Automotive Industry Insights

Analysis: Carmakers face flux with flexible production as labour crisis deepens

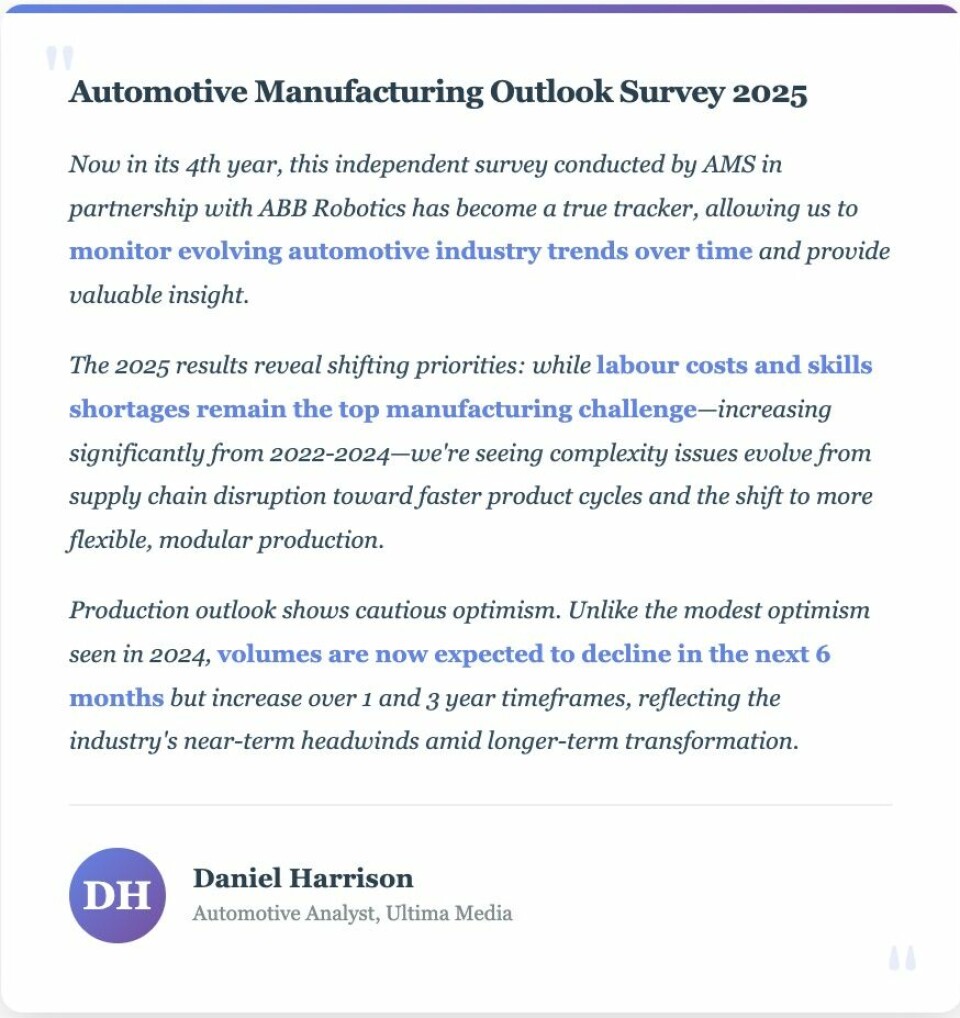

Fourth annual survey reveals workforce challenges remain paramount whilst production flexibility emerges as new complexity. Early data suggests fundamental shift in how manufacturers approach capacity and agility in uncertain times.

After four years of tracking sentiment across the global industry, patterns are emerging that suggest something more profound than cyclical adjustment. The challenges that dominated 2024 have not disappeared. Instead, they have evolved, mutated into new forms that demand different responses from vehicle manufacturers already stretched thin by transformation.

Labour costs and skills shortages claimed the dubious honour of top manufacturing challenge in 2024, a position they had climbed to steadily since 2022. That ascent told its own story about an industry struggling to reconcile traditional production methods with demands for electrification, digitalisation and sustainability. The workforce capable of navigating this transition remains elusive, expensive and increasingly mobile.

"Labour costs and skills shortages were the top manufacturing challenge, increasing significantly from 2022 to 2024," says Daniel Harrison, Automotive Analyst at Ultima Media. "Initial signs for the 2025 survey are that this is still the top issue."

That persistence matters. Whilst other sectors have seen labour pressures ease as post-pandemic disruption fades, automotive manufacturing confronts something structural rather than temporary. The skills required to build electric vehicles differ fundamentally from those needed for internal combustion engines. Software competencies trump mechanical knowledge in ways that would have seemed improbable a decade ago, while training pipelines have not kept pace with this velocity of change.

Why modular production is becoming the new survival strategy

Yet labour's dominance may face competition. Early results from the 2025 survey hint at a shift in complexity challenges that could reshape how vehicle manufacturers think about production architecture. Supply chain disruption held the crown in 2024; an unsurprising consequence of geopolitical tensions, pandemic aftershocks and the brutal realignment of global logistics networks. That particular nightmare has not ended. It has simply been joined by others.

