An exclusive focus on flexibility as OEMs look to modular-based manufacturing

Modular production in automotive manufacturing is rapidly becoming more innovative and flexible with the ability to multitask. As a result, OEMs are increasingly rethinking their methods and working closely with technology providers to make flexible manufacturing hegemonic.

Digital tools are making robot cells far smarter and advancing opportunities for modular cell production, while flexibility in automotive assembly is becoming a competitive advantage.

Automation experts from Ewellix and Rockwell spoke to AMS in an exclusive interview about the innovations in modular production and how assembly lines are being improved in both brownfield and greenfield factories.

Leitner sees partnerships as an essential process in OEMs and providers developing cooperative solutions to a lack of flexibility.

Christian Leitner, business leader of future mobility at Rockwell Automation, explained how automotive manufacturing is shifting towards a more module-based layout to deal with a changing and dynamic market.

“I believe it’s not just production that’s becoming more modular operations management systems and even goes further all the way to supply chains,” Leitner said.

Enhanced flexibility is developing hand in hand when it comes to modular production, as flexibility is being integrated into their existing strategies. In addition, the expansion of control within a factory setting is also making a significant change to how manufacturing takes place.

“During operation, you can use a modular MS system comprised of core functionalities of templates, and you can just pick what you need … and depending on where you actually develop, you can expand from there,” Leitner added. “If you use cloud software service on top of that… you don’t need to worry about the infrastructure, and you can scale much quicker.”

Collaboration for flexibility

Manufacturers expect providers to bring particular expertise as they look to bring flexibility into their manufacturing process.

Laurent Sanchez, automotive director at Ewellix, said that this is where co-engineering becomes essential as it increases the level of knowledge needed to meet these requirements from customers.

Technology providers are also hoping to get involved in the pre-engineering side to maximise the amount of integration they have with the product in order to satisfy demand specifications.

Leitner added: “In order to really be successful, it’s all about collaborating closely and creating those partnerships in order to gain those synergy effects.”

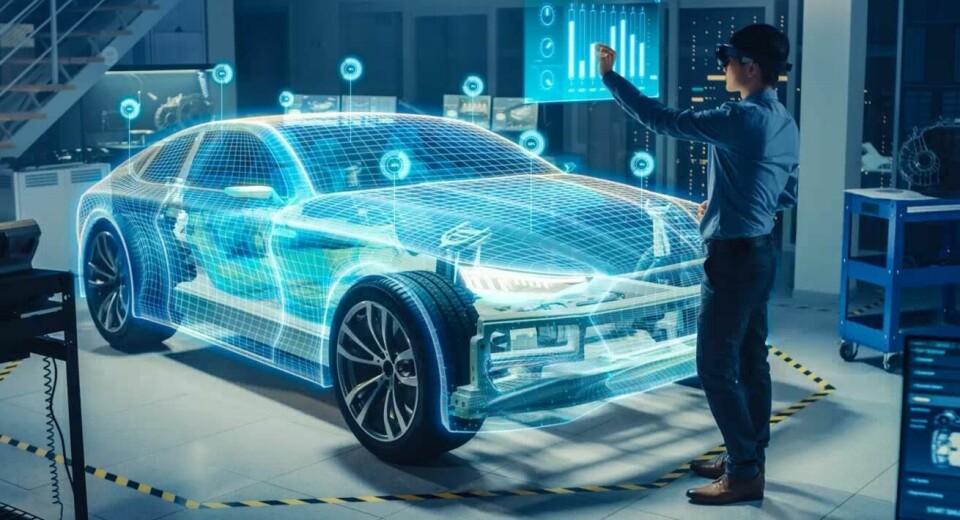

It is no longer the case that carmakers can simply demand a solution but must work collaboratively with providers while utilising innovative technologies such as virtual tools and digital twins.

Green vs brown

There is a converging distinction regarding the cost and benefits of newer companies against established legacy producers.

In terms of flexibility, a greenfield means you can design the factory how you wish and integrate flexibility into its process. However, Sanchez said one big challenge for brownfields is that they need upgrading and require free space to develop flexible processes.

Greenfields have the benefit of being able to integrate flexibility into their operations from the beginning, Sanchez says.

This sentiment was echoed by Leitner, adding that while legacy systems come with difficulties, brownfields do not ultimately stifle flexible production. Technologies can simulate and emulate production to help develop flexibility, utilising tools such as digital twins, linear motion technology, AMRs and HGVs and Cobots.

Increasing complexity

The rising demand for various car models means that production itself is becoming more complex, and manufacturers are considering this with their approach to the factory floor.

“Traditional production lines can have one or two models … some car makers today are talking about five or even twelve different car models,” said Sanchez.

Tooling has likewise seen an evolution, Sanchez explained. Production is now expanding its ability to cope with various parts, such as doors and sides of the cars, which elevates value for carmakers.

Multitask processes are attractive to more prominent carmakers as they are under significant pressure to meet shifting demand for different models and electric vehicles.

Industry disparity

Leitner added that there is little to show for geographical inequity when it comes to startups. However, the shift to electrification has pushed the industry to think “outset the box” to keep up with massive demand.

Sungwon Lee, managing director for flexible solutions at Ewellix, also highlighted how Japan was developing new start-ups while flexibility is a given when developing new factories in South Korea.

“They [OEMs] need to change their lines, so they are really thinking about flexible production lines in the factory,” Lee said.

Robots

Lee and Sanchez both emphasised the benefit of bypassing human interventions provided by robots involved on the factory floor, which don’t need to be changed manually, saving almost 80% of the time required.

“It doesn’t require a change in tooling but can simply change position,” Lee said.

Lee says that robots utilised on the factory floor have the means to expand flexibility and decrease time wasted in production.

The ability to program for a specific position of a robot is important for investors and, in the future, could save a lot of cost and time, Lee explained.

Leitner emphasises how factories are looking to extend the use of collaborative robots (cobots) when making models as well as parts.

“We have seen the cobot link to 3D printing, now being used in the automotive industry,” he said.

However, Cobots still have their limitations, and Sanchez cautioned that these tools are often better utilised in smaller applications with less weight.

All eyes on 2030

All projections and forecasts of EV sales demonstrate that a magnitude of the change is on the way, even more, exacerbated by the Covid crisis and governmental 2030 zero-carbon targets. According to Sanchez, non-electric vehicles could reach 10-15% by the end of the decade. As this situation ramps up, OEMs are scrambling for flexibility to stay productive in the face of this sea-change.