Production technology: Megacasting

Production minimalism:

How Megacasting is reshaping automotive manufacturing

Single aluminium components replace hundreds of welded parts as Tesla's gigacasting revolution spreads to Volvo, Toyota and Chinese manufacturers, promising dramatic cost cuts but demanding massive capital investment.

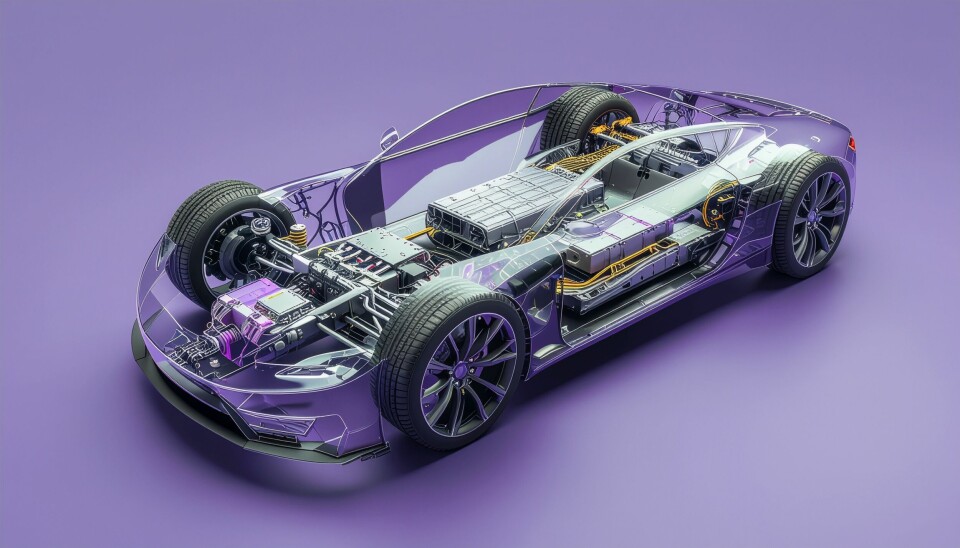

In the perpetual quest for vehicle production efficiency, few innovations have captured the automotive industry's imagination quite like megacasting - or 'gigacasting', as Tesla's marketing department prefers to call it. What began as an ambitious experiment in aluminium die-casting has evolved into a manufacturing revolution that is fundamentally altering how vehicles are conceived, designed, and built.

The premise is deceptively simple: rather than fabricating hundreds of small components and laboriously welding them together, manufacturers pour molten aluminium into enormous machines weighing thousands of tonnes, creating single, massive structural components. The implications, however, are profound.

