A divided global electric vehicle market could limit OEM economies of scale in manufacturing

Sales of hybrid and battery electric vehicles are set for significant regional divergence, which could fragment economies of scale across automotive production, R&D and technology costs, according to a new powertrain forecast by Automotive from Ultima Media

Download our global powertrain forecast and report

The automotive industry’s shift to electrification is clear and well known, with vehicle manufacturers already announcing billions of dollars in investments in new products and production of electric vehicles and powertrains.

While the pipeline of EVs is growing across most major regions, a new forecast and analysis by Automotive from Ultima Media suggests this growth will vary significantly across markets and by type of powertrain (download the full forecast and report here). Such variance could challenge OEMs and tier suppliers serving those markets, especially in achieving economies of scale in R&D and manufacturing.

According to Daniel Harrison, automotive analyst at Ultima Media and author of the report, this regional divergence will be driven less by consumer demand, and much more by regulations, notably those aimed at limiting carbon emissions and increasing fuel efficiency, as well as subsidies and tax benefits in favour of low-emission vehicles.

“ Such regulations are only being applied in some regions around the world such as Europe and China, where emissions regulations are forcing automotive OEMs to develop and sell an increasing proportion of hybrid and electric vehicles to meet those emissions targets,” he said.

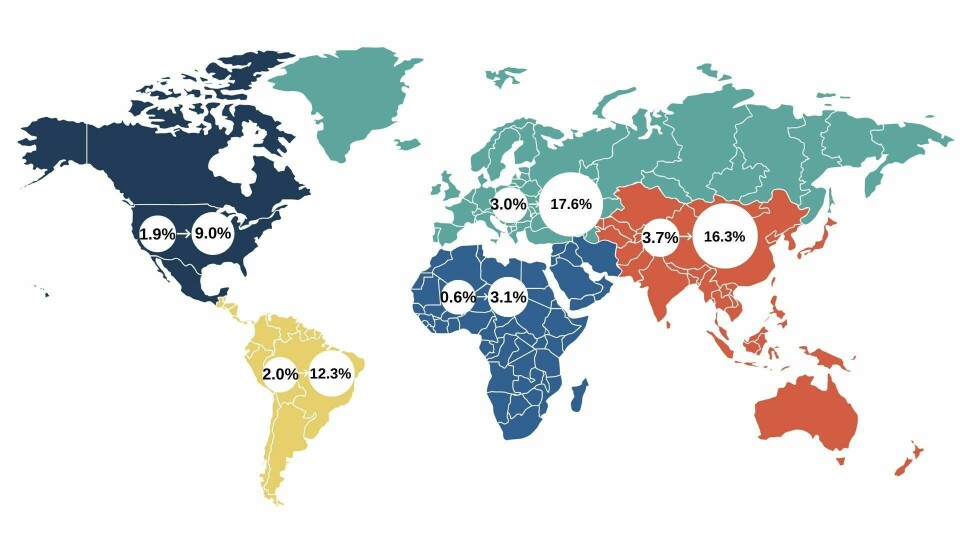

According to the forecast, the differences in EV penetration will be significant across large markets. By 2030, EV sales are forecasted to account for only 9% of annual new vehicle sales in the US, where emissions regulations are laxer than in Europe and expected to be loosened further; in China and the EU, electric vehicle market share is expected to be nearly double at 16.3% and 17.6%, respectively.

For a full forecast on global and regional powertrain to 2030 download our full report here

Researching, developing and bringing to market a new generation of hybrid and electric vehicles requires considerable investment in technology, design, production tooling and equipment. For example, most OEMs have so far used adapted ICE platforms for electric vehicles, but now many are developing specific architecture for EVs, such as VW’s electric MEB platform. Technology compliance costs can also run into the billions of dollars, such as fitting powertrains with a variety of hybrid electric motors. Producing and sourcing batteries and cells is also hugely expensive.

However, most EVs and hybrids are being sold at cost price or even at a loss in an attempt to drive sales and meet emission targets.

Making these vehicles economically viable requires economies of scale to recoup heavy investment. But if hybrids and EVs fail to reach meaningful volumes in important regions like North America, OEMs will face more fragmentation and higher costs than if there were a truly global market.

OEM and supplier investments are also dependant on the whims and changes of governments, putting long-term investments at risk over short-term decisions. In October 2018, for example, the withdrawal in the UK of purchase grants for hybrid and plug-in hybrids led to a sharp decline in sales for these segments. This past summer, the Chinese government also halved purchase subsides for hybrids and EVs and intends to remove the subsidies completely in 2020. Almost overnight, a string of new EV models and startups hit turbulence.

Battery manufacturers could be kingmakers

Despites these uncertainties, EV and hybrid powertrains are expected to see significant growth over the next decade. This will bring huge opportunities for existing and new OEMs to exploit the relatively simple nature of manufacturing EV powertrains, paving the way both for potentially more efficient production methods – as well as disruptive new players, such as US startup Rivian.

For tier suppliers tasked with supplying the new powertrains, there will be considerable opportunities to gain market share with innovative technologies. Battery producers may also become the most critical players in the success of new hybrid and EV models.

“Hybrid and electric vehicle battery suppliers are potentially going to become the kingmakers in an electric future,” Daniel Harrison concluded.