Reshoring key EV lines

GM invests $4bn to boost US EV output and shift assembly from Mexico, Canada

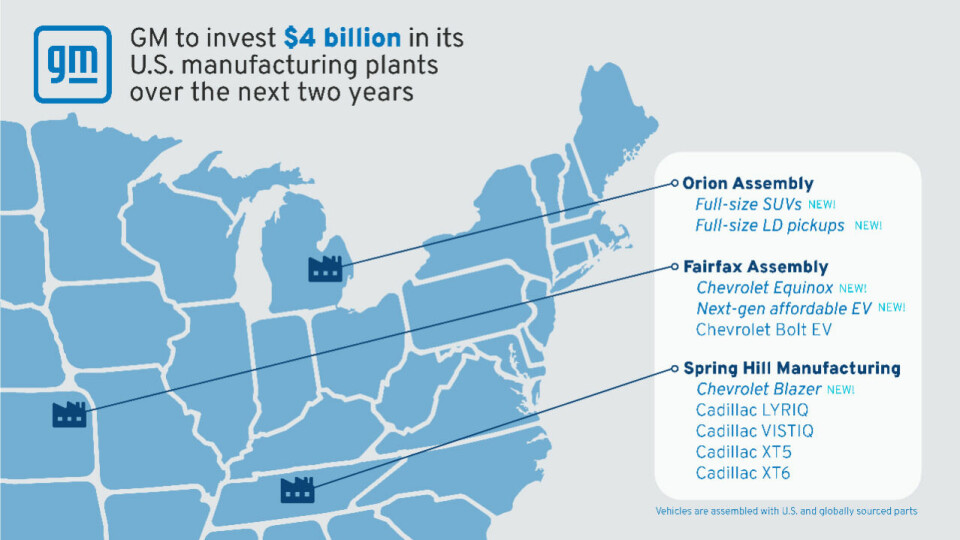

General Motors will invest $4bn to expand vehicle production in Michigan, Kansas and Tennessee, shifting models from Mexico and Canada in a move that highlights localisation, EV growth and trade policy anticipation.

”We believe the future of transportation will be driven by American innovation and manufacturing expertise. Today’s announcement demonstrates our ongoing commitment to build vehicles in the US”

General Motors has unveiled plans to invest $4 billion (approximately £3.1 billion) in its US manufacturing network over the next two years, a move that goes well beyond volume growth. The strategy signals a decisive reordering of GM’s production footprint, reshoring critical vehicle and powertrain assembly to the United States while doubling down on both electric and combustion-driven models.

The investment will expand finished vehicle production across GM plants in Michigan, Kansas and Tennessee. At its Orion Township site in Michigan, GM will introduce production of full-size petrol-powered SUVs and light-duty pickup trucks by early 2027. This represents a significant shift in the carmaker’s strategy, likely replacing units currently manufactured in Mexico and Canada, though this is yet to be confirmed.

However, in turn, the Orion site will complement Factory ZERO in Detroit-Hamtramck, which will concentrate on battery electric vehicles including the Chevrolet Silverado EV, GMC Sierra EV, Cadillac Escalade IQ and both pickup and SUV versions of the GMC Hummer EV.

Meanwhile, Fairfax Assembly in Kansas will begin building the latest petrol-powered Chevrolet Equinox from mid-2027, as the model enjoys a surge in demand following its redesign. Sales jumped more than 30% year-on-year in the first quarter of 2025.

The Kansas plant is also on track to begin producing the 2027 Chevrolet Bolt EV before the end of this year. GM confirmed that further investment in Fairfax is under consideration to support the next generation of its more affordable EVs.

In Tennessee, GM’s Spring Hill Manufacturing facility will add production of the petrol Chevrolet Blazer from 2027, alongside the Cadillac Lyriq and Vistiq electric models, as well as the combustion-engined Cadillac XT5.

