Challenging relationships

As the trend of electrification gains pace, and demand in the global new car market dwindles, suppliers are looking at ways to best serve their OEM customers

The global automotive components industry is facing some severe headwinds; from finances being buffeted by demand fluctuations, mostly involving declining vehicle volumes; from increased investment requirements in electrification and autonomous vehicle technology; and from the global trading environment, which is experiencing severe turbulence as the US and China battle for economic supremacy. The EU is unavoidably caught up in the latter, and although US tariffs on EU cars or components have yet to be increased this may well happen in the next six months or so, placing further strain on existing supplier finances.

More than 20,000 jobs are said to have been cut at US suppliers between January and May 2019, and these losses, resulting from the trends mentioned above, are symptomatic of an industry that is at risk of seeing much of its established value eroded. Analysts at Deloitte have calculated that automotive suppliers have created over $500 billion in shareholder value since the 2008-09 recession, more than doubling the sector’s pre-recession value. Much of this is now at risk, especially in highly commoditised, traditional technologies, or sectors where rapid technological change means once standard technologies will no longer be required. The converse is also true, with new technologies representing significant potential for value creation.

“Data from a recent North American supplier survey suggests that purchasing conflicts are increasing, especially in electronics. Suppliers are having to invest heavily in new areas but are finding it difficult to see a financial return at this stage, making them resistant to further investment.”

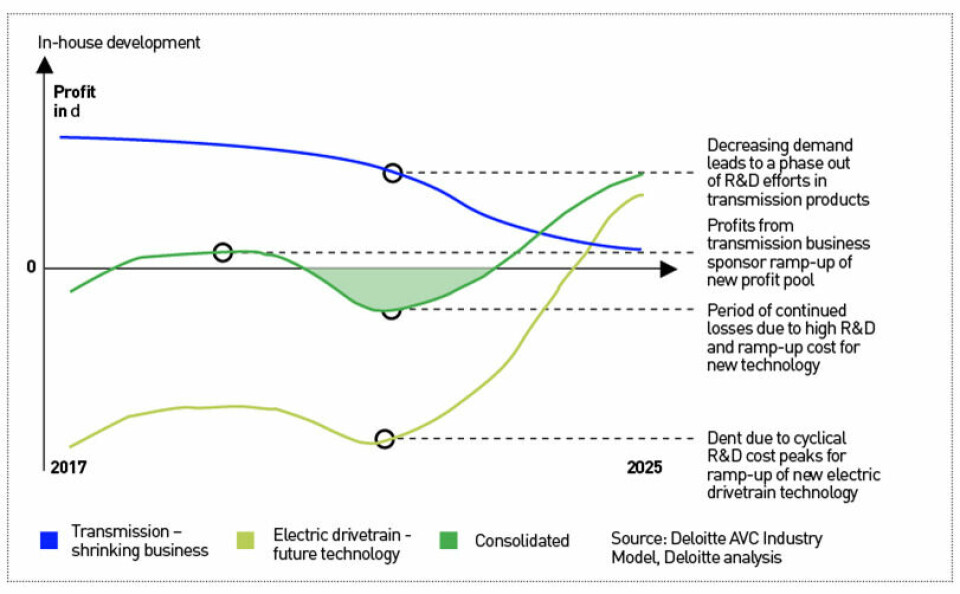

As examples of this potential destruction and creation of value, Deloitte suggests transmissions and conventional axles will see their value decline by up to 10% by 2025; however, for transmissions especially, the potential for a much bigger decline is clear, as they will not be needed in full EVs.

