EU zero emissions rethink

Carmakers and regulators rethink EV timelines as ICE makes a comeback in Europe

Electric vehicle momentum is slowing across Europe as automakers delay EV launches, extend hybrid and ICE models, and push for regulatory flexibility. The EU is under pressure to revise zero-emission targets and support its own supply base.

Not so long ago it all seemed so certain. By 2035 if you wanted a new car in Europe, all you would be able to buy would be zero emission vehicles, essentially only battery electric vehicles with a few fuel cell vehicles possibly available as a “high tech” alternative. Vehicle manufacturers were falling over themselves to see who could go all-electric the fastest; several all-electric new brands appeared, following in Tesla’s wake. Rivian, Lucid and others have, however, found the public not as enthusiastic for EVs as they had expected, and entering the automotive sector has also proved more rather complex than perhaps they had thought, and certainly much more expensive.

For all their focus on EVs, the Chinese vehicle companies are actually proceeding cautiously and are hedging their bets with EV and hybrids in production or planned for production

Changing plans and multi-powertrain platforms

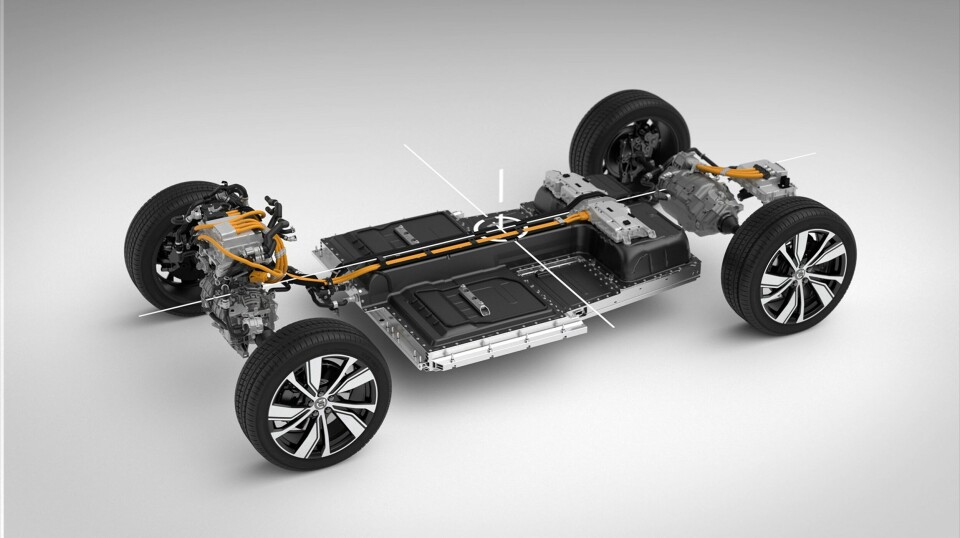

Meanwhile, as EV demand has not grown as fast as hoped for, vehicle companies as diverse as Stellantis, Ford, Porsche, Bentley and Volvo have rowed back on their plans to go fully electric before the 2035 cut-off. Such plans have been put on hold and new model launch plans are under revision. For example, Ford will launch a major new multi-energy vehicle platform in Spain by 2027. This will produce vehicles powered by pure ICE, hybrid and electric powertrains, to be sold worldwide. And at the upper end of the market, Porsche will add ICE and hybrid options to its new top-of-the-range model positioned above the Cayenne. A new ICE/hybrid powertrain Macan is also planned alongside the electric model of the same name.

Meanwhile, as EV demand has not grown as fast as hoped for, vehicle companies as diverse as Stellantis, Ford, Porsche, Bentley and Volvo have rowed back on their plans to go fully electric before the 2035 cut-off. Such plans have been put on hold and new model launch plans are under revision. For example, Ford will launch a major new multi-energy vehicle platform in Spain by 2027. This will produce vehicles powered by pure ICE, hybrid and electric powertrains, to be sold worldwide. And at the upper end of the market, Porsche will add ICE and hybrid options to its new top-of-the-range model positioned above the Cayenne. A new ICE/hybrid powertrain Macan is also planned alongside the electric model of the same name.

Nissan and JLR have made major bets on EVs, with the bulk of their European sales offering due to be pure EVs. However, both companies have extended the life of their current ICE and hybrid models. The Nissan Juke and Range Rover Evoque PHEVs have been extended by 12-24 months and may see their lived extended still further. These companies’ all-new pure battery electric models have also been delayed by periods ranging for six to eighteen months. And even the Chinese are revising their plans. BYD will make hybrids in its two new European plants in Hungary and Turkey, not just EVs. The initial vehicles made by Chery in Spain are actually pure petrol ICE or hybrid-powered, not electric. For all their focus on EVs, the Chinese vehicle companies are actually proceeding cautiously and are hedging their bets with EV and hybrids in production or planned for production.

Changing powertrain mix comes at a cost

It is worth noting moreover that the changing powertrain mix, which the vehicle companies are now adopting – ahead of any regulatory shift – is not cost-free. For example, Volkswagen will take a €5.1 billion hit in the current financial year due to changes in product plans and timings at Porsche alone. This has led Oliver Blume, still CEO of both Porsche and VW Group, to say the industry is “seeing massive changes within the automotive environment,” adding that the company has “made key strategic decisions”, adding that “now it’s time to put them into action. It’s going to be a tough and long road, and it will demand our full focus and strong effort”.

The components trade body, CLEPA, is also calling for a “substantial and timely revision” of CO2 plans and the end of sale of ICE vehicles

EV sales and registration data show at best a mixed picture and while BEV volumes may be rising in many markets, they are not growing at the rate hoped for. Hence the new powertrain strategies being followed. However it is not vehicle company strategies which are changing, with EU policy also under review. This is in response to the lack of EV market development, but also the rising strength of the Chinese vehicle companies and the confusion caused by US tariffs adding to the complexities facing the industry.

Trade bodies, along with vehicle companies, are beginning to move against the drive to full electrification. A complete ban on ICE vehicles is, for many in the industry, no longer seen as viable, if it ever was. The current ACEA president, Ola Källenius of Mercedes, has spoken of the need for “bold and fast” action; “concrete steps” are needed to ensure CO2 regulations are “fit for reality”. The components trade body, CLEPA, is also calling for a “substantial and timely revision” of CO2 plans and the end of sale of ICE vehicles. Suppliers such as Valeo are leading the call for the EU to mandate a certain level of local EU content to support the supply base in Europe as a means of slowing the rise in market share of the Chinese vehicle companies whether from local European assembly or imports.

Zero emissions regulations under review

The EU appears to agree that it needs to change tack to protect EU vehicle companies and suppliers. It is coming round to the idea of implementing Renault and Stellantis’ request for a new category of small electric vehicles. Such vehicles would have less stringent technical requirements than larger vehicles and benefit from favourable tax treatment to encourage their purchase.

Quite what regulators in Brussels will do remains to be seen. The UK government will also be under pressure to mirror EU actions on one side but also to go it alone and stick to current plans on the other side. Meanwhile, the European Commission has brought forward a scheduled review of the switch to EVs from next year to the end of this year. It seems unlikely that the Commission would do so and then announce no change to the current timetable. Change is on the way, but how far the delay to 100% zero emission vehicles will be delayed remains to be seen.