The genesis of a manufacturing revolution

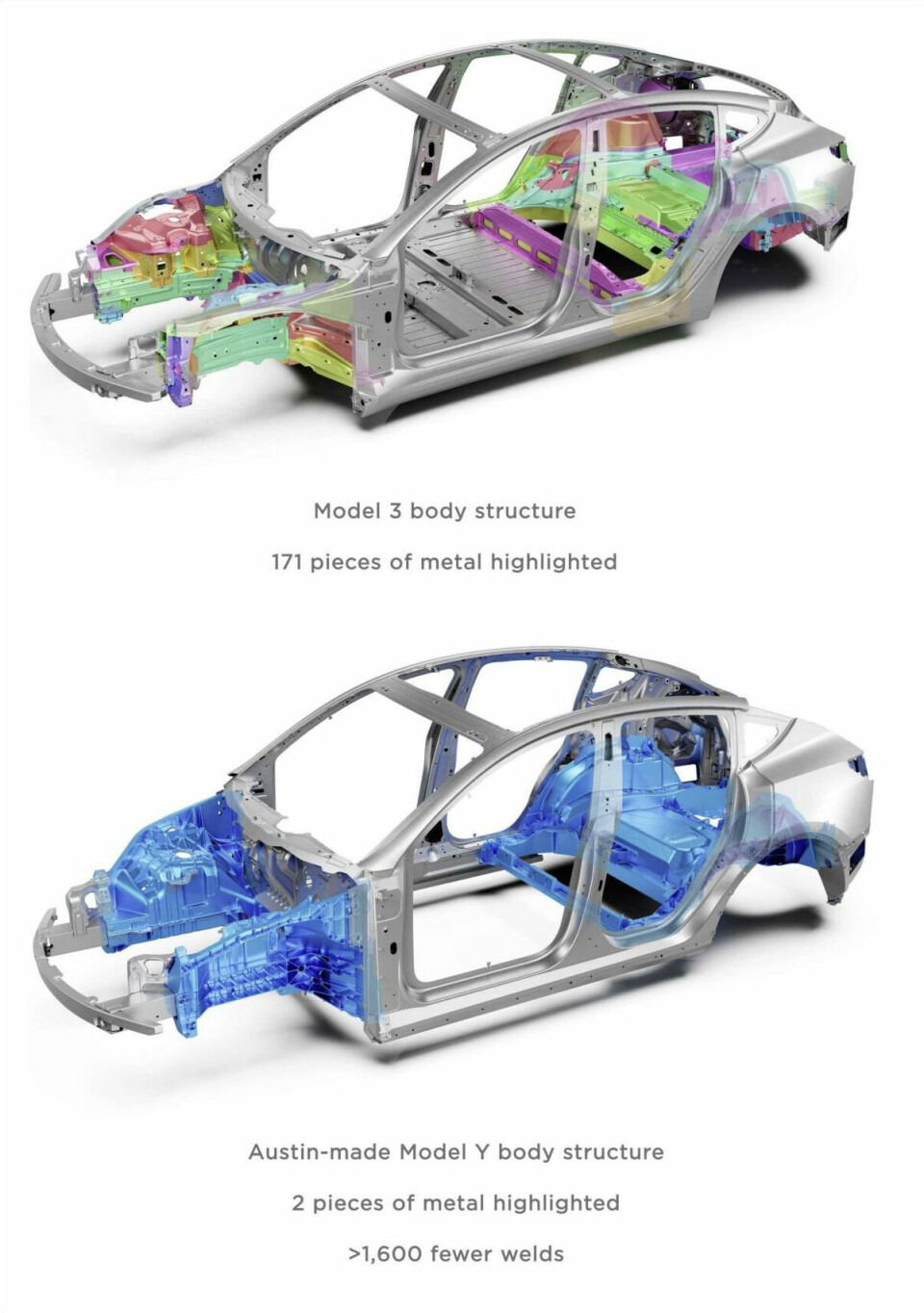

While Tesla did not invent large-scale die-casting, the carmaker deserves credit for popularising the concept and pushing it to unprecedented scales. The transformation is starkest when examining Tesla's own evolution: the Model 3's rear structure comprises 171 separate metal pieces, whilst the Model Y achieves the same structural integrity with merely two megacast components. This dramatic simplification eliminates approximately 1,600 welds - a reduction that speaks to both the elegance and audacity of the approach.

The technology relies on massive die-casting machines, colloquially termed "Giga Presses," capable of exerting forces between 6,000 and 12,000 tonnes. These behemoths, supplied by Italian manufacturer IDRA and Swiss-based Bühler Group, dwarf traditional automotive manufacturing equipment. Tesla's pioneering machines at its Texas Gigafactory produce single rear body pieces that previously required dozens of individual components, fundamentally reimagining vehicle architecture.

Volvo, Nissan, Ford, Mercedes: the expanding constellation of adopters

What began as a Tesla innovation has rapidly proliferated across the global automotive landscape, particularly in China. 'Western' OEMs, meanwhile, are patchy in their approach to adopting the technology. While Tesla has mainstreamed the term, involving enormous, high-pressure aluminium die casting machines that punch out vehicle chassis and bodies-in-white, the technology has largely caught on in the Chinese mainland.