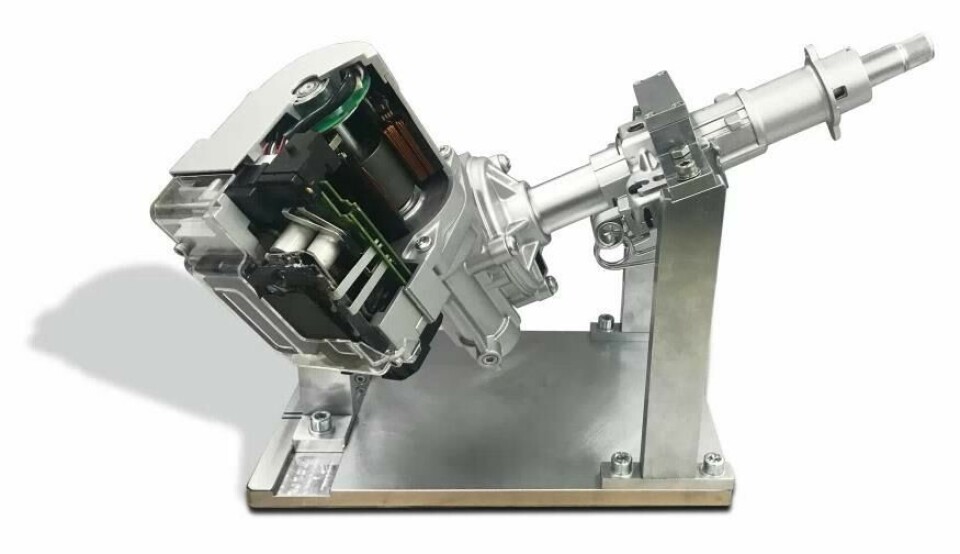

On the other side of the equation, Deloitte suggests that electric drivetrain suppliers’ value will rise by over 300%, battery and fuel cell sector suppliers by over 250%, and ADAS and sensor suppliers by close to 200%. Again, for some of these, the long-term increase in value could be much higher. However, for all the potential growth in electric vehicle technologies especially, the rate of growth in value creation and in new technologies will likely be stymied by the turbulence caused by the factors mentioned earlier, and the possible risk of a new downturn, or recession.

The changing technological and challenging financial environment is also creating tensions in relations between vehicle companies and suppliers. Data from a recent North American supplier survey suggests that purchasing conflicts are increasing, especially in electronics. Suppliers are having to invest heavily in new areas but are finding it difficult to see a financial return at this stage, making them resistant to further investment. The toughening stance of vehicle companies with regard to prices they are willing to pay is placing further strain on the system. This survey showed that Fiat Chrysler Automobiles, in particular, was poorly regarded by North American suppliers. Toyota and Honda saw their supplier ratings improve, while GM and Ford were broadly unchanged compared to the previous year’s survey. Nissan, meanwhile, was rated just above FCA but, having been the bottom-ranked vehicle company of the six largest US vehicle manufacturers, this was barely a positive outcome.

Financial troubles evident today …

Q2/2019 results for some of the major tier ones make for grim, although perhaps not surprising, reading in view of the above-mentioned trends. Several companies have reported declining profits, with common reasons cited, including tariffs between the US and China; falling consumer demand (and therefore falling vehicle production) in the major markets, especially China; rising and seemingly unending investment requirements in electric vehicles, emissions reduction and autonomous technology especially. Currency fluctuations do not help (but these have always been an issue for suppliers, so there is nothing new here), while the traditional industry-wide drive to reduce costs is intensifying. Some tier ones, such as BorgWarner, have also blamed their own tier two and three suppliers for failing to cut costs.

As examples of the worrying financial position of the sector, we can note the following: Visteon reported an 80% fall in Q2 income (attributed mainly to falling production), while Continental reported a 41% drop, attributing this to problems in China and investment requirements in electric and autonomous vehicle technologies. ZF and Autoliv have issued profit warnings for the year as a whole; Valeo has implemented a major cost-cutting exercise; Adient saw its quarterly earnings fall 37%, but intriguingly its share price rose by over 30% on the back of new seating contract awards from GM, Ford, VW and Kia; its competitor Faurecia actually saw a profit rise, albeit of just 1%, but its future results will likely be negatively affected by the loss of contracts with Groupe PSA in Spain and Mercedes in the US.

As is often the case, amidst the negative news there have been some positive results reported; Gestamp, the Spanish group that is one of the leaders in stampings and pressings, reported its best-ever quarter, with profits up 9% and revenue up 8%. It has grown strongly in recent years on the back of two major trends: the rise in outsourcing by the vehicle companies and the growth in hot stamping. OEMs increasingly focus on producing only the largest panels and as their in-house equipment comes to the end of its working life, it is unlikely to be replaced, except for producing the main body panels and key structural chassis parts.

Gestamp has picked up significant business as a result of this trend, and not just in Spain, but across Europe as a whole. It runs JLR’s on-site press shop operations in Slovakia, saving the carmaker significant investment cost. Furthermore, the rise in hot stamping, a key element in the industry’s overall weight reduction strategy, is an area in which Gestamp is one of the world leaders. Having spotted this emerging technology and backed it very early on, the company has benefited from being early to market and is now an acknowledged leader.

