of Honda Development & Manufacturing of America, frames the challenge plainly: "The Honda EV Hub provides us with the adaptability to produce ICE, hybrid-electric, and EV models on the same lines, allowing us to react swiftly to changing customer needs and market trends."

The statement sounds deceptively unremarkable until one considers what it entails: body shops reconfigured to accommodate structural battery cases, welding systems that can secure components unique to EVs, and dedicated areas where battery packs can be installed into EVs while combustion vehicles flow past uninterrupted.

The Anna Engine Plant exemplifies this complexity. Six 6,000-ton high-pressure die-cast machines now produce aluminium battery cases using megacasting technology - except Honda has deliberately chosen not to follow Tesla's monolithic approach.

Instead, the carmaker manufactures cases in two parts, allowing different sizes for midsize and large EVs with one half common to both. These sections are then joined using friction stir welding, a solid-state process that Honda has refined to eliminate several machining steps. Photogrammetry systems equipped with up to 120 cameras inspect each case, ensuring mountability before it reaches the assembly plant.

This is flexibility as an engineering challenge: standardised positioning points, universal carriers, adaptive grippers, servo-controlled framing stations that adjust in real time. BMW's Regensburg plant - honoured as Factory of the Year in 2024 - rolls out up to 1,400 BMW X1 and X2 models daily in combustion, plug-in hybrid and battery electric variants, all from the same flexible line. The technical achievement is considerable; the strategic imperative is greater still.

We are using AI for quality control in vehicle assembly. In this way, we are optimising our production processes and creating added value for our products and, ultimately, for our customer

Digital orchestration and the invisible factory

Yet hardware flexibility alone proves insufficient. The modern flexible factory increasingly depends on a digital shadow that orchestrates, optimises and anticipates. This represents the second dimension of manufacturing adaptability: the ability to simulate, manage and reconfigure production systems not in weeks but in milliseconds.

Regensburg operates what it describes as a cloud traffic-control system managing more than 500 automated guided vehicles. These publish position and battery-health data every 100 milliseconds, enabling swarm optimisation that has reduced in-plant material lead-time by up to 30%.

Armin Ebner, head of Plant Regensburg, explains the application: "We are using AI for quality control in vehicle assembly. In this way, we are optimising our production processes and creating added value for our products and, ultimately, for our customers."

The plant produces a new vehicle every 57 seconds, each configured uniquely. An AI-powered inspection system analyses real-time production data and generates individualised quality control checklists for every vehicle. This is flexibility as cognitive capability: systems that ‘comprehend’ what they are building and adjust verification protocols accordingly.

Honda's battery pack assembly line at Marysville operates 75 production cells supported by digital twin models. These enable simulation of different product flows and real-time performance monitoring, providing the agility to expand, contract or modify operations based on vehicle variants and demand.

Mike Fischer, project lead at Honda North America, articulates the strategic calculus: "When you think about flexibility [ICE, hybrid, EV] and for us to be able to do this and scale it from an existing facility, then ultimately you can pass that positioning onto the customer to say we can build any of these vehicles in these existing facilities based on what's happening in the market."

The shift is consequential. Where production control was once static planning, it has now become continuous real-time orchestration. AI-powered scheduling engines, industrial IoT-enabled equipment telemetry and centralised data architectures allow plants to re-sequence workflows, reallocate resources and anticipate bottlenecks before they impact throughput. This transforms flexibility from hardware reconfigurability to systemic responsiveness.

The human variable of flexible production

Automation, as we know, attracts headlines; workforce adaptability however, often receives less attention, although it proves equally critical. Chris Glover, former executive vice president of Volkswagen Group of America's Chattanooga operations, reduced labour attrition at the Tennessee plant from 35% to 10% within just two years. His observation carries weight: "Labour retention creates stability in your process. It's a great enabler of flexibility because you retain knowledge and skills."

At Chattanooga, the decision to integrate EV and ICE production on the same line emerged as what Glover terms "one of the best decisions we made early on." The facility created adaptable infrastructure in its body shop, with pre-installed flexibility capabilities allowing seamless integration of new derivatives over time. Yet in the fine-balancing act between people and production tech, Glover acknowledges a fundamental truth: "The key to flexibility comes down to training and manpower development."

Volkswagen has hired 3,500 new employees over two years, implementing training programmes spanning basic skills, industry-specific professional training and on-the-job learning. The OEM recognises that while automation handles complexity, humans provide adaptability - particularly in mixed-model environments where timing and variant alignment remain critical.

Jamie Moore, senior principal engineer at Toyota North America, describes how engineering roles themselves have transformed: "Engineers now have to adopt a flexible mindset. We need to build up a bigger skill set to meet the growing scope of needs. Engineers must now consider not only the feasibility of designs but also their manufacturability, logistical requirements, and lifecycle impacts."

To state it rigidly: traditional silos are dissolving. Toyota has implemented rotational programmes to expose employees to different organisational areas, creating a more versatile workforce. This reflects broader industry trends, with the World Economic Forum estimating that 54% of manufacturing employees will need significant reskilling by 2025 to keep pace with technological advancement.