"Supply chain disruption was the top complexity challenge," Harrison notes. "However, early 2025 results indicate that the top issue may have shifted to faster product cycles along with the shift to more flexible and more modular production."

This transition from external disruption to internal capability speaks volumes about where the industry finds itself. Manufacturers have grudgingly accepted that supply chains will remain volatile - and so the question now becomes how to build production systems resilient enough to absorb that volatility without grinding to a halt.

Flexibility (that is the ability to produce EVs and ICE on the same production lines), and modularity offer answers, but implementing them requires investment, reorganisation and, crucially, those elusive skilled workers capable of managing more complex, adaptable systems.

The drive towards flexible production reflects broader market realities. Consumer preferences are shifting faster than ever, regulatory frameworks are diverging across regions, and technology platforms are evolving between model cycles rather than across generations.

Fixed production lines optimised for volume over variability represent increasingly precarious bets. Manufacturers are recognising this, and redesigning facilities to accommodate multiple platforms, integrate software updates without hardware changes - and pivoting between powertrain types as demand fluctuates.

Production volumes were modestly optimistic in the 2024 survey. However, preliminary results for 2025 indicate that volumes are expected to decline in the next six months but increase in one-year and three-year timeframes

Weak now, stronger later: The vehicle production paradox

Production volume expectations lay bare an industry caught between an array of competing pressures. The 2024 survey showed modest optimism; a tentative belief that the worst disruption had passed and growth would return. However, the 2025 data - thus far - paints a more nuanced picture–one that depends entirely on which timeframe you examine.

"Production volumes were modestly optimistic in the 2024 survey," Harrison explains. "However, preliminary results for 2025 indicate that volumes are expected to decline in the next six months but increase in one-year and three-year timeframes."

This divergence between near term pessimism and longer term confidence captures the sector's mood precisely. Immediate headwinds remain formidable; economic uncertainty persists; interest rates, whilst falling, remain elevated, and consumer confidence wavers. Yet carmakers cannot afford to plan solely for the next two quarters. Electrification mandates loom, while autonomous vehicle technology matures. And from a consumer perspective, mobility patterns continue their slow evolution away from individual ownership towards shared access.

The three year horizon matters because that represents the minimum timeframe for meaningful capacity adjustments. Retooling a plant, training a workforce, validating new processes; these cannot be accomplished in six month sprints. Carmakers anticipating growth in 2027 must commit resources in 2025 despite immediate market softness. Those calculations grow more difficult when labour costs rise, vehicle supply chains remain fragile and flexibility requirements multiply.

Be part of the conversation...

Four years of data reveal shifting baselines in automotive manufacturing

Four years of consistent data collection transforms isolated snapshots into something more valuable: Trends become visible, regional variations clarify, and the distinction between temporary disruption and permanent transformation sharpens. What appeared anomalous in 2022 may now represent the new baseline, and according to emerging data - what seemed permanent in 2023 may have already shifted.

This longitudinal perspective matters enormously for strategic planning. Manufacturers allocating capital across decades benefit from understanding whether current challenges represent cyclical downturns or structural breaks. Automotive suppliers positioning themselves for future demand need visibility into how OEM priorities are evolving, not merely where they stand today. Policymakers attempting to support industrial competitiveness require evidence of persistent versus transient obstacles.

The Automotive Manufacturing Outlook Survey, now entering its fourth year as a collaboration between Automotive Manufacturing Solutions and ABB Robotics & Automation, offers precisely this insight. Independent from commercial pressures yet informed by commercial realities, it captures sentiment from experts actually grappling with these challenges daily. Their collective experience, aggregated and analysed, provides a compass for an industry navigating without clear maps.

Survey voices turn data into direction for the industry

The value of any survey depends entirely on participation breadth and respondent quality. A thousand generic responses offer less insight than two hundred from individuals directly responsible for manufacturing strategy, investment decisions or operational execution. The 2025 survey seeks precisely that informed perspective, covering everything from immediate operational headaches around trade and costs to longer term strategic priorities around sustainability and technology adoption.

Understanding how labour challenges manifest differently across regions helps suppliers target training programmes more effectively, knowing whether electrification anxieties have eased or intensified guides investment in battery assembly capabilities, and tracking whether sustainability remains rhetorical commitment or hardens into procurement requirements influences how auto suppliers position their offerings.

These insights emerge only through participation. Every response adds texture, reveals variation and challenges assumptions. This is where your voice comes in…

The preliminary findings already suggest 2025 may mark an inflection point, with flexibility and adaptability displacing brute volume efficiency as the paramount manufacturing virtue. Whether that pattern holds - depends on who responds and what they report from their particular vantage point across the sprawling automotive production and supply chain.

The survey remains open. Early signals suggest fascinating evolution from previous years, but signals require validation through participation. Those working in automotive manufacturing possess the experience that transforms data into understanding - and contributing that experience - takes minutes. The collective intelligence generated could shape industry direction for years. Join us…