Meanwhile, CATL, China’s leading battery and cell maker, has reported rising H1 profits and predicted a rise in annual profit in 2019 of between 120% and 150%. CATL is expanding outside China and will be a key supplier to VW amongst other non-Chinese vehicle companies.

For some companies, therefore, profits can still be made in the automotive supply chain. But for many, especially those in conventional technologies, this is not the case at present; certainly, the current challenges will remain in place for the rest of this year and probably well into 2020. Longer term, whether traditional suppliers will be able to maintain recent levels of shareholder value creation (i.e. retained profits) is questionable. It certainly seems unlikely. It is also clear that the ongoing fall-out from the challenging economic conditions across the globe and the need to invest in electric vehicle technology (plus potential further fall-out from the diesel emission scandal) will continue to place major strain on suppliers’ finances, and the industry should brace itself for further disappointing figures in the next quarter, and quite probably in the quarter after that too.

M&A and supply chain restructuring to increase?

In response to the challenging environment mentioned here, M&A activity and supplier realignment will continue along the established trends of recent years. That said, the rate of M&A activity is arguably lower than in the past, but some notable deals have taken place, and more will follow. The risk of a recession will likely increase defensive measures – including M&A – in the supply base.

Calsonic-Kansei’s merger with – or takeover of – Magneti Marelli is perhaps the biggest deal of recent years. Owned by private equity group KKR, the merged company will be run out of Japan under the guidance of supplier industry veteran Beda Bolzenius, formerly of Johnson Controls. Ultimately, this merged entity, which will be called simply Marelli, will likely be spun off as a separate business in due course. However, this will not happen until further acquisitions have been made; the company is looking for growth areas in electric powertrain in particular

Other notable M&A developments include Italian specialist brakes company Brembo, which has announced it plans to make a number of acquisitions outside Italy. Meanwhile, the leading US stamping supplier, Tower, is to be acquired by Autokiniton, a private equity-owned group. The deal is worth up to $900m, highlighting the value of the company, which derives close to half its business from Ford, just over a fifth from FCA and over 10% from Nissan. The company being sold is the US operations, its European operations having been bought earlier in the year by SNOP of France for around d250m.

Vehicle companies are also involved in this trend. For example, Toyota is optimising the structure of its driveline subsidiaries; the shares it holds in Yutaka Seimitsu Kogyo have been transferred to JTEKT to better manage resources across traditional driveline technologies in an era when most effort is focus on the development of electric drivetrains.

Meanwhile, for other companies, spinning off some areas of established businesses is another way of optimising resources and raising funds for new investments. Examples here include Textron, which is looking at spinning off its Kautex unit, which specialises in fuel tanks and windscreen and light cleaning systems; the diversified group also makes light and windscreen cleaning systems, selective catalytic reduction systems, cast iron camshafts and crankshafts. With the industry moving away from traditional fuel-based powertrains, Textron is likely to be looking for ways to realise value from some of its businesses to raise funds to position itself better for the future.

Elsewhere, Leoni, one of the leaders in wiring harness supply, is looking at a stock market listing for its Wire & Cable Solutions division, to allow it and the parallel Writing Systems (harnesses) division to operate better independently.

Some suppliers, such as Varroc, are looking at organic growth strategies. The Indian group, which owns the former Visteon lighting unit, had wanted to make more acquisitions following the purchase of Sa-Ba Automotive in Turkey. This gave it production capacity and business in Turkey, and a new factory in Bulgaria. However, it has found potential acquisitions too expensive and has refocused its efforts, opening a new factory in the Czech Republic and preparing to add a new plant in Poland by the end of the year. Varroc has also opened a factory in Tangiers in Morocco, which is a major new market for suppliers given the Renault-Dacia and new PSA factories in the country. The Moroccan plant will supply car plants both in Morocco itself and also export back to Spain and France.

Other examples of organic growth and investment in existing factories include Woodbridge, in Canada. One of the global leaders in foam for seats, it is investing $77m in two existing factories in Ontario, supported by the Canadian government’s Strategic Innovation Fund.

In a rare case of expansion in the UK components sector amidst the uncertainty of Brexit, IAC has announced it will expand its existing factory at Elmdon in the Midlands. This headliner plant is an existing JLR supplier and has been nominated a supplier for a series of models made on the new JLR MLA platform. The expansion will be operational by 2021 and will add 400 jobs.

