Shaping the future – Developing electric vehicle architectures

In our AMS Evolution Livestream experts from ArcelorMittal and Gestamp tackle EV production challenges and explain how digital tools, new technologies, processes and materials innovations could help solve some key issues

A long list of challenges awaits those entering EV production. Keeping costs down while ensuring vehicle functionality, performance, sustainability, and safety requirements are all met is a simplified summary of the difficult balancing act facing carmakers. Materials experts are developing solutions that could prove vital in tackling these challenges, and as the global EV market climbs in volume, carmakers must look to strengthen their manufacturing capabilities to cater for the growing demand.

In the latest Automotive Evolution livestream by AMS, Paul Belanger, R&D Director North America Gestamp, and Jérôme Favero, Head of Automotive Steel Solutions ArcelorMittal – Global R&D, come together to discuss EV manufacturing and the future that lies ahead.orth America )

From ICE to EV

“When it comes to the vehicle structure, the change from having the engine in the front to having a heavy battery in the floor, the load paths and how you design the vehicle, the dynamics and of course the crash management – it all changes,” says Belanger. “For side impact especially, the structure has to absorb a lot of energy in a very short space.”

Another key challenge regarding the production of EVs is in relation to the battery housing. Belanger explains that many current battery trays have been designed using aluminium extrusions to maximise protection. “For these first generation EVs, OEMs probably didn’t know exactly how to design the trays, what they had to protect, and what the duty cycles were,” he suggests. “So, the designs tend to be very complex and aluminium intensive, and that has driven complexity. Couple this with the fact that the rise of the EV is still relatively new, and there is no track record so we are not exactly sure how they will sell and what the demand will be. There was also volume uncertainty.”

Favero sees the consistent growth in global EV sales as a trend that will continue. As a result, companies that specialise in steel solutions like ArcelorMittal are constantly innovating to provide solutions for the EV market.

“The growth in the EV market will mean that cost competitiveness will become more important,” he states. “On one side, we have the need for competitiveness, but on the other hand we have the technical aspect of EVs. For example, with lightweighting, it is still an important topic for EVs because we still have issues with range, and when it comes to car handling and dynamics – the lighter the car the better. So, there is an important space for advanced high-strength steels and press-hardened steels. If we consider legislation, the other important topic is lifecycle assessment. Sustainability is another key driver for material choices in the EV market, and I think this is another aspect that will push steel. Today, there are some applications for aluminium extrusions, but I think they are still early in development. And if we take the time to design a steel solution, we can be very competitive in terms of weight without having the problems of hybrid assembly. So, I think that steel is in a very good place to provide solutions for the next generation of EVs.”

Time-to-market

As the global EV market continues carmakers will continue expand their electric vehicles portfolios. To do this efficiently and cost-effectively, many are looking to introduce new platforms, but each of these platforms do different jobs. For example, one carmaker may opt for a dedicated EV platform, like Hyundai’s E-GMP or Ford’s GE1, while others may wish to opt for a more flexible platform that can underpin ICE vehicles, hybrids and EVs. Some OEMs may even modify existing platforms that were originally designed for ICEs.

The latter option was chosen by companies that aimed to speed up development times and be ready with an EV several years ago, Favero recalls. BMW’s CLAR platform, for example, was originally designed for pure ICE vehicles, but was tweaked in 2018 for the iX3. Similarly, VW Group’s MQB platform was designed for vehicles using all powertrains, from pure ICE to plug-in hybrid through to BEVs. This allowed the company to be faster when expanding its portfolio to offer EVs.

But there are other ways to reduce time-to-market. Belanger thinks that carmakers need to turn to virtual validation tools to help with more processes. “One of the things we are seeing with newer EV OEMs is that they are disruptors, and they are really speeding up time to market,” he notes. “So now we are starting to see more traditional OEMs adjust their plans to match this speed. How can traditional OEMs shrink their vehicle development times by 30% or more? Virtual validation has been around for some time, but OEMs are relying on it more now. They are using a virtual environment to characterise materials, assemblies and production processes even before they start building tools.”

By planning ahead with virtual validation tools, Belanger believes that carmakers can significantly reduce their time-to-market on new models. He also underlines the need for companies like Gestamp to be involved earlier on in the development phase of vehicles – a factor that is particularly important when considering EVs.

“For us, as stampers and assemblers, we have to validate the processes,” he explains. “We do a lot of forming simulations, and we have to make sure that the material cars that we use accurately represent our production processes. So, we are getting involved earlier to enable DFM (design for manufacturability) – a critical piece to reduce time to market.”

