China’s rapid rise in electric vehicle adoption is reshaping global auto manufacturing, forcing Western OEMs to rethink costs, portfolios and consumer strategies

As China leads the global EV transition with record-breaking sales and technology advances, Western carmakers face mounting pressure to cut costs, target regional needs and rethink loyalty strategies.

China’s EV boom forces shift in global manufacturing

Electric vehicles (EVs) are no longer a novelty for automotive production. In China, they are now the norm. According to McKinsey & Company’s 2025 Mobility Consumer Pulse Survey, EVs made up around half of all new passenger vehicle sales in China in 2024, with battery electric vehicles (BEVs) leading the way. In stark contrast, EVs accounted for just 21% of sales in Europe and a mere 10% in the United States. The automotive world’s centre of gravity is shifting eastwards, and the implications for manufacturers are profound.

This latest data suggests that the Chinese EV market has entered a phase of “consumer pull,” no longer reliant on regulatory nudges. More than 80% of Chinese respondents said their next car will likely be electric. In Europe and the US, intent lags sharply behind.

Only 23% of Europeans and 12% of Americans expect their next car to be a BEV. Plug-in hybrid electric vehicles (PHEVs) remain more popular in these markets, underscoring the enduring importance of hybrid powertrains in the transition phase.

Regional EV trends reveal diverging paths

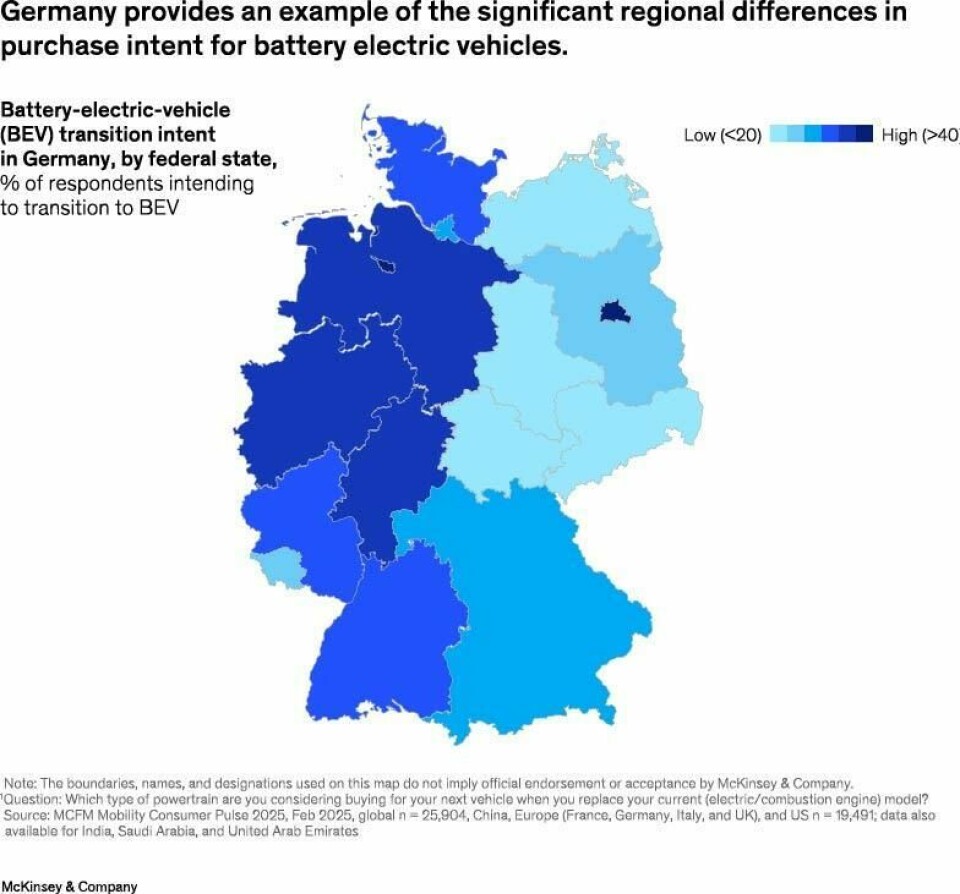

Regional differences have widened in recent years. In Germany, where government subsidies ended in 2023, demand dipped but has since begun to recover. BEV intent now sits at 30%, well ahead of PHEVs at 18%.