Elsewhere in Europe, the decision by Toyota to assume 100% ownership and control of the former Toyota-PSA joint venture plant in the Czech Republic has led to Koyo Seiko expanding its factory in Romania ahead of being awarded higher volumes from Toyota.

Investment in new factories continues

For all the problems and challenges facing the supplier sector, many companies are investing in new factories, in response, it must be said, to new contract wins. This is driven in part by vehicle companies constantly switching suppliers, especially at major model or platform changes; a policy that means opportunities for suppliers regularly emerge. Equally, the move to electric vehicles is leading to a whole raft of supplier investments, mainly by battery suppliers, but in other areas too.

In electric vehicle component supply, investments outside batteries include the building of a plant in Hungary by Japanese supplier Toray to make battery cell separators. Once in production, in 2021, this will increase Toray’s global capacity by 20% and will add to existing capacity in japan and Korea. Another Asian supplier moving to Europe to supply the growing battery market there is battery terminal supplier Bumchun Precision, which will build its first plant outside Korea in Hungary.

In Korea, Hyundai Mobis is investing 380 billion won ($321m) in a new electric vehicle components plant. This will be at Ulsan in the south-west of the country, close to Hyundai’s main vehicle plant. This adds to an existing EV part factory in Chengdu, 150km south of Seoul, which makes drive motors, electronic driving units and battery modules both for full electric and hybrid vehicles.

Most the new EV supply chain investment is taking place in established locations, but there is some in unusual and atypical locations, including Finland, where Valmet, best-known as a contract manufacturer for Mercedes and (in the past) Porsche, is opening a battery plant at Sato, a former mobile phone manufacturing locations.

In established technologies, several new plants are in the process of being built, for a range of new models. These include a new Rochling plant in Slovakia, at Kocovce, to supply a wide range of parts for Daimler-Mercedes, JLR and PSA. The factory will make active grille shutters, underbody panels, wheel-arch liners and air filters.

Meanwhile, in Germany, ThyssenKrupp is building a new forging line at its factory in Homburg, Germany. €80m will be ploughed into what will be the largest single investment at the factory. The new line will feature an automated, digitised forging oppress weighing 1,700 tonnes, with a pressing force of 16,000 tonnes. The company says this is the first eccentric press of such a scale worldwide, capable of producing 360,000 forgings a year. Parts for front axle systems and crankshafts will be the main, but not sole, parts made.

Close by the ThyssenKrupp plant, also in the Saarland, Hella-Behr-Plastic Omnium (HBPO) has recently started building a new front-end module assembly plant. This is HBPO’s largest factory, covering 15,000 sq.m and will supply a Daimler electric vehicle to begin with. Plastic Omnium will also use part of the new factory to make plastic parts for the same vehicle.

“OEM investments in new factories may be few in number but when they occur, they normally lead to new supplier investments. Up to 2,000 jobs will be created in the supporting supply chain of FCA’s new plant in Detroit.”

ThyssenKrupp will also build a new plant in Pecs, south-west Hungary, to make valvetrain parts for conventional powertrains and parts for electric motors. This will be in production by the end of 2020 and follows the opening in June this year of a new ThyssenKrupp plant in Sibiu, Romania, which makes shock absorbers for Mercedes, JLR and Porsche.

In China, Continental, which is facing a number of financial challenges as noted above, is opening a huge new plant at Wuhu. Its 22 different production lines will make a range of powertrain products including thermal management parts, sensors and actuators for both conventional powertrains and electric vehicles. A key product to be made here will be a coolant flow control valve (CFCV) which directs either hot or cold air to the correct part of the powertrain. One of the first CFCV products will be used on a Chinese-made EV by the end of 2019.

In Ohio, US, Magna is building a new $60m plant to make rear seat structures for a new contracts starting in Q1/2020. The seats will be fitted in a new plug-in hybrid model and their structures will be welded using robotic lasers.

OEM investments in new factories may be few in number these days but when they occur, they normally lead to new supplier investments. For example, FCA is opening a new factory in Detroit and expects to attract a number of new suppliers to the area. The factory will provide close to 5,000 jobs with up to 2,000 to be created in the supporting supply chain.

One of the most interesting new investments in North America comes from Tiberina Group of Italy. This long-established Fiat supplier of stampings and body-in-white assemblies has won business with FCA business in North America. It will build a new plant on a site formerly occupied by American Axle which closed in 2012.