New chapter, different story?

International expansion continues but, as Ian Henry reports, Audi’s long-term role within the VW Group is now under scrutiny

Audi is expanding globally, notably in China, as it seeks to escape from its recent controversial past. Having been complicit in the diesel scandal affecting Volkswagen Group, it has been hit by a series of significant fines in the US and Europe. In October 2018 Audi received its latest penalty, an €800m fine from German prosecutors connected to offences with its V6 and V8 engines; interestingly, just €5m of the fine was a penalty for ‘regulatory offences’, with the remaining €795m covering the assumed economic benefit Audi had gained from using the offending engines.

Accepting this latest fine, the company said further proceedings will not now be followed through, signalling an end to this sorry saga. However, whether this means merely the end of proceedings in Germany, while leaving the company exposed to further action and penalties elsewhere remains to be seen. VW and Audi have together already paid out around Ä20 billion in fines and compensation payments in the US and it would not be surprising if there were more punishment payments levied in the US in future. While this may be the beginning of the end of the company’s exposure for past misdemeanours, at least in Europe, German and indeed US courts remain likely.

Having been a crucial and close partner of the Volkswagen brand in recent times, using VW platforms and providing its own technology to the rest of the VW group, Audi’s long-term role, especially in R&D, is now under scrutiny. Reports emerged in November 2018 suggesting Audi could be somewhat side-lined as the VW group finalises a new 10-year plan which could see a close tie-up between Volkswagen and Ford. VW Group CEO Herbert Diess is due to unveil the new strategy in mid-November, which is expected to see a major reduction in the leading role of Audi as a development centre for the group.

Provisional plans also include significant co-operation with Ford in LCVs, EVs and autonomous vehicles. The latter area is especially significant for Audi as it has been the technology leader for the group for some time. However, although it has built versions of the A8 with some leading-edge autonomous driving technology, there is a feeling that it is somewhat behind the technology being developed by new entrants such as Waymo. This is one of the reasons behind the new VW strategy and the likely multi-faceted link-up with Ford. However, while details on Audi’s future developmental role within VW await confirmation, there are several major developments in its manufacturing network that are worthy of comment and which will provide the foundation for the brand’s future growth. Audi has two principal factories in Germany, its home plant of Ingolstadt, which has a capacity of around 600,000 vehicles a year, and Neckarsulm which has around a 300,000-units annual capacity.

It also has a 160,000-unit plant in Gyor in Hungary and a plant in Brussels that has been reconfigured to make e-tron EVs at a lower output than the 100,000+ A1s which used to come out of it. The A1 is now made in SEAT’s factory in Martorell, Barcelona.

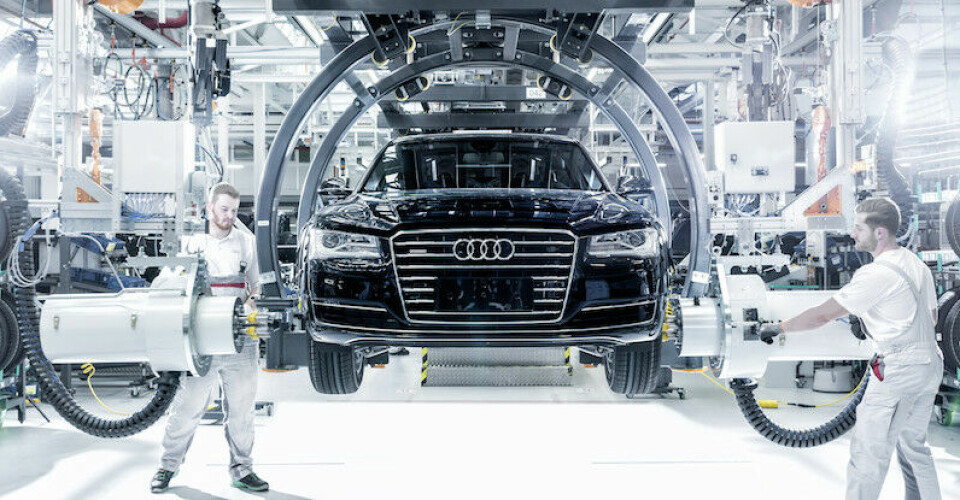

Outside Europe, it has a 150,000-unit plant in Mexico, which supplies Q5 SUVs worldwide, and several factories in China, where its production network is growing rapidly. Major investment has taken place across its manufacturing network in recent years to convert them into ‘factories of the future’, adopting the principles of industry 4.0. The Ingolstadt plant has been at the forefront of this move, with conventional assembly lines having been converted to a modular format, using drones, self-driving forklifts, lasers and robots to a far greater extent than other Audi plants have done hitherto.

Audi has concluded that traditional assembly lines do not work well with the immense variations that are possible across its range. Its solution is a modular assembly line where vehicles of varying complexity and specification are moved automatically by self-driving robots to the appropriate part of the assembly hall for a specific part to be fitted or process to be carried out. In this way low specification models can move more quickly along the ‘line’ missing out fitting stations that are not relevant to it.

While this may mean cars appearing to be moving all over a factory in unusual patterns, Audi claims sensors and GPS technology can monitor where they are to within five centimetres. Alternatively, large modules can be transported to the car – for example in Ingolstadt, 16 AGVs or self-driving robots move heavy air conditioning units for the A3 and Q2 as the vehicles move down the assembly line.

Industry 4.0 techniques are used elsewhere on the Ingolstadt line; for example, a camera system, called CleverKlaus, monitors and sends reports on simple, yet critical tasks such as clipping electronics into doors; a machine called LBR Inline automatically inserts screws for the underside of the vehicle; while the FlexShapeGripper is like an arm that can adapt to the shape and size of the component and refill trays and boxes next to the assembly line. Elsewhere Audi is using drones to deliver parts like steering wheels or other weighing up to five kilogrammes on pre-programmed aerial routes within the factory.

Another interesting technological development at Ingolstadt is the imminent introduction on a production basis of two-tone paint application in a single spray process. This new process avoids the time-consuming and labour-intensive masking process required when two-tone cars are painted. Currently being trialled in Ingolstadt, a production version of the process should be in action during 2019.

Brussels: Leading the environmental charge

In Brussels a fundamental change has taken place recently, with the factory being converted from making 100,000-125,000 A1s to probably than fewer than half that number of e-tron EVs, although Audi will surely be delighted if it can make 100,000+ e-trons in Brussels in future. The first e-tron, an SUV, was shown at the Paris motor show and is now in production, and a Sportback model will be made from mid-2019.

As well as having been reconfigured to make EVs, the Brussels plant has received certification as CO2-neutral for its production processes, with 95% of the energy used coming from renewable sources and the remaining 5% balanced with carbon-offset environmental projects. Specific energy improvements completed for e-tron production include: 30% energy reduction in the bodyshop, where the use of hot water in the climate control system saves 3,500 megawatt hours of energy a year. Photovoltaic cells cover 37,000 sq.m on the factory roof, saving 700 tonnes of CO2; and changes to waste and filtering systems in the paintshop save 50 tonnes of solvents and other waste from being emitted each year.

Production of the e-tron SUV had started on a small-scale basis in September, but by the middle of October its full production launch was delayed for a month. This was because of software updates requiring additional regulatory approval (somewhat unfortunately and rather ironically given the software problems Audi has suffered with diesel engines); in addition, reports have emerged of issues with lithium-ion battery supplier LG Chem, mainly concerned with price negotiations; the batteries themselves are actually made inside the Brussels plant within the former logistics centre. Drive axles (the motor, transmission and power electronics) are assembled in Audi’s Gyor plant.

Hungary: Going electric with SUVs

The Gyor site has long been Audi’s main diesel plant (making around 900 engines a day), as well producing the TT sports car range, the A3 cabrio and the A3 sedan. The A3s are likely to move to Ingolstadt now that the Q3 has been moved from Spain to Hungary, with the Q4 coupe version also expected to be added in the near future.

In addition, Gyor is Audi’s lead plant for electric motor production. Initially it will make up to 400 electric axle motors a day, with the potential for this to be increased in due course. The first of these have gone to the e-tron SUV plant in Brussels and will also be sent to Neckarsulm, which will make the e-tron GT in late 2019 or early 2020 as Audi rapidly expands its EV range. The electric motors and axles are made on a cell-like modular arrangement rather than on a traditional continuous assembly line; as at Ingolstadt, automatic self-driving vehicles or robots deliver parts to the workers at different stages of the modular assembly line.

Gyor has also been testing a range of ergonomic devices to help reduce stresses and strains on employees on the assembly line. For example, it has started using a ‘chairless chair’, a kind of exo- or ergo-skeleton that reduces or relieves strain on workers’ legs and waists.

For the Q3, Audi built a new bodyshop in Gyor, using 700 robots, helping raise capacity to 160,000 units a year; one final assembly line produces all the models made in Hungary (Q3, TT coupe and roadster and, for now at least, the A3 sedan and cabrio). In addition to the vehicle and engine production roles, Audi Hungary is developing its R&D capabilities, with a new centre focused on electric motors and diesel engines set to be operational in 2019/20.

The reason the Q3 has been moved to Gyor is to free up space at Martorell to make the smallest Audi, the A1. This model shares the MQB A04 platform with the SEAT Ibiza and Arona on Martorell’s Line 3, which operates on a two-shift basis, and 500 jobs were created as part of the launch of the Arona and A1.

