Presidential suite

As Donald Trump has entered the White House, Ford has elected to make a number of key financial and strategic changes

Things have changed at Ford in recent times, both financially and strategically. And since November 2016, its strategy has changed still further, with a number of key decisions taking on a clear political hue and tone, which have in turn been largely determined by the newly-incumbent president. Its full year financials for 2016 revealed a significant fall in profits, although its long-time loss-making European arm managed to turn in a $1.2bn profit, with both rising revenue and unit sales. Back in home in the US, however, the election of President Trump has – depending on your interpretation – seen either a coincidental or a consequential change in terms of where new investment will be made and its overall North American manufacturing strategy.

New strategic directionFord’s strategy focuses on three key aims, namely Fortify, Transform and Grow. Fortify focuses on the company’s core pillars, namely US truck and European van sales, increased sales of high priced performance vehicles and Ford Credit, the latter being an especially strong source of profits. In fact, these are the two areas of the business which generate most of the company’s profits. Transform brings in two product areas and one geographic segment, namely luxury and small vehicles, plus improved performance in emerging markets. Finally, Grow centres on three core new technology areas, namely electrification, autonomy and mobility.

More specifically, Fortify means building on the long-established leadership position which Ford has enjoyed in the US for over 40 years with the F-series pick-up in the US and on its current leadership position in Europe’s van market; these positions will be enhanced with the addition of several electric vehicles, beginning with electric versions of the F-series and Transit van; more significantly, Ford will expand its SUV offerings, including new all-aluminium Expedition and Navigator full-size trucks in the US and a range of smaller models for the North American and European markets, as noted below. In addition, there will also be 12 new performance vehicles, including a F-150 Raptor; and production of the GT will be extended to 2020.

The Transform element of Ford’s plan will focus on improving the product offering – and the sales volumes – of the Lincoln range in the US, and boosting the Fiesta and EcoSport SUV volumes in Europe, with the latter soon to be added to Ford’s Romanian factory portfolio. In addition, despite reducing investment in from Mexico (the Focus will still switch production to Mexico but will be supplied from an existing rather than an all-new factory), Ford will continue with plans to import the EcoSport small SUV into the US from India. This is something yet to catch the new president’s attention. In parallel, Ford has exited from the Indonesian and Japanese markets entirely, actions which have turned its ASEAN operations into profit, albeit with a total charge of $80m against Q4/2016 profits. In addition, its strategy for India is being re-evaluated, while new distribution channels are being put in place in the Middle East where Ford still sees significant potential for growth

However, it is in the area of powertrain electrification and autonomy, as well as in new mobility solutions that Ford’s future will really be determined, especially in North America and Europe. Thirteen new EVs will be launched, along with a wider range of EcoBoost hybrid vehicles; