Production Evolution

Modular manufacturing moves automotive production into the future

Automotive manufacturers embrace modular platforms to achieve unprecedented flexibility whilst maintaining efficiency gains, transforming traditional production paradigms for electric and conventional vehicles.

"Make everything as simple as possible, but no simpler," goes the adage. With the automotive industry undergoing a quickening paradigm shift in the pursuit of critical efficiencies, this optimal simplification is now centre-stage. Where Henry Ford's assembly line once defined efficiency through repetition, today's manufacturers are discovering that flexibility and standardisation need not be mutually exclusive.

‘Modular manufacturing’ is emerging as a possible answer to an increasingly complex production puzzle; where the imperative for cost-effective, high-volume production collides with an array of disruptions from policy impediments and lagging EV demand, to the internal structural disadvantages of ‘Western’ OEMs as compared to their Chinese counterparts. Modularity just may just modulate the Electric Vehicle (EV) shift.

Quick flashback: When Volkswagen Group unveiled its Audi A3 at the Geneva Auto Show, way back in 2012, the carmaker proudly announced the model would debut VW's ambitious Modularer Querbaukasten (MQB) manufacturing platform. The modular manufacturing platform was predicted to save 20% on costs and reduce production time per unit by 30% by allowing VW to manufacture interchangeable parts for 40 models across its Audi, VW, Skoda and Seat brands. VW described the $8bn investment as its 'strategic weapon'.

Now, more than a decade later, this strategic weapon has evolved into an industry standard. VW's MQB platform is now in its third 'Evo' iteration, and the addition of the Ford Tourneo Connect to its manufacturing lineup in 2020 is testament to the platform's enduring versatility. The success has prompted manufacturers worldwide to reconsider their production philosophies, particularly as the shift to electrification requires greater adaptability as compared to traditional production systems.

Flexible van architectures from Mercedes-Benz to Renault & Volvo’s ‘Flexis’

Modularity has many iterations and just as with any technology, finds itself spreading across diverse solutions and formats as it matures. Just this year, Mercedes-Benz announced it has developed a flexible van architecture to accommodate both EV and ICE powertrains.

Beginning in 2026, the fully electric models - built on the Van Electric Architecture (VAN.EA) - will be introduced. The second variant - the Van Combustion Architecture (VAN.CA) - will follow, featuring ‘state-of-the-art’ combustion-engine vans. According to the OEM, both architectures will share roughly 70% of common parts and be produced on the same assembly line. This approach allows Mercedes-Benz to achieve greater production efficiency and flexibility.

Around the same time, and in the same Commercial Light Vehicle (CLV) segment, Flexis; the electric van joint venture between Renault and Volvo, also announced it is leveraging a modular architecture for numerous separate vehicles hinging on a shared platform, as well as European battery production to cut costs and enhance efficiency.

Flexis COO, Krishnan Sundararajan, commented: ”Because we have the high-volume platform that allows us to make three models on the same platform, it has a high degree of commonality in parts, which will make the price extremely competitive.” With serial production of this modular platform and architecture set to begin in mid-2026, the vehicle maker is positioning itself to be a key player in scalable electric commercial vehicle production.

The architecture of efficiency and modularities ‘across the board’