In the UK, BEVs and PHEVs are now equally in demand, with 25% and 22% of respondents respectively saying they expect to choose one next. In France and Italy, PHEVs retain a stronger hold, often doubling BEV intent. These variations reflect not only policy divergence but also consumer sentiment, infrastructure, and affordability.

In the United States, the gap is even more striking. While EV sales are growing in progressive coastal states like California - where purchase intent exceeds 50% - they languish below 20% across much of the South and Midwest. In total, only 10% of US new car sales are electric. Urban consumers remain far more inclined to adopt EVs than rural ones. In cities, EV intent stands at 51%; in rural areas, it drops to just 18%.

”Around 35% of respondents said they would not purchase an EV unless it was cheaper than a comparable ICE model. And while some are willing to pay a premium, the majority are not.”

Despite the fragmented picture, one finding remains consistent: those who have owned an EV are far more likely to buy one again. Across all regions, the repurchase rate is high. Most would opt for another BEV, while some favour switching to a PHEV. Fewer than one in ten would return to an internal combustion engine (ICE) vehicle. And fewer still say they will “never buy an EV again” - less than 1%, in fact.

Range, charging and price still block mass EV adoption

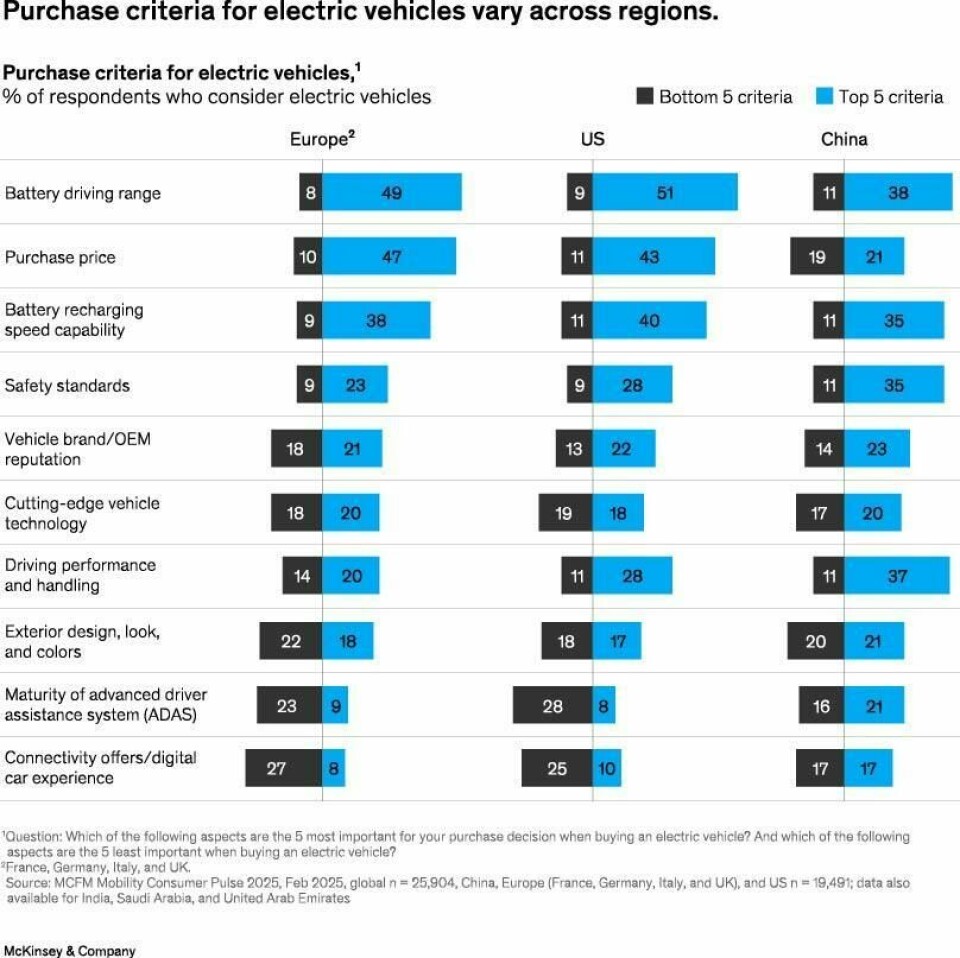

Yet several factors continue to deter new buyers. The most prominent concern is range. When asked what might change their mind, nearly half of all survey respondents cited longer driving range.