Chinese electric vehicle manufacturers NIO and XPeng have commissioned 12,000-tonne machines from Tesla-supplier IDRA, whilst established automotive powers are taking notice. It may be worth mentioning that IDRA is one of China's top five manufacturers of injection moulding machines.

Volvo, Nissan, Ford, Toyota and Hyundai are among automakers either using or planning to use megacasting in their production operations. Volvo Cars represents perhaps the most significant Western adoption beyond Tesla, with initial plans to implement megacasting at its Torslanda plant in Gothenburg, Sweden, in 2025.

However, implementation is a complex process, and involves a complete overhaul of their production line. The OEM has been working on building in-house knowledge and competence in megacasting and has successfully completed the "try-out" phase of the technology.

The first Volvo car to use megacasting as part of its production is expected to be the all-electric Volvo EX60. The cast parts will be for the rear chassis section, made from a single aluminium casting and is expected to confer 15–20 % section weight reduction.

Anirudha Shivappa, Advanced Engineering Leader, Body Structures at Volvo Cars told AMS: "With megacasting, we will replace around 100 stamped parts with a single cast part, meaning that we can eliminate a lot of complexity related to the supply chain and assembly of these 100 parts. "

Shivappa says the time taken to transform raw material into a finished product that is ready for assembly in the car will be shortened from months to days. Megacasting, he notes, also allows for more design flexibility throughout a car’s lifetime.

"The technology also helps us improve in terms of material utilisation," he adds. "By eliminating 100 stamped parts, we eliminate the scrap produced in each stamping production, which tends to amount for around 50% of the blank weight. We remelt all the casting scrap in-house, thereby achieving 95% material utilisation in our process.

"Aluminium production is very energy-intensive and can consequently come with a high carbon footprint. We counter this by committing to source aluminium with a low carbon footprint, making megacasting less carbon-intensive than a welded steel rear floor." The full effects of Volvo's cost and cash turnaround plan, which includes these investments, are expected to be realised in 2026.

For megacasting, at least about 80% of part CO2e typically comes from the aluminium itself – even when sourcing below ~5 kg CO2e/kg – so meeting OEM environmental targets is primarily a material-sourcing question: prioritise low-carbon primary and maximise certified secondary content to drive the footprint down

The Swedish manufacturer has selected Bühler's die-casting solutions over IDRA's machines, suggesting that supplier competition is intensifying as demand grows.

Mercedes-Benz has explored megacasting for its EQXX concept vehicle, whilst Toyota - long a bastion of manufacturing conservatism - is eyeing the process for future applications.

Ford is pursuing its own ambitious path with the technology, branding its approach 'unicasting'. The US automaker is leveraging massive castings not only for structural simplification but also to enable a radical reconfiguration of its assembly process. Its strategy involves building three major subassemblies - a front unicast module, a rear unicast module, and a central battery-and-cabin unit - in parallel on an "assembly tree" before merging them.

The modular methodology is designed to drastically reduce conveyor length and complex material handling, while also significantly improving assembly ergonomics by minimising strenuous overhead and underbody work for line operators. This represents a fundamental philosophical departure from the traditional sequential production line, echoing the scale of the company's historic moving assembly line revolution.

To implement this vision, Ford is investing $2 billion to retool its Louisville, Kentucky, plant, betting that this synthesis of megacasting and modular assembly will be a cornerstone of its future EV manufacturing competitiveness.

Notably, Stellantis remains conspicuously absent from the megacasting movement, proving that industry consensus on the technology's merits is not yet universal. The carmaker has concluded that the potential efficiencies of gigacasting are eclipsed by its substantial drawbacks. These include not only prodigious capital outlays but also thorny implications for vehicle repairability and the economics of the aftermarket.

Arnauld Deboeuf, Stellantis' Chief Manufacturing Officer has commented: "We have done some internal study concerning Tesla's Gigapress. Today, we don't see the benefit. So today, it might be good for Tesla—I don't know—but for Stellantis, we just don't see the benefit.

"We don't see the benefit in manufacturing, we don't see the benefit in CapEx, and we don't see the benefit in after-sales. So today, we are not taking this direction."

The economics of scale and simplicity

However, looking at the larger picture, the financial arithmetic underlying megacasting seems to be compelling, though not without complexity. Traditional automotive body construction involves hundreds of individual stampings, each requiring separate tooling, assembly fixtures, and welding operations. The labour intensity is enormous: skilled welders, quality inspectors, and assembly line workers are needed at multiple stages. Megacasting consolidates this complexity into a single operation.

At Gigafactory Texas, Gigacasting leader Tesla is using an enormous Giga Press to cast a single rear body piece for Model Y, which replaced 70 different parts. This consolidation eliminates not only the welding operations but also the associated quality control procedures, reducing both labour costs and potential failure points.

However, the economics are not straightforwardly favourable. A single Giga Press represents an investment of approximately $18-25 million, excluding tooling and facility modifications. The breakeven point depends heavily on production volumes - megacasting becomes economically viable only at scales exceeding 100,000 units annually per casting die. For manufacturers with diverse model portfolios and lower individual model volumes, the mathematics becomes less favourable.

Technical advantages beyond cost

The benefits of megacasting extend beyond mere cost reduction. Structural integrity represents perhaps the most significant advantage: a single cast component eliminates numerous weld joints, each representing a potential weakness. This structural continuity translates into improved crashworthiness and reduced weight - critical factors in electric vehicle design where every kilogram affects range. Manufacturing consistency also improves dramatically.

Traditional welded assemblies are subject to cumulative tolerances across dozens of operations, often requiring expensive rework or acceptance of suboptimal fits. Megacasting delivers dimensional accuracy within tight tolerances directly from the mould, reducing downstream assembly complications.

The environmental implications are noteworthy as well. Aluminium's recyclability means that manufacturing waste can be directly reintegrated into the casting process. Additionally, the energy required for melting and casting aluminium is significantly lower than the combined energy needs of multiple stamping, welding, and assembly operations.

The challenges of adoption: From pilot to production scale

Despite its promise, megacasting presents formidable challenges. Tooling costs are astronomical: whilst traditional stamping dies might cost $1.2-2.5 million, megacasting moulds can exceed £12 million. More critically, these moulds are entirely specific to individual components - there is no flexibility for model variations or updates without complete tooling replacement. Such inflexibility poses a clear production risk to vehicle manufacturers.

Moving from pilot programs to stable, high-volume production represents one of the most significant hurdles. As Michael Cinelli, Director of Product Management & Marketing for Die Casting at Bühler, explains: "The hardest leap is mastering every step of the process - melting, dosing, injection, die thermal control, extraction, trimming, inspection, and palletising - while maintaining consistent quality. It goes beyond technology. It is about managing system-level complexity and building casting know-how in organisations that often come from stamping."

This transition is particularly challenging for traditional OEMs who must transform existing manufacturing capabilities. Cinelli notes that "while Chinese newcomers act very quickly and promptly resort to technical prototype solutions, more traditional OEMs tend to rely heavily on simulation because a change to megacasting for them often means to transform existing manufacturing sites."

Even quality control becomes more complex in some respects. A defective traditional component affects only that part; a flawed megacasting can render an entire structural assembly unusable. The casting process itself requires precise control of aluminium temperature, injection speed, and cooling rates - variables that traditional automotive manufacturers have limited experience managing.

For castings over 60 kg that go directly into crash structures, maintaining quality without sacrificing cycle time demands sophisticated melt-handling practices. Bühler's approach involves "tightly controlled melting, multi-stage filtration, and rotary degassing with continuous hydrogen monitoring; maintain disciplined ladle and dosing system hygiene; and employ gating/venting designed to avoid air entrainment and trap inclusions," according to Cinelli.

Strategic decisions: One-piece versus modular approaches

Manufacturers face critical strategic decisions about how extensively to implement megacasting. The choice between full one-piece underbodies versus multiple large castings reflects deeper considerations about manufacturing philosophy and risk tolerance.