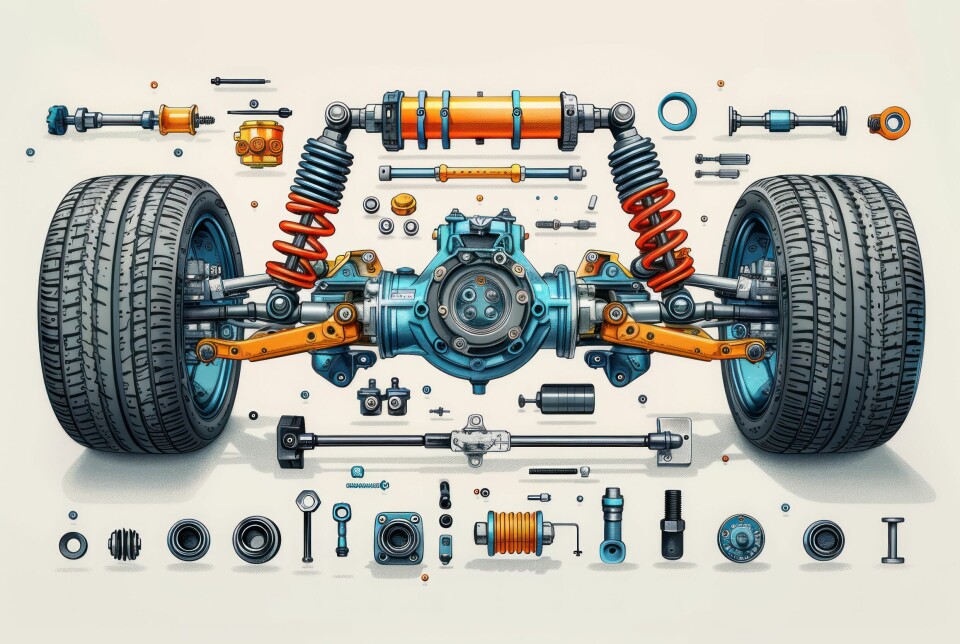

For one thing, modular manufacturing represents a fundamental shift from the integrated 'unibody' approach that dominated automotive production for decades. The current trend indicates that the next generation of vehicles will change from the integrated 'unibody' with high production volume and low flexibility, to the modular ones of middle to high production volume, and higher levels of flexibility.

The approach also carries critical modular supply chain implications. It allows manufacturers to create what researchers such as Kasra Ferdows, Professor at Georgetown University, identifies as networks characterised by their geographical dispersion and high number of alternative plants for production; allowing for greater operational flexibility to transfer and share manufacturing resources internationally. In other words, the global logistics and production network is, for all intents and purposes; modular.

Such flexibility proves invaluable when supply chain disruptions or market fluctuations require rapid production adjustments; a linchpin for automotive production.

JLR and Daimler flex their modular muscles to build resilience

This philosophy of building resilience is being actively pursued by major players. Jaguar Land Rover (JLR), for instance, is actively constructing a future-proof manufacturing ecosystem. The OEM is focusing on flexible vehicle architectures, agile supply chains, and modular production systems to navigate an unpredictable market.

Its forthcoming Electrified Modular Architecture (EMA) platform is designed for this flexibility, enabling the company to build a mix of electric and internal combustion engine vehicles on the same line, a crucial capability as EV demand fluctuates. This inherent flexibility allows JLR to pivot production based on real-time market demands without costly factory retooling.

We chose the [Honda] Ohio EV Hub [...] because we have a lot of synergy opportunity between our development operations (Marysville Auto Plant, East Liberty Auto Plant). While they’re unique, have different histories and line structures, we saw this as an opportunity to build a new, unified manufacturing footprint, and monument-based structure for mainline assembly or mainline weld, etc. regardless of the powertrain

Similarly, Daimler Truck is leveraging a common "platform concept" across its global portfolio, including the Freightliner eM2 and the Mercedes-Benz eActros. This modular "building block" system allows for the sharing of key components like e-axles, battery packs, and electric motors across different models and brands.

This standardisation not only drives down costs through economies of scale but also simplifies a complex supply chain, making it more agile and resilient to disruptions. By designing modularity into its core strategy, Daimler Truck can efficiently scale electric truck production across diverse global markets.

At Audi's Ingolstadt plant in Germany, this philosophy has translated into tangible results on the manufacturing floor. The facility uses flexible and modular 'production islands' serviced by automated guided vehicles (AGVs), where components can be assembled independently of the production line. Audi says smart-modular manufacturing techniques at Ingolstadt boosted worker productivity across some processes by 20%. These production islands represent a radical departure from the classical, linear assembly line, allowing multiple vehicle variants to be produced simultaneously within the same facility.

Modular workflows: KPIs beyond cost savings

Whilst cost reduction remains a primary driver, the inherent flexibility of modular manufacturing delivers benefits that extend far beyond the balance sheet, and perhaps even beyond net production output. Gerd Walker, member of the board of management, production and logistics at Audi, said: “We are a premium OEM and therefore flexibility is much more important than maximum unit numbers.”

The modular workflow requires less space, energy and manpower than a conventional production line, whilst the production of uniform parts results in decreased waste. In an industry increasingly scrutinised for its environmental impact, these reductions carry significant weight with both regulators and consumers.

Additionally, significant quality control benefits emerge from the modular approach's inherent design. Modular manufacturing allows manufacturers to implement quality control and oversight over individual components to ensure that each is built to the same standards.

This component-level focus enables manufacturers to identify and address defects before they propagate through the entire vehicle.