But the use of digital tools for validation, and the need for suppliers to be involved earlier on, are not new ideas. Favero believes these are both important factors in reducing time-to-market but suggests that they are now common practice. ArcelorMittal is instead turning to the use of digital tools to collect data and identify the specific requirements that a vehicle must meet depending on targets. The data gathered by these tools can then inform decisions such as material choices and production process selection.

“Do we need to have CO2-optimised design, a mass-market optimised design, or a cost-optimised design?” Favero asks. “Thanks to some interesting digital tools we can have a much more efficient design approach to target the requirements.”

Component integration

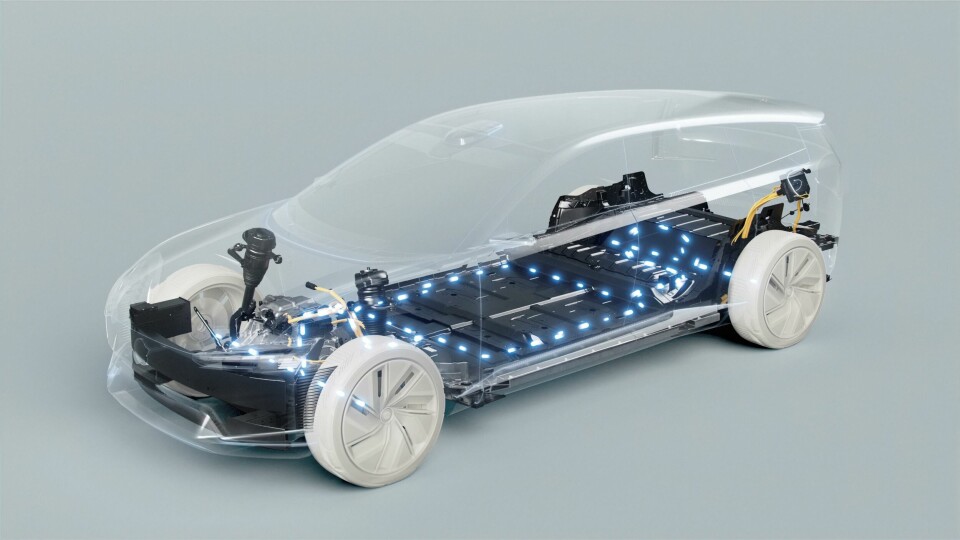

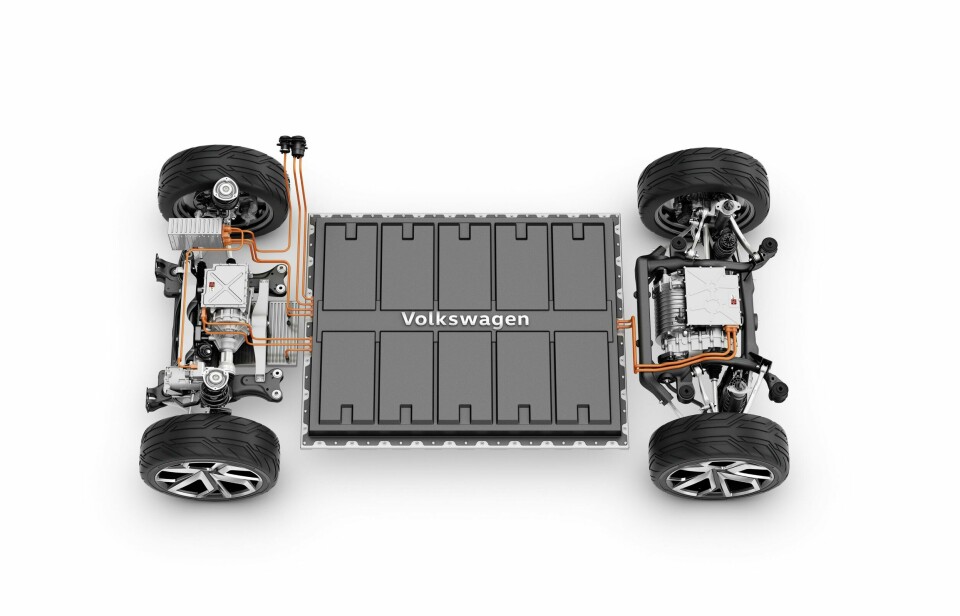

Circling back to the topic of platforms, Favero acknowledges the excitement surrounding so-called “skateboard” platforms. These have already been championed by several carmakers, like the Amazon-owned American electric pick-up and SUV company Rivian and Chinese OEM Geely. The platforms have specially been designed to reduce costs and complexity in manufacturing by integrating the necessary driving components, like the motors and batteries.