Calculating the cost of flexibility - or rigidity

Flexibility carries costs that manufacturers are only beginning to fully comprehend. According to the survey carried out by ABB and AMS, 54% of industry respondents cite high initial capital expenditure as the primary barrier to smart factory development, whilst 35% identify technical integration challenges. These figures suggest that flexibility, whilst strategically essential, remains economically fraught.

The investment required for advanced automation, modular cells and digital systems must be justified by projected efficiency gains and long-term utilisation improvements. Honda's billion-dollar Ohio commitment, VW's extensive Chattanooga retooling, BMW's continuous upgrading across its global network - these represent not discretionary enhancements but existential requirements. Yet the return on investment calculations grow increasingly complex as manufacturers balance flexibility against productivity.

Highly adaptable lines designed for mixed-model production may struggle to match the efficiency of dedicated, single-model mass lines. Optimising layout, changeover protocols and predictive scheduling becomes essential to avoid diluting output potential. As Glover acknowledged regarding automation complexity, manufacturers walk a tightrope: sophisticated systems can handle variation, but at a cost.

System integration complexity compounds the challenge. Flexible factories demand seamless interoperability between software systems - manufacturing execution, product lifecycle management, enterprise resource planning - and physical assets: robots, conveyors, sensors. The architecture is intricate while the failure modes are numerous.

Change management adds another dimension. Workers must be trained on new roles, tools and digital interfaces, often whilst production continues. Honda addressed this through ergonomic redesigns and digital instructions to ease transitions. Yet the underlying tension persists - flexibility requires workforce adaptability, which requires training investment, which requires labour stability in an industry where retention grows increasingly difficult.

The strategic imperative for increased flexibility

Moore and Glover's conversation at the AMS Evolution North America 2024 conference returns repeatedly to a central theme: uncertainty has become the only certainty. "The only constant in our industry right now is change," Glover noted. From navigating regulations to addressing supply chain vulnerabilities, the industry's ability to adapt quickly has evolved from competitive advantage to survival requirement.

The pandemic and subsequent geopolitical shocks exposed the fragility of global value chains, and automotive manufacturers now lean towards localisation, regionalisation and just-in-case inventory models - all dependent on flexible capacity that can pivot when upstream disruptions materialise. Honda's joint venture with LG Energy Solution for battery production in Jeffersonville, Ohio, exemplifies this approach, with the deployment of a secure, scalable battery cell supply aligned with production needs - across multiple plants.

Flexibility is a competitive edge, but it's also a mindset. It requires constant learning, adaptation, and a willingness to embrace change

Market volatility, particularly around EV adoption patterns, reinforces the imperative. Consumer incentives, tariff regimes and purchasing power remain fluid across regions. Fixed, single-model production lines have become both inefficient and unsustainable. As EV sales volumes track below earlier forecasts whilst energy, materials and labour costs climb, manufacturers must extract more value from existing assets or risk losing to lower-priced competition - particularly from Chinese manufacturers who have built flexibility into their DNA.

The technological shift to electrified and software-defined vehicles demands retooling speed that traditional manufacturing models cannot provide. Over-the-air updates, zonal architectures and rapidly iterating battery chemistries require flexibility not only in hardware but in software integration across the factory floor. Regulatory and sustainability pressures - stricter emissions targets, lifecycle carbon assessments, circular-economy mandates - push manufacturers towards adaptable systems capable of scaling recycling and closed-loop materials operations.

An emerging paradigm of increased flexibility

What emerges from this transformation is not simply flexible manufacturing but a fundamentally different industrial model. The convergence of automation, artificial intelligence and industrial IoT creates what BMW and others term "smart, self-optimising factories" - systems that continuously learn, adapt and reconfigure with minimal human intervention.

To add to this, digital twins are becoming more sophisticated and widespread, allowing manufacturers to simulate and scale new production setups across global facilities with limited disruption. Automotive supply chains are evolving towards what industry observers call "leagile" networks - hybrid systems combining lean efficiency with agile responsiveness.

Configuration lifecycle management enables mass customisation by synchronising design, production and logistics from the earliest development stages. Emerging technologies - gigacasting, microfactories, modular production islands - promise reduced part complexity, faster changeovers and decentralised production closer to demand centres.

Yet perhaps the most significant shift is psychological. Flexibility has evolved from an operational capability to a defensive asset. In markets facing mounting geopolitical tension, trade volatility and rapid technological change, flexible operations offer a hedge against disruption. They allow manufacturers to pivot with speed, preserve profitability and sustain competitive advantage in an unpredictable environment.

Moore captured this mindset shift: "You have to embrace change and be willing to innovate. If you're not, you're falling behind." Glover's formulation is equally direct: "Flexibility is a competitive edge, but it's also a mindset. It requires constant learning, adaptation, and a willingness to embrace change."

The automotive industry spent a century perfecting the economics of scale, building ever-larger factories to produce ever-greater volumes of increasingly similar vehicles. That model delivered extraordinary prosperity and transformed global mobility. Its obsolescence is now arriving with similar speed. The question facing manufacturers is no longer whether to become flexible, but whether they can do so quickly enough - and whether flexibility itself will prove sufficient in an industry where the only reliable forecast is continued disruption.