The average minimum range required to prompt an EV purchase is now 500 km (310 miles), up from 425 km (264 miles) just two years ago.

That figure drops by about 10% among drivers who already own EVs, suggesting that experience tempers anxiety.

Charging infrastructure remains another sticking point. Many buyers remain wary of long recharging times and insufficient networks. Price is also a sticking point. Around 35% of respondents said they would not purchase an EV unless it was cheaper than a comparable ICE model. And while some are willing to pay a premium, the majority are not. Only a third of consumers globally say they are likely to buy an EV at current price levels. This figure rises to 63% if EV prices fall below those of ICE vehicles, even without subsidies.

Chinese OEMs gain edge through lower EV costs

Such pricing dynamics put Western OEMs under mounting pressure to reduce their cost base. Chinese manufacturers, both new entrants and incumbents, already operate with 30 - 50% lower vehicle costs. This is achieved through streamlined vehicle architectures, integrated battery supply chains, and highly competitive factor costs. If legacy OEMs are to compete, particularly in mass-market segments, they must urgently rethink their design, supply chain and platform strategies.

”In Western markets, interest [in connected vehicles] is growing, especially among younger and urban customers. In China, 66% of consumers say they are likely to buy a car with Level 3 autonomy, compared to just 20% in Europe and the US”

They must also differentiate. Driving range and charging speed remain the battlegrounds of EV product development. Customers now expect 30-minute top-ups on a long trip - and a third expect 20 minutes or less. Today’s BEVs rarely meet this benchmark. Fast-charging capabilities under 20 minutes are limited to premium models with 800-volt systems, and the infrastructure to support them remains patchy. Nonetheless, range remains more valuable than speed. Twice as many consumers are willing to pay for an additional 50 km of range as would pay for a 10-minute reduction in charging time.

ADAS and smart tech raise the bar for brand appeal

Another area of potential advantage is advanced driver assistance systems (ADAS). In China, these features have already become central to brand value, especially for premium EVs. Survey respondents there rank ADAS fourth in importance for now, but expect it to be the top differentiator by 2030.

In Western markets, interest is growing, especially among younger and urban customers. In China, 66% of consumers say they are likely to buy a car with Level 3 autonomy, compared to just 20% in Europe and the US.

Intelligent Connected Vehicles (ICVs) are also emerging as a distinct market segment. These models combine high-range batteries, immersive infotainment, AI-powered voice assistants, multifunctional interiors and advanced ADAS in a single, digitally integrated package. They are already popular in China. In Western markets, excitement is building, but traditional concerns such as price, energy consumption and basic performance still hold sway for the broader base of consumers.

Read more Electrification stories

- Stellantis: too big to fail or too big to be managed?

- Volvo launches EX30 EV production at Ghent plant

- VW’s Bratislava and Pamplona gain strategic production value

- “Pure electrical production is not our goal”

