Lofty production plans

AMS provides a summary of the latest electrification plans outlined by numerous OEMs across the world

Barely a day goes by without a carmaker announcing the launch of a new electrified vehicle, or outlining projections for growth in the battery electric vehicle (BEV), hybrid or plug-in hybrid electric vehicle (PHEV) segments. A Bloomberg report in December 2017 suggested that more than 100 BEVs would be available within five years, but it would not be surprising for this to be an underestimate. However, the availability of EVs is one thing, but getting consumers to buy them is another. With concerns lingering over the availability of charging facilities, the speed of recharging and the price premium that comes with EVs, it remains to be seen whether or not consumers will accept the new offerings.

Barely a day goes by without a carmaker announcing the launch of a new electrified vehicle, or outlining projections for growth in the battery electric vehicle (BEV), hybrid or plug-in hybrid electric vehicle (PHEV) segments. A Bloomberg report in December 2017 suggested that more than 100 BEVs would be available within five years, but it would not be surprising for this to be an underestimate. However, the availability of EVs is one thing, but getting consumers to buy them is another. With concerns lingering over the availability of charging facilities, the speed of recharging and the price premium that comes with EVs, it remains to be seen whether or not consumers will accept the new offerings.

European governments, notably in the UK and France, have recently stated their intentions to ban vehicles using conventional powertrains by 2030, or possibly later. The anti-diesel movement is gaining momentum as evidence of the health and environmental impact of diesel emissions becomes irrefutable. To date, however, the switch from diesel to cleaner powertrains is slow. In the UK, for example, registration data suggest that either diesel vehicle owners are holding onto their older (and therefore most polluting) vehicles for longer, or if they are replacing them, they are doing so with petrol-powered vehicles.

One of the original selling points of diesel was the benefit it was believed to give in terms of reduced CO2 emissions, while the impacts of NOX and particulate levels was either ignored or not recognised at the time. But as diesels account for a lower proportion of new vehicles sold, the ratio of CO2 tail-pipe emissions is rising once again, even with improvements to petrol engines. For the industry to reduce tailpipe emissions and for urban air quality level to improve, diesel vehicle sales need to be reduced, if not eliminated, and petrol-powered vehicles also need to see a similar reduction in numbers. Wholesale switching to BEVs, or a mix of these, hybrids and PHEVs is required.

In the established European, US and Japanese markets, car companies are developing their own products, mainly independently of each other. In China, the government is playing a key, directional and strategic role in the development of the EV sector. This is not only forcing local OEMs to accelerate their EV offerings, but is also helping suppliers, especially in batteries, to develop market leading positions. For example, Contemporary Amperex Technology (CATL), the biggest battery supplier in China, is investing in new battery production capacity which would place it ahead of Tesla, BYD and LG Korea in terms of volumes. CATL will become the main supplier of lithium-ion batteries for Chinese-made EVs by Volkswagen, BMW and Hyundai, while Japanese companies are also considering using CATL for the EVs they make in China. Before long, the company will also be operating in Europe and North America.

With political pressure to push EVs intensifying, and the rise of China as both a major market for EVs and battery development, how are the vehicle manufacturers responding? Mary Barra, CEO of General Motors, has said the company will sell more than 1m EVs a year by 2026, and will do so profitably. In contrast, the forever optimistic Tesla claims it will sell half a million EVs in 2018, despite failing to hit any of its targets for its supposedly high volume EV, the Model 3. With all this and more in mind, this review summarises the current state of play regarding EVs at the major global automotive companies.

European manufacturers BMW was the first premium vehicle company in Europe to enter the EV market with a dedicated EV platform, beginning with the i3 and i8. Both are built at the Leipzig plant, which was specifically designed for EV production, but neither has been a great success in volume terms. Future electrified BMWs will now be developed in parallel with those that are conventionally-powered, and will also be made on the same assembly lines.

