Strategic US Production Expansion

Stellantis stakes $13bn on US manufacturing renaissance

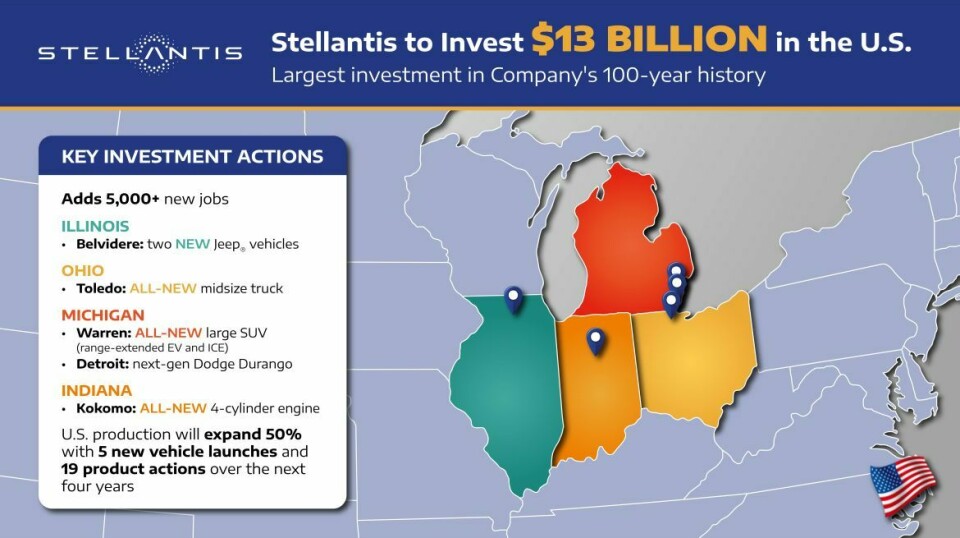

The transatlantic carmaker's largest-ever domestic commitment signals a decisive pivot towards US production, promising five new vehicles and 5,000 jobs as it pursues a 50% capacity expansion across the industrial Midwest.

This investment in the US – the single largest in the Company's history – will drive our growth, strengthen our manufacturing footprint and bring more American jobs to the states we call home

As automotive executives speak cautiously of market volatility and geopolitical uncertainty, Stellantis has made headlines by moving decisively towards a regional production strategy of huge consequence and proportion. The carmaker announced on 14th October 2025 plans to invest $13bn over four years in its US operations, marking the largest single capital commitment in its century-long American history. The investment promises to reshape the company's North American manufacturing footprint - adding five new vehicle programmes, reopening a shuttered Illinois assembly plant, and creating more than 5,000 jobs across four states in the industrial Midwest.

The scale of the commitment is remarkable, not merely for its size, but for its timing. Whilst rivals have hedged their manufacturing strategies, dispersing investments across multiple continents, Stellantis has opted for production concentration. The plan targets a 50% increase in annual finished vehicle production capacity, complemented by 19 product refreshes spanning its entire US assembly network through 2029.

This represents a decisive and significant recalibration of the OEM's global manufacturing strategy, elevating US production from a regional priority to a cornerstone of worldwide competitiveness.

"This investment in the US – the single largest in the Company's history – will drive our growth, strengthen our manufacturing footprint and bring more American jobs to the states we call home," said Antonio Filosa, Stellantis CEO and North America COO. "As we begin our next 100 years, we are putting the customer at the center of our strategy, expanding our vehicle offerings and giving them the freedom to choose the products they want and love."

The investment arrives at a moment of strategic inflection for Stellantis. Having weathered the consolidation that created the company from the merger of Fiat Chrysler and PSA Group, the OEM now confronts questions about its long-term positioning in the world's second-largest automotive market. Mr Filosa's comments suggest an answer rooted in manufacturing presence rather than import dependency.

The anatomy of a $13bn manufacturing pledge

The financial architecture of Stellantis' commitment extends beyond simple factory investment. The $13bn envelope encompasses research and development expenditure, supplier ecosystem development, and manufacturing infrastructure modernisation. The integrated approach reflects contemporary automotive economics, where vehicle programmes demand coordinated investments across design, engineering, and production systems, hearkening to the enhanced Design for Manufacture (DfM) systems that put Chinese automakers far ahead of their 'Western' contemporaries.

Yet the announcement's true significance lies in its geographic concentration. Rather than dispersing capital across its global network, Stellantis has chosen to concentrate resources in four adjoining states: Illinois, Ohio, Michigan, and Indiana. This clustering strategy promises operational efficiencies through supplier proximity, logistics optimisation, and workforce mobility. It also carries political resonance, concentrating job creation in states that have experienced decades of manufacturing employment decline.

The product portfolio underlying the investment spans multiple segments and powertrain architectures. Five new vehicle programmes will join 19 product refreshes, creating what the company describes as a "regular cadence" of launches through 2029. This rhythm of introductions aims to maintain product competitiveness whilst avoiding the feast-or-famine cycle that has plagued automotive manufacturers in previous decades.

"Accelerating growth in the US has been a top priority since my first day. Success in America is not just good for Stellantis in the US — it makes us stronger everywhere," Filosa said.