”By securing local production and supply chains, supporting combustion engine platforms and investing heavily in US manufacturing, GM appears to be hedging against an unpredictable regulatory and trade environment”

GM pivots towards localisation and tariff offset

This $4 billion investment follows GM’s announcement of $888 million for its Tonawanda Propulsion Plant in Buffalo, New York. That capital will support the company’s next-generation V8 engine, which remains a cornerstone of GM’s high-margin pickup and SUV business.

The scale and timing of these investments strongly indicate a concerted localisation push, as GM aims to secure its US production base in response to shifting trade dynamics and ongoing tariff risks.

“We believe the future of transportation will be driven by American innovation and manufacturing expertise,” said Mary Barra, Chair and CEO. “Today’s announcement demonstrates our ongoing commitment to build vehicles in the US and to support American jobs. We’re focused on giving customers choice and offering a broad range of vehicles they love.”

The New American Drive: Localising, Electrifying, Rebuilding

As GM retools its production base for a more resilient and regionally rooted future, its peers are charting similar paths…

Those shaping this industrial reset - including GM, Ford, Toyota, VW, Stellantis and Bosch - will convene at Automotive Manufacturing North America 2025, 22–23 October at The Henry Hotel, Detroit.

The shift is real. The discussion starts here…

To shore up its defences against persistent waves of disruption, the carmaker is simultaneously readjusting its sourcing strategies. As policymakers in Washington intensify scrutiny over foreign-made vehicles, GM’s decision to concentrate production stateside, appears as much about geopolitical risk management as it is about production efficiency.

“Today’s news goes well beyond the investment numbers — this is about hardworking Americans making vehicles they are proud to build and that customers are proud to own,” said GM President Mark Reuss. “As you travel the country, you can see firsthand the scale of our manufacturing footprint and the positive economic impact on our communities and our country.”

The hybrid approach: GM takes a large leaps for its large footprint

GM’s North American industrial footprint spans 50 US manufacturing and parts sites across 19 states, including 11 vehicle assembly plants. The OEM states that nearly one million Americans, including its employees, suppliers and dealers, depend directly on its business.

The repositioning is also designed to serve GM’s dual propulsion strategy. While electric vehicles gain momentum, the company is keen to not cede ground in combustion-engine markets, where it continues to lead. GM expects its sixth straight year as the top seller of full-size pickups in the US, and its 51st consecutive year as the market leader in full-size SUVs.

Read more GM stories

- GM invests $888M in Tonawanda plant to build next-gen V-8 engines for trucks and SUVs

- Unifying global manufacturing: GM under Mike Trevorrow

- GM hires Aurora’s Sterling Anderson as product chief

- Human-Machine Interfaces at GM, Mercedes, Ford, and Volvo

This hybrid approach is reflected in sales. In the second half of 2024, GM overtook key rivals to become the number two electric vehicle seller in the US, with 13 models on offer across its Chevrolet, Cadillac and GMC brands. Chevrolet is now the fastest-growing EV brand in the country and ranks second in total EV sales.

Capital spending guidance for 2025 remains unchanged at between $10 billion and $11 billion. GM expects annual capital expenditures through 2027 to range between $10 billion and $12 billion. The company said this reflects increased investment in US facilities, prioritisation of core programmes and productivity improvements.

A North American new normal?

While GM’s long-term goal remains a transition to zero-emission vehicles, the latest announcements suggest a more pragmatic near-term approach. By securing local production and supply chains, supporting combustion engine platforms and investing heavily in US manufacturing, GM appears to be hedging against an unpredictable regulatory and trade environment.

General Motors has not disclosed whether the recent shift will directly impact existing production volumes in Mexico and Canada. However, the reallocation of key SUV and pickup models strongly suggests a reduction in North American import reliance.

This adjustment, reinforced by incentives tied to the Inflation Reduction Act and US content requirements, aligns with a broader industrial recalibration; one that prioritises resilience, economic competitiveness and regional manufacturing depth over globalised footprint imperatives.