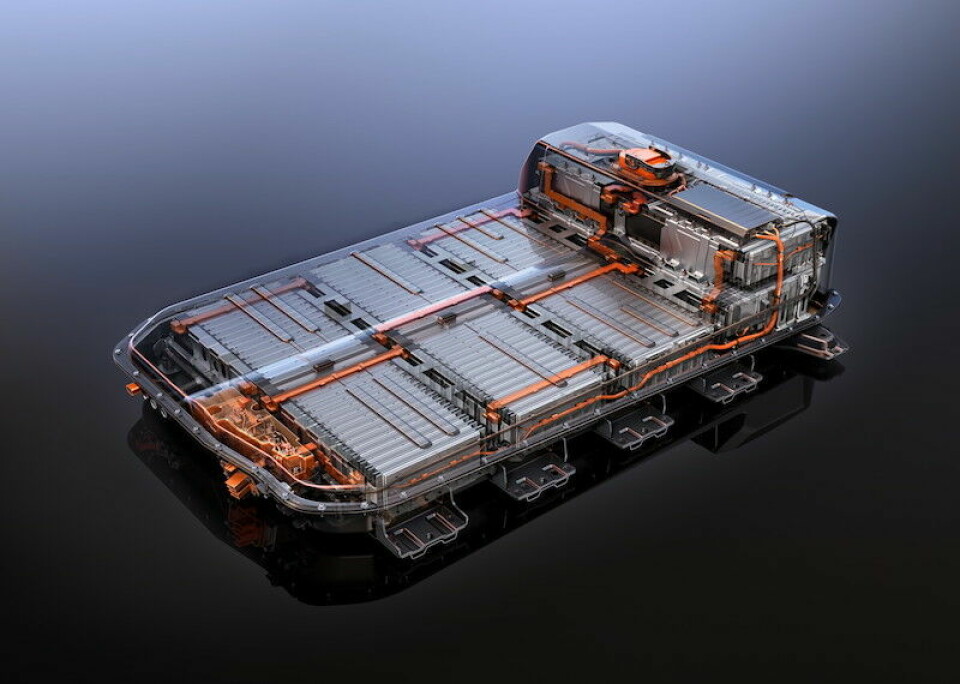

Its largest plant at Spartanburg in the US has been reconfigured to make all core models on the same lines, irrespective of the powertrain chosen for an individual vehicle. Explaining the reasoning behind this decision, CEO Harald Krueger told Automotive News that BMW did not know how the market for EV vehicles would develop, so it had to future-proof its assembly lines by ensuring they can adapt to whatever mix of vehicles the market requires. An existing body shop requires major changes to allow fitting of battery packs into the different shapes of each vehicle’s floor assembly. Moreover, the weight of a battery, which ranges from 400 to 900kgs depending on power, means that assembly needs to be close to the production line to reduce the costs and complexity of shipping.

BMW plans to offer at least 25 electric models by 2025, a mix of full EVs and hybrids. The next X3 and 3-series will be the first programme to offer fully electric options within a mainstream BMW model line, rather than under the i sub brand. The sub brand will remain but will be integrated into the existing model line-up rather than continuing as a parallel set of vehicles; the i3, for example, is now expected to be replaced by an electrified X1, while the much-trailed iNext will likely be the last model to be an independent i vehicle. Future models with an i designation will be variants of high volume models, with an X1i or iX1 likely to appear on the next X1 programme.

Mercedes-Benz has finally made its EV plans clear. In January this year, it revealed it would make EVs in six factories world-wide, accompanied by a global battery and electric motor supply network. The models will be sold with their traditional names, but will also carry the EQ mark – a label created to denote the OEM’s upcoming family of BEVs. The first such vehicle will be EQC – an electrified version of the next C-Class – due for launch in 2019. It is part of the company’s previously announced plan to invest US$11 billion in BEVs, hybrids and PHEVs by 2022.

Like most other vehicle companies with developing EV plans, all Mercedes-Benz models will have an electrified option by 2022. There will be more than 50 such models from the smallest Smart through to the largest Mercedes-Benz SUVs. The EQC will be made at Bremen, while a new battery plant is set to open in Kamenz. The EQC will also be made in China at the Beijing-Benz JBV plant. Other EQ models will be made Rastatt (EQA), Sindelfingen (EQE) and electric SUVs will be produced in Tuscaloosa. As well as its work on BEVs, Mercedes-Benz has been preparing its first fuel cell electric vehicle (FCEV) targeting the mass market for series production. Pre-production versions of the GLC F-Cell were showcased at the 2017 Frankfurt Motor Show, and winter testing is now underway in the harsh conditions of northern Sweden. The assembly of the model will take place at the company’s Bremen plant alongside the EQC.

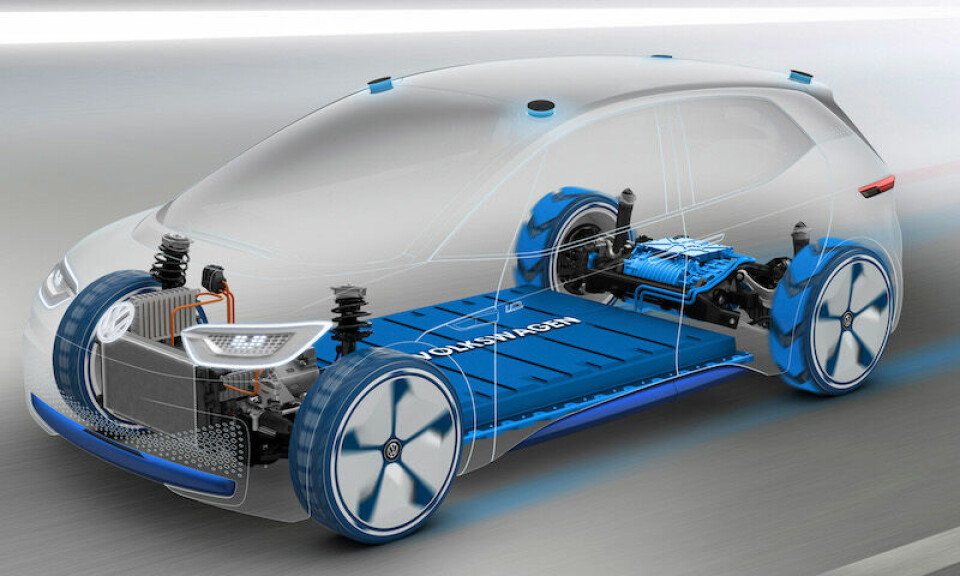

Electrification of the Volkswagen range is essential as the company tries to distance itself from its tarnished diesel history. Significant investment in new all-electric models and in manufacturing facilities is now under way, and the first European plants to make VW’s new EVs will the Zwickau plant in Germany and the Brussels factory in Belgium. The Zwickau plant will make up to 1,500 EVs a day, which equates to around 300,000 a year. Achieving this volume would make it one of the largest EV plants worldwide, and would also represent an increase in the plant’s current capacity of 1,350 units a day.The implementation of the MEB platform and new manufacturing strategy will be undertaken under the leadership of a new e-mobility division, which also covers VW’s involvement in Ionity – a consortium of manufacturers that is currently rolling out a charging network across Europe. In total, the VW Group is investing around €70 billion ($85.49 billion) to bring 300 electric models to market by 2030 across all brands. Part of this is being allocated to a second EV platform, developed by Porsche, for electric sports cars and supercars. Known as SPE, the platform will also be used by Audi and Lamborghini, but will not see the light of day in a production vehicle until around 2025. Ahead of this, a third EV platform called PPE will be the base of premium models for Audi and Porsche.

Jaguar Land Rover (JLR) has just started production of its first all-electric vehicle, the Jaguar I-Pace. It is being made under contract at Magna in Austria, but future EVs will be made in JLR’s own facilities in the UK and quite probably in a new factory in Slovakia, which is due to open later in 2018. The OEM is planning to launch hybrid versions of much of the Range Rover range in the next few years, but it has yet to decide on its manufacturing plans. Press reports from Slovakia during 2017 also suggested that planning permission had been sought for an EV powertrain facility within its new Slovakian plant’s footprint. Meanwhile, in the UK, JLR is planning to build a battery plant near its Midlands headquarters. It also recently promised to electrify all new models under both the Jaguar and Land Rover marques from 2020.

Groupe PSA has been somewhat behind the rest of the market in terms of developing an electrified vehicle range. Having sold Peugeot- and Citroen-badged versions of the Mitsubishi i-MiEV from 2011, it is now applying hybrid and BEV technology to its existing range. As it has chosen to produce these models as versions of its existing line-up, production is being integrated onto existing assembly lines. Electric versions of the Berlingo/Partner will be made in PSA’s plant in Vigo, Spain, in the second half of 2018, while a PHEV version of the Peugeot 5008 and the new Citroen C5 Aircross will come off the Rennes assembly line at around the same time. The same will apply to the smaller 3008 (and Opel Grandland X version) at Sochaux. An electric DS3 Crossback will appear in 2019, and an electric 2008 will follow in 2020. While most OEMs have invested in battery production, PSA will likely use third party battery suppliers. However, it is investing in electric motor production, spending €220m ($268.50m) in a joint venture with Nidec of Japan to make 900,000 units per year in Europe by 2022. Production will be housed in the facilities of French company Leroy-Sommer, which Nidec acquired in 2017. Having control over electric motor production will be essential for PSA and its newly-acquired Opel/Vauxhall brands, as CEO Carlos Tavares has said that all PSA models will be electrified by 2025.

Fiat Chrysler Automobiles (FCA) is currently something of an outlier in the developing BEV market. It simply has no significant offering yet, nor any discernible plans to offer BEVs any time soon. According to its CEO, Sergio Marchionne, FCA is currently staying out of the BEV market because it is not possible to make money in the segment. Until regulatory strictures make it illegal to sell petrol or diesel-powered vehicles, it would seem that FCA will let others develop the technology and then acquire what it needs at the time. However, at an event held in Toronto in May 2017, Marchionne reportedly suggested that most of the Jeep portfolio would be hybridised in the future.

Renault and Nissan were amongst the first vehicle companies to offer BEVs as part of their mainstream ranges, with the Zoe and Leaf respectively. For all the supposed advantages of being first to market, neither model has been a major volume success. The two companies are likely to come under increased pressure with the German brands accelerating their offerings and PSA also entering the market. Initially, Renault had hoped to make as many as 150,000 Zoe models, and to prepare for this, it shifted the bulk of the production of the Clio to Turkey, freeing up space at its Flins plant to the west of Paris. However, Zoe volumes have never reached 50,000 units a year, and to keep utilisation rates up at Flins, production of the Nissan Micra has been transferred from India. Nissan, meanwhile has also seen sales of the Leaf disappoint.

Across the Renault-Nissan-Mitsubishi alliance, 12 EVs will be launched by 2022 alongside a range of hybrid models. Renault-Nissan had focused solely on EVs until recently, but hybrids variants will be offered for all future Nissan and Infiniti models from 2021. There will also be four Nissan and two Infinitis BEVs launched during this timeframe. Important though this will be for Nissan and Infiniti, it still means the brands will have a much smaller EV offering than other volume or premium competitors.

American manufacturers Ford’s plans for EVs are detailed in a feature elsewhere in this supplement (see pages 24-25). Key highlights of the company’s strategy include the launch of 40 electrified vehicles within the next five years, 24 of which will be PHEVs while 16 will be BEVs. The first is a compact SUV to be made in Mexico. Having originally planned to make EVs in the US, Ford has decided to use it Michigan facility, originally slated to make EVs, as the production hub for autonomous vehicles. Like General Motors, Ford also plans to widen its electrified range in China where it has established a 50-50 joint venture with Zoyte.

GM has committed to the EV trend in a major way, and plans to sell 1m units a year by 2026. Crucially, the company is aiming to do this in a profitable manner, and given that no company has made money on EVs so far, analysts are waiting with interest to see how or if the company can actually achieve this. From the details released so far, it would seem that GM’s strategy involves using proprietary battery technology, applied to a low-cost vehicle design, but accompanied by high volume production, most of which will take place in China.

GM appears to be on a path to developing two separate businesses: a conventional vehicle company in the US that makes SUVs and trucks, and a company based in China focused predominantly on EVs. At the heart of GM’s plan is the design of a battery that consumes much less cobalt than existing solutions, the price of which has risen dramatically in recent years. With concerns over the long-term global availability of the material, GM is switching to nickel instead. Long-term, the OEM expects to be able to reduce battery cell production costs by 30%, from around $150 per kilowatt hour to less than $100 by 2021.

The focus on China is driven by government policy. From 2019, OEMs will need at least 8% of their sales to be electrified. As GM sold around 4m vehicles in 2017, it would need more than 300,000 of those to be BEVs and PHEVs, representing a major leap from c11,000 it sold. The company will also offer EVs in the US, with the newest version of the Bolt at the centre of its strategy. The model has a range of nearly 240 miles, which GM believes will greatly increase its market acceptance, despite the fact that many companies are working on EVs with 400-mile ranges. Two more EVs will be offered by 2020, a welcome development, but somewhat behind the model range expansion plans revealed by its German competitors.

Asian manufacturersToyota created the hybrid market with the Prius, and is now planning to develop BEVs. The Japanese OEM wants to sell more than 5.5m electrified vehicles a year by 2030, 1m of which will be BEVs. It hopes to bring 10 of these to market by the early 2020s. Furthermore, every model in the Toyota and Lexus portfolios will either be a full electric model in its own right, or have an electrified option by 2025. The company will start this model range extension in China, followed by Japan, India, the US and Europe.

Hyundai is focusing its EV plans in India, while in Korea it has recently launched an FCEV capable of self-navigating the 190km trip from Seoul to Pyeongchang. This is claimed to be the first time that Level 4 autonomous driving has been achieved with a FCEV. The company plans to launch its first EV in India in 2019, stealing a march on Maruti-Suzuki by a year. According to YK Koo, managing director of Hyundai India, this will mark the first time a foreign car company launches an EV in the country.

The Swedish-based, Chinese-owned Volvo Cars caused a stir in July 2017 when it published a press release titled “Volvo Cars to go all electric”. Inside the release was a bold statement from CEO Håkan Samuelsson, which read: “This announcement marks the end of the solely combustion engine-powered car. Volvo Cars has stated that it plans to have sold a total of 1m electrified cars by 2025. When we said it we meant it. This is how we are going to do it.” Journalists and industry watchers alike scrambled to cover the news, which implied that the company could shy away from the internal combustion engine (ICE) altogether.

However, the OEM was quick to explain that, while it planned to launch five BEVs between 2019 and 2021, it would also bring a range of PHEVs and mild hybrid vehicles to market. To bolster this, it decided to turn its performance arm Polestar into a standalone marque before revealing the Polestar 1 – a hybrid electric vehicle that will be built in Chengdu, China. The construction of this facility, which was purpose-built for the Polestar brand, is scheduled for completion in mid-2018. All models after the Polestar 1 will be BEVs, with the Polestar 2 already scheduled for production in 2019. A larger, electric SUV will follow soon after. Although Volvo Cars is headquartered in Europe, its EV strategy is firmly directed towards the Chinese market, including its production plans.

One of the reasons for starting the transformation of production lines at Spartanburg is that the facility already has some experience in the assembly of hybrids, and therefore an understanding of the challenges associated with integrating batteries into conventional assembly lines. Over 30,000 X5 PHEVs have been made at the plant since 2015, with final battery assembly taking place there too. Spartanburg will be able to make electrified versions of X3, X4, X5, X6, X7 and, should it be required to be made in the US rather imported, an electric 3-Series too.

EV production at Zwickau will begin in 2019, focusing on vehicles made on the new MEB platform. The company’s EV models will be made under the I.D. brand, the first of which will be Golf-sized models followed by a crossover currently known as CROZZ. Finally, a minivan or microbus, currently known as BUZZ, is due in 2022.Coinciding with VW’s extension to its EV range will be the production of the Audi e-tron SUV. The model, which has been dubbed as a challenger to Tesla’s Model X, will be produced in Brussels, and will also come as a VW-branded version. The I.D. EV range, however, is not a strategy exclusive to Europe. Production of EVs under this badge will take place in the US by 2020 at VW’s Chattanooga plant, and will also be built in China. Furthermore, in addition to the I.D. names referred to above, there will be an I.D. Aero model for the US and China.

The EV will likely arrive in India in CKD format for local assembly, but full local production should not be ruled out in the long run. The Kona SUV may well be the chosen vehicle, as it has been designed with an EV powertrain and, what is more, Hyundai’s Indian plants are geared up to making B-segment sized vehicles. The larger Ioniq, for all its technical enhancements and advantages, would likely be too expensive for the Indian market.