From closure to resurrection at Belvidere, Illinois

Perhaps no element of the investment carries greater symbolic weight than the planned resurrection of the Belvidere Assembly Plant. Stellantis intends to invest more than $600m to reopen the facility, which will expand production of the Jeep Cherokee and Jeep Compass for the American market.

The vehicle producer anticipates the reopening will create approximately 3,300 jobs, with initial production launch expected in 2027. The Belvidere reopening reverses one of the more contentious manufacturing decisions in recent Stellantis history.

The facility's closure had become emblematic of the challenges facing industrial communities in the American Midwest, where automotive employment has contracted sharply over the past two decades. Its revival transforms the plant from a symbol of industrial decline into an anchor of regional economic revitalisation.

The economic calculus supporting Belvidere's resurrection reflects broader shifts in automotive manufacturing. Rising logistics costs, supply chain fragility exposed during pandemic disruptions, and growing political pressure for domestic production have altered the economics of global manufacturing networks. What appeared uneconomical several years ago now presents compelling returns, particularly for vehicles serving primarily domestic markets.

Reconfiguring the Toledo, Ohio production ecosystem for increased flexibility

Ohio emerges as a second major beneficiary of the investment programme. With nearly $400m in capital commitment, Stellantis plans to produce an all-new midsize truck at the Toledo Assembly Complex, where it will share production lines with the Jeep Wrangler and Jeep Gladiator. The programme, originally allocated to Belvidere, could create more than 900 jobs. Production launch is anticipated in 2028.

The Toledo investment illustrates the company's approach to manufacturing flexibility. By consolidating multiple vehicle programmes within single facilities, Stellantis aims to achieve economies of scope whilst maintaining the ability to adjust production volumes in response to market demand. The strategy reflects lessons learned from previous cycles, when dedicated single-product facilities struggled during market downturns.

Beyond the new truck programme, Stellantis confirmed its intention to proceed with previously announced Toledo investments. These include advanced technologies and product enhancements for both the Wrangler and Gladiator, alongside expanded component production at the Toledo Machining Plant. The integrated approach treats the Toledo complex as an ecosystem rather than a collection of discrete facilities.

Michigan's dual-powertrain gambit

Michigan's allocation within the investment programme reflects the industry's technological uncertainty. Stellantis plans to develop an all-new range-extended electric vehicle and internal combustion engine large SUV for production at the Warren Truck Assembly Plant beginning in 2028. The company will invest nearly $100m to retool the facility, with the new programme anticipated to add more than 900 jobs to a plant currently assembling the Jeep Wagoneer and Grand Wagoneer.

The investment programme extends beyond vehicle assembly to powertrain manufacturing. The [Kokomo] programme will [ensure] American production of what the company characterises as a 'strategic powertrain'

The dual-powertrain strategy hedges against technological and regulatory uncertainty. By developing both range-extended EV and traditional internal combustion variants simultaneously, Stellantis positions itself to respond to market preferences that remain unclear. The approach acknowledges that whilst regulatory pressure favours electrification, consumer adoption patterns continue to diverge from policy ambitions.

Stellantis also expects to invest $130m preparing the Detroit Assembly Complex at Jefferson for production of the next-generation Dodge Durango, reaffirming a commitment announced in January. Production launch is anticipated in 2029, extending the facility's production timeline and securing employment for its workforce.

Kokomo, Indiana's four-cylinder engine and 'strategic powertrain' play

The investment programme extends beyond vehicle assembly to powertrain manufacturing. Stellantis confirmed plans to make additional investments exceeding $100m across several Kokomo, Indiana facilities to produce the all-new GMET4 EVO four-cylinder engine beginning in 2026. The programme will add more than 100 jobs, ensuring American production of what the company characterises as a 'strategic powertrain'.

The four-cylinder engine investment merits attention for its strategic implications. At a moment when industry discourse emphasises electrification, Stellantis has committed substantial capital to advanced internal combustion technology. The GMET4 EVO designation suggests evolutionary improvements in efficiency and emissions performance, positioning the engine as a bridge technology during the extended transition to electrification.

The decision to locate four-cylinder production in America rather than importing engines from lower-cost manufacturing locations reflects changing economics. Currency fluctuations, logistics costs, and tariff considerations increasingly favour regional manufacturing for regional markets. The Kokomo investment also strengthens the company's bargaining position in future trade negotiations, demonstrating domestic manufacturing commitment.

Stellantis' American footprint now encompasses 34 manufacturing facilities, parts distribution centres, and research and development locations across 14 states. These operations support more than 48,000 employees, 2,600 dealers, and nearly 2,300 suppliers in thousands of communities nationwide. The October announcement builds upon previously announced actions from January 2025, suggesting a sustained commitment to American manufacturing expansion rather than a one-time capital deployment.

The $13bn commitment represents more than financial engineering. It signals a fundamental reassessment of global manufacturing strategy, elevating American production from cost centre to competitive advantage. Whether this wager on the industrial heartland delivers promised returns will determine not merely Stellantis' future in America, but its positioning in the global automotive hierarchy.