“These newer EV OEMs that chose the skateboard style might have done it for business reasons,” Belanger surmises. “It is their technology and IP, but when it comes to the vehicle that they put on to the platform, there is potentially a limited number of options. And some of these companies that have these skateboard platforms might want to build EVs for other OEMs that don’t have the technology. For the legacy OEMs, they are not going in the same direction, and are instead building very specific unibody vehicles that can handle the EV structure.”

Favero agrees, suggesting that it is “very difficult to find the right balance between a skateboard platform approach and a sophisticated design that is adapted for cost and weight optimisation, particularly for passenger cars.” However, for vans or last-mile delivery vehicles, he thinks that the skateboard platform could be enticing. VIA Motors is one company currently developing a skateboard platform for light electric trucks, which it hopes will be highly scalable for a variety of different vehicle sizes and types.

Putting skateboard platforms to one side, another similar focus area that could grow in importance for EV production is cell-to-chassis design – an approach that allows for the battery cells to be integrated inside the vehicle structure, rather than the more common way of adding a separate battery pack to the floor.

Belanger imagines this trend to take off as companies look to simplify designs, thereby simplifying production and saving money. That said, he questions the foresight of this approach, suggesting it could cause problems when it comes to battery servicing and repairability. If the battery is embedded inside the structure of the vehicle, Belanger warns that it may be extremely difficult to extract or access when there is a problem.

Favero seconds this, adding that it could also pose difficulties when considering recyclability. “There is an evolution of legislation around the circularity of EVs,” he says. “The materials need to be recyclable, and having battery packs inside a metal structure will require separation and sorting for recycling. So, the sustainability question is there. We are investigating some concepts, but there is still uncertainty.”

Recyclability is also an issue when it comes to multi-material vehicle designs. This, again, is not a new idea, but one that has been consistently returned to. Companies have experimented with carbon fibre composites and aluminium for several years, and while some use cases are appropriate, both Favero and Belanger think that the production and materials costs associated with multi-material designs and the issues around recyclability will make it difficult to be used in mass-market EVs.

As the conversation leans into multi-material vehicle designs, Belanger introduces the topic of welding. This is another problem that has hindered these designs, as the joining of two very different materials can cause headaches in the production process.

The use of adhesives in vehicle manufacturing has been steadily growing in popularity over the past 20 years, Belanger reflects, allowing carmakers to use a host of different materials in individual parts. “The multi-material approach is driving the use of these methods, and it might be a quick solution, but we think that steel structures will prevail in the long-term for sustainability and cost reasons, and spot welding is the least expensive way to join steel parts.”

When considering EVs, a potential area of development could be the welding of battery packs. Belanger explains that the first-generation battery structures with aluminium extrusions have typically been MIG (Metal Inert Gas) or MAG (Metal Active Gas) welded, but he thinks that seam welding could play a more important role in the future. He also notes that some companies are examining the potential for laser welding but warns that the leak-proof requirement of battery enclosures currently makes this solution unsuitable. “If there is a system with all the vision tools to make a 100% good weld then this could change, but I haven’t seen enough evidence yet to support this approach,” he states.

Additive manufactured parts

Looking further ahead to innovations in EV production, Favero highlights the potential use of additive manufactured parts. “We can separate this into powder-based parts (PBF) and wire-based parts (WAAM). For powder-based parts, we do not see any short- to mid-term applications due to costs. However, wire-based solutions are much more attractive because the deposition rate is already quite high and investment low.”

WAAM works by melting metal wire using an electric arc, creating beads of metal that are layered. The wire used could be sourced from a range of metals, from steel to nickel- or aluminium-based alloys. This raw material is significantly less expensive than the costly metallic powders used in PBF printing.

Favero says that some carmakers may use the same platform for vehicles that have as much as a one tonne weight difference. Heavier cars, he continues, will need to have reinforced structures to meet the same crash requirements. This is where he thinks additive manufacturing and WAAM could play a key role. “By printing some inserts, we could significantly reinforce some strategic areas of the BiW,” Favero states. “And if we look at the cost structure of this kind of solution, it is very positive for high-end vehicles that are produced at lower volumes. The technology has to evolve a little, but it could be a good way of providing solutions in the medium term.”

Belanger takes a more cautious view and suggests that additive manufacturing techniques will be constrained to use in tooling and prototyping. “Our view on AM is that it will play a significant role in tools, more so than in parts. For parts, it can only currently work on ultra-premium niche vehicles in low volumes, and it is hard to see having a cost scale required to enter mass-market vehicle production.”