Cinelli explains that "the choice often starts with make-or-buy analysis and supply-chain constraints. Committing to a single-piece underbody usually implies investing in a megacasting foundry inside or adjacent to final assembly, along with the floor space, competence build-up, and risk acceptance that come with it."

Some manufacturers pursue maximum integration for structural benefits, while others prefer modular approaches that leverage existing supplier relationships. Cinelli says that a modular approach reduces the on-site burden and leverages the existing supply base, but comes at the cost of less integration, more joints, potentially lower global stiffness, and added logistics.

Repair considerations also complicate adoption. Traditional welded structures can often be repaired through sectional replacement; megacast components typically require complete replacement following significant damage. This reality has created concerns among insurance companies and collision repair facilities about long-term serviceability costs.

Operational flexibility and changeover challenges

For manufacturers running multiple structural parts on the same megacasting line, operational flexibility becomes crucial. Die changeover times vary significantly based on complexity, with realistic windows ranging from 2-6 hours for same-product die changes, according to Bühler's experience.

Cinelli also points to the main reason for the large variation in changeover time being crane accessibility, crane fixtures, and overall procedure and preparation. Full product changes require longer periods due to adjustments in grippers, trim tools, sensors, and peripheral equipment.

To address these challenges, suppliers are developing modular solutions including hydraulic quick clamping, ejector quick couplings, and guided rails for trim press tool changes. "Preparation and preheating of the dies to target temperature, combined with recipe-driven controls, enable fast ramp-up with only a few startup shots after installation," Cinelli adds.

The automotive tier supplier ecosystem response

The megacasting revolution has catalysed a new supplier ecosystem. IDRA, previously a niche die-casting equipment manufacturer, has become a critical Tesla partner and is experiencing unprecedented demand from Chinese automakers. Bühler Group, with its century of metallurgical expertise, offers an alternative technical approach emphasising precision and repeatability.

Traditional automotive suppliers face an existential challenge. Tier-one suppliers who built business models around assembling hundreds of components into sub-assemblies find their value propositions undermined by megacasting. Some are pivoting towards supplying raw materials and technical services for megacasting operations, whilst others are investing in developing complementary technologies.

The materials science requirements have also evolved. Traditional automotive aluminium alloys optimised for stamping and welding may not perform optimally in high-pressure casting applications. Suppliers are developing new alloy compositions specifically for megacasting, with improved flowability and reduced porosity characteristics.

Sustainability implications and environmental targets

As OEMs face increasing pressure to reduce their environmental footprint, megacasting's sustainability profile becomes a critical consideration. The technology's environmental impact is complex, with significant implications at both material and process levels.

According to Cinelli, "for megacasting, at least about 80% of part CO2e typically comes from the aluminium itself – even when sourcing below ~5 kg CO2e/kg – so meeting OEM environmental targets is primarily a material-sourcing question: prioritise low-carbon primary and maximise certified secondary content to drive the footprint down."

Beyond material sourcing, process improvements offer additional environmental benefits. After material, melting is the largest process contributor, says Cinelli; biogas in place of natural gas, electric melting concepts powered by renewables, and waste-heat recovery on gas-fired furnaces are effective levers.

The closed-loop potential of megacasting operations provides another sustainability advantage. Housing melting operations within the foundry enables closed-loop recycling of pre-consumer scrap, improving material yield and reducing waste.

BMW and Audi: reserving judgment or credulity?

The geographic distribution of megacasting adoption reveals interesting competitive dynamics. Chinese manufacturers have embraced the technology most aggressively, seeing it as an opportunity to leapfrog traditional manufacturing paradigms. European manufacturers are more cautious, perhaps reflecting their deeper investment in existing manufacturing infrastructure.