Mexico: Audi’s first move into North America has a global aspect

Outside Europe, Audi’s newest plant, at San José Chiapa, in Mexico, is now fully operational, supplying vehicles across the globe and parts to Audi China. Production started in September 2016 with the Q5 SUV, which transferred production from Ingolstadt. The Mexican plant was also the first factory Audi had built outside Europe (production of Audis in Brazil or India take place in group sites and in China production is in JV facilities).

The plant made over 158,500 Q5s in 2017 and a similar number should be made this year; 95% of production is exported to the US, Europe and China, which receives CKD kits and parts. Exports to the US move north by rail, with rail also used to move vehicles to the east coast port of Veracruz for shipping to Europe; exports to Asia go through Lázaro Cárdenas on the west coast.

Close by the San José Chiapa plant an entirely new city is being built, a Model City or Ciudad Modelo, it is a master-planned town designed primarily for the factory’s workforce. Before this, Audi had had to bus most of its workforce in from more than 50km away. The factory employs over 4,000, with 10,000 or more jobs created among suppliers, and a total of 69,000 new jobs are expected to be created within the next decade or so, with the authorities hoping than many of these people will live in the new city, which is being designed to house 100,000 people.

The San José plant also uses the same kind of smart techniques used in Brussels, Ingolstadt and other Audi plants. In fact, the Mexican plant was the first Audi factory made operational with the use of virtual, or simulation, techniques. According to Hubert Waltl, Audi’s board member for production and logistics and the chairman of Audi Mexico, using advanced simulation techniques in designing the factory enabled Audi to put the factory into operation 30% more quickly than previously. The complete factory, with press, body, paint and assembly shops was built and made operational in a record three-and-a-half years. It also utilises the most up-to-date digital technology to control the manufacturing process.

There is a supplier park next door, with seven suppliers and logistics providers – Faurecia, Hella-Behr-Plastic Omnium (HBPO), Thyssen Krupp, TI, Truck & Wheel, Kuehne + Nagle and Syncreon – delivering on a sequenced basis into the factory. The plant has over 100 direct suppliers and has seen 60 supplier investments in Mexico, on a mix of brown and greenfield sites, with the Q5 achieving a 70% local (NAFTA) content level.

China: Audi’s most important market

Meanwhile in China, which is where Audi has its longest established overseas operations, the company continues to expand, with existing partners, new partners and in the long term potentially alone. As well as its longest-established partnership there with FAW, Audi is now also working with SAIC, a partner in China for both the Volkswagen brand and also GM, for many years.

In October 2018, work started on a new factory, in Shanghai, where VW-SAIC will build a ‘new energy’, electric Audi in 2020; other Audi EVs are likely to be added in due course. This plant will have capacity of 300,000 upa and will cost 17 billion yuan ($2.5 billion). As part of this development Audi has also bought a 1% stake in SAIC-VW, giving the VW Group an overall 50% stake in the joint venture, having been the minority 49% shareholder since inception.

Audi plans to launch 10 pure EVs in China by 2022, half of which will be made locally. This is part of a plan to double Chinese sales by 2023 from around 600,000 in 2017. Audi’s strategy to grow so significantly has been made in the light of the rapid growth in EV demand, stimulated by the strategy of the Chinese government in large part. But it has also been made possible by the decision announced in April 2018 to reduce restrictions on foreign ownership in China. Specifically, the Chinese government will no longer require foreign car companies to be limited to just two joint ventures in the country, and they will also be allowed to hold 100% of their operations, rather than having to have joint-venture partners. A 100% Audi plant is therefore highly likely in the near future.

Ahead of these EVs appearing, Audi is expanding its conventionally powered SUV range, notably with long-wheelbase versions. The Q5L (produced in a new 150,000 upa plant in Changchun, featuring over 500 welding and painting robots. albeit with a high proportion of Mexican parts sourced on a CKD basis) was launched in early 2018. This has now been joined by the China-only Q2L, which is made at a FAW-Audi joint venture plant in Foshan, a factory that makes both Volkswagen and Audi models.

Audi is also expanding its own vehicle R&D activity in China; by the end of 2023, it will employ as many as 800 in its Chinese R&D operations, up from the current level of 280. Its next R&D and vehicle testing centre will open in the eastern city of Wuxi in the first quarter of 2019. All of these moves are being made under the Audi strategy strapline of ‘In China. For China’ – the brand has recognised the need to increase its presence in the country as it becomes the largest and fastest growing electric vehicle market.

As well as expanding its manufacturing operations in China, Audi is expanding in the autonomous vehicle sector, with a tie-up with Huawei also confirmed in October 2018. This will see co-development of level-four autonomous technology, an approach required because of Chinese security concerns. Whereas China will now allow overseas companies to hold majority or 100% stakes in manufacturing operations, they cannot operate on their own in China in sectors reliant on maps and other security-sensitive information. Hence Audi is working with Huawei and Mercedes is forming similar partnership with Baidu. Developments such as this will be increasingly important for Audi as it seeks to maintain its independence within the growing Volkswagen Group.