Gerd Walker, Audi Board Member for Production

Honda Ohio: Flexible, smart and modular battery manufacturing

For example, Honda’s production team achieves impressive predictive quality control through a modular design of its battery‑pack assembly at its Ohio plants. The line at the Marysville Auto Plant comprises 75 production cells arranged like an accordion, enabling flexible expansion or contraction without disrupting the main assembly flow. There, each cell - in combination with AGVs - is supported by a digital twin system, allowing simulation of production flows and volumes.

The architecture allows for scalable operations, while offering fine‑grained oversight: in‑line measurements and IoT integration at the component level (for example, battery casing production) inform whether each part meets tolerance requirements before assembly. This ensures proactive quality management of individual components before they're integrated into the full vehicle.

Mike Fischer, Honda’s North American BEV Project leader, says: “We chose the Ohio EV Hub for this starting point because we have a lot of synergy opportunity between our development operations (Marysville Auto Plant, East Liberty Auto Plant). While they’re unique, have different histories and line structures, we saw this as an opportunity to build a new, unified manufacturing footprint, and monument-based structure for mainline assembly or mainline weld, etc. regardless of the powertrain.”

Technology as the great modular production enabler

The resurgence of modular manufacturing owes much to advances in digital technology and automation. Automotive manufacturers need to manage more part variety and complexity than ever, which is why more are implementing autonomous logistics, cobots and other technology to support more flexible, modular concepts. These systems enable the dynamic routing and scheduling that modular production demands.

Leading automakers like Tesla, Toyota, and BMW are spearheading this transformation by establishing dedicated AI research centres focused on generative design, autonomous systems, and energy optimisation.

Tesla's Manufacturing VP, Lars Moravy, emphasised how the carmaker’s organisational structure ensures "engineering, manufacturing, design, automation, they're all in one org. They all report to one person. We can't point fingers at each other, we have to solve [problems] together, which is the best way to innovate."

Essentially, one could argue that the modularity seen across production architectures, that is, simply put - ‘systems made of several parts that can be reconfigured in different ways’, is also being reflected across organisational structures. This is also the intersection of modular architectures and Design For Manufacture.

The integration of digital twins and real-time monitoring systems further enhances modular manufacturing's appeal. Tesla's approach includes building interior components on battery cases outside the cabin, giving workers and robots exceptional access from all angles whilst achieving what Moravy calls "44% more operator density" and "30% improvement in space-time efficiency."

Accelerating Electric Vehicles and powertrains through modularity

The transition to electric vehicles has provided fresh impetus for modular manufacturing adoption. As the prospect of electrification and increased connectivity forces automakers and OEMs to adopt careful make vs buy strategies over the coming decade and beyond, modular manufacturing will become a mainstay of the manufacturing landscape.

Electric powertrains' different spatial requirements and thermal management needs make traditional platform sharing more challenging, whilst modular approaches offer greater adaptability.

With the growing demand for electric vehicles and the push for more sustainable manufacturing practices, modular vehicle production is likely to play an increasingly important role. The ability to rapidly reconfigure production lines for different battery configurations and electric drivetrain variants provides manufacturers with the agility needed in a rapidly evolving market.

Implementation realities

Despite its advantages, modular manufacturing presents implementation challenges that manufacturers must navigate carefully. Developing and implementing a modular production system requires significant investment, with costs particularly high when introducing new machinery, tools, and digital platforms. However, industry experience suggests these investments generate substantial returns over time.

Read AMS' Flexible Production stories

While the upfront costs are substantial, the long-term savings in efficiency and cost reductions often outweigh the initial investment. The key lies in careful planning and phased implementation that allows manufacturers to realise benefits incrementally whilst managing financial exposure.

The transition requires significant workforce adaptation. Traditional assembly line workers must develop new skills for component-based production, whilst maintenance teams need training on more sophisticated automated systems. This human element often determines the success or failure of modular manufacturing implementations.

Future horizons

As the automotive industry continues its transformation, modular manufacturing stands poised to become the dominant production paradigm. As more car manufacturers adopt modular manufacturing, this approach may become the standard manufacturing workflow.

The implications even extend beyond individual manufacturers to reshape entire supply chains and industrial ecosystems. Regional manufacturing hubs may emerge around modular platforms, with suppliers specialising in specific components or modules rather than complete vehicles. This evolution could fundamentally alter the geography of automotive production, bringing manufacturing closer to end markets whilst maintaining economies of scale.

For manufacturers contemplating this transition, the question is no longer whether to adopt modular manufacturing, but how quickly they can implement it without disrupting existing operations. Those who master this balance will find themselves uniquely positioned to thrive in an industry where change has become the only constant.