German manufacturers, despite their engineering prowess, have been notably slow to adopt megacasting. This hesitation may reflect the complexity of integrating new manufacturing processes into established production systems, or scepticism about the technology's long-term viability. BMW and Audi have reportedly evaluated megacasting but have not announced significant implementations.

BMW’s Chairman of the management board, Oliver Zipse, has stated that the OEM doesn't see an economic reason to use very large integrated parts in their vehicles, citing concerns about repair costs and the potential for a car to be a total write-off after a crash.

However, this doesn't mean BMW is completely ignoring the technology. The carmaker has been exploring the advantages and disadvantages of giga or mega castings and its own plant in Landshut, Germany, is a highly innovative location for various casting technologies. While it has not yet committed to using presses with a clamping force of more than 6,000 tonnes for full-body parts, it does use die-casting machines for components like strut braces and rear longitudinal members.

BMW's focus seems to be on a more balanced approach, aiming for optimal results by using the right material and process for the right part, rather than a "one-size-fits-all" megacasting solution.

Audi, as part of the Volkswagen Group, appears to be more receptive to the idea of megacasting. The Volkswagen Group's "Project Trinity" is an initiative that aims to use techniques like large die-casting to speed up production and cut down the number of components in its cars. Audi has also been mentioned as one of the automakers actively investigating the use of large cast components in its series production.

Volkswagen's original plan was to build the Trinity vehicle at a new, dedicated factory in Wolfsburg that would use the large casting machines. However, those plans were scrapped and in 2023, the OEM announced the Trinity would be produced at the existing Zwickau plant instead. The carmaker now plans to produce megacast parts at its factory in Kassel and then transport them by train to Zwickau.

Despite the changes in the production strategy, megacasting is still seen as a core technique for future high-efficiency EVs on the SSP platform, even though the flagship Trinity car itself has been heavily delayed.

Audi's approach aligns with a broader industry trend of moving toward modular manufacturing. The company is already using flexible and modular "production islands" in its factories to increase efficiency. Megacasting fits into this philosophy by allowing for simplified production and a significant reduction in parts and assembly steps. Audi has also chosen suppliers that provide technology for producing high-quality structural parts in aluminum, which is a key material for megacasting.

The implications for global automotive competitiveness are significant. Manufacturers who successfully implement megacasting may achieve substantial cost advantages, whilst those who delay adoption risk competitive disadvantage. However, the technology's capital intensity means that implementation decisions are not easily reversed.

Future trajectories and industry evolution

Tesla is working on an upgrade of its gigacasting tech to die-cast almost all vehicle underbody parts in one piece, suggesting that the current implementations represent merely the beginning of a broader transformation. The ultimate vision involves casting entire vehicle chassis as single components - a prospect that would fundamentally alter automotive architecture.

The technology's evolution will likely focus on several dimensions: larger machines capable of handling even more complex geometries; improved alloy compositions optimised for casting applications; and enhanced simulation tools for predicting casting behaviour and optimising mould designs.

As electric vehicle adoption accelerates, megacasting's advantages become more pronounced. Electric vehicles' simpler mechanical layouts and emphasis on structural integration align naturally with megacasting's capabilities. The technology may prove less applicable to complex internal combustion engine vehicles, where packaging constraints and thermal management requirements create different design priorities.

Conclusion: a manufacturing paradigm in transition

Megacasting represents more than a manufacturing innovation; it embodies a fundamental reimagining of how complex products can be conceived and produced. Its adoption reveals the automotive industry's willingness to abandon established practices in pursuit of efficiency and competitiveness.

The technology's ultimate success will depend on manufacturers' ability to navigate its complexities whilst realising its benefits. Early adopters like Tesla and Chinese manufacturers appear to have achieved significant advantages, but the technology's broader applicability across diverse vehicle portfolios and production scales remains to be proven.

What seems certain is that megacasting has permanently altered the manufacturing milieu. Whether it becomes the dominant paradigm or remains a specialised application for specific vehicle types will depend on how successfully the industry addresses its current limitations. For now, the aluminium revolution continues, one gargantuan casting at a time.