EV brand loyalty is weak: specs now drive decisions

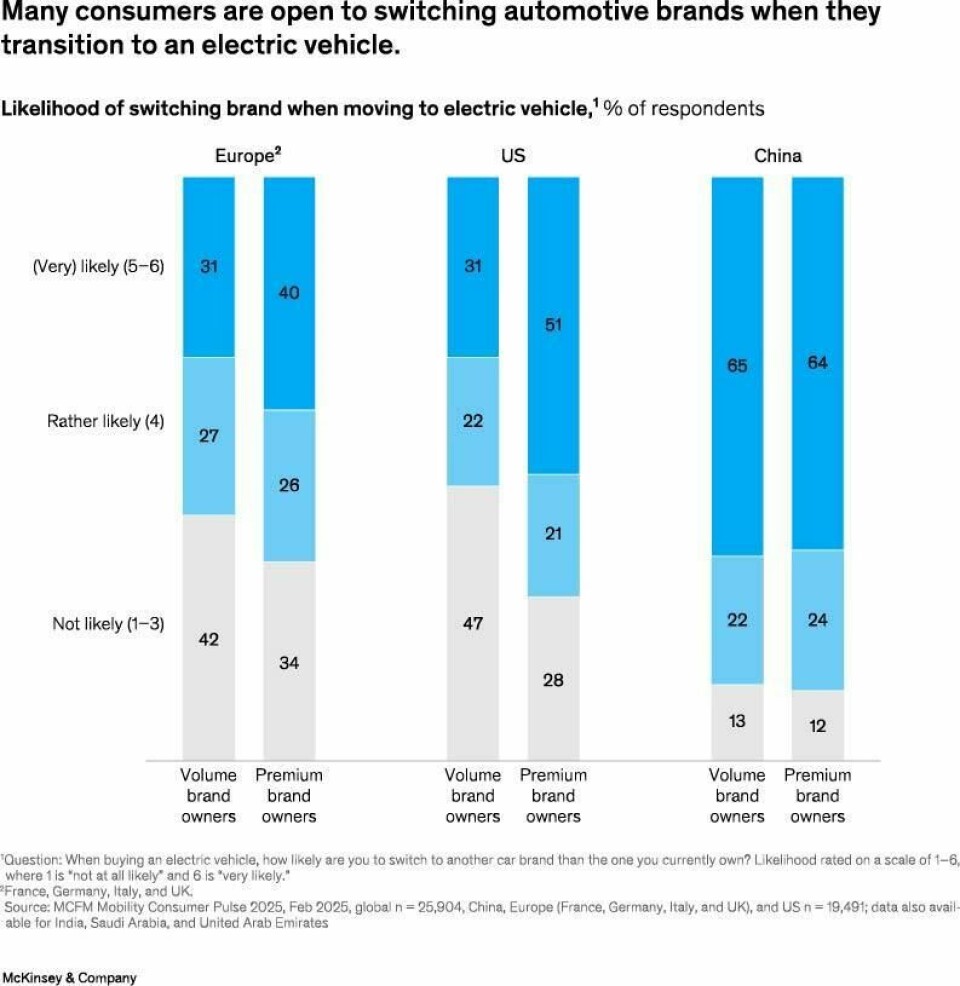

Notably, EV buyers are far less loyal to automotive brands than ICE buyers. In China, nearly two-thirds switch brands when buying an EV. Similar patterns are emerging in Europe and North America, particularly among premium buyers. Brand heritage no longer guarantees customer retention.

Specifications now matter more. Consumers choose the vehicle that meets their range, performance and price criteria - then look for the badge that matches. Without more targeted retention strategies, OEMs risk bleeding market share.

Powertrain extended EVs and portfolio diversity offer a bridge to BEVs

Affordability remains a key hurdle. Many Western consumers continue to expect EVs to cost the same or less than ICE alternatives. China’s market, by contrast, has already reached a point where EVs are frequently cheaper.

There, consumers also value EVs more than ICE vehicles, largely because of the enhanced driving experience. Fast product cycles, a wide model range and aggressive pricing have accelerated the EV transition, reinforcing China’s lead.

To win over hesitant buyers, OEMs might also consider expanding their powertrain offerings to include extended-range electric vehicles (EREVs). Popular in China, these models combine a small petrol-powered generator with an electric drivetrain, enabling 400 to 500 miles (650 to 800 km) of total range - far beyond that of conventional PHEVs.

After being introduced to the concept, many consumers in the US and Europe showed strong interest in EREVs, which could serve as a bridge to full electrification. Their adoption may depend on regulatory frameworks, which remain unclear in some markets, as well as on investment decisions and production complexity.

Western OEMs must regionalise, simplify and invest

As demand becomes more diverse and expectations more nuanced, OEMs must abandon the notion of global EV homogeneity. Customer priorities now vary not only by region, but also by country, city and demographic. Urban and younger drivers seek smart cockpits, seamless connectivity and AI assistants. Older and rural drivers demand longer range, lower cost of ownership and robust infrastructure. Hyper-granular portfolio planning, paired with regional cost and production strategies, will be essential.

The message from McKinsey’s 2025 survey is clear. The electric future is arriving at different speeds across different geographies, but China is already living it. The rest of the world is still negotiating its path. For manufacturers, that means listening more closely to consumers, investing wisely in technology and cost leadership, and preparing for a landscape where loyalty is fleeting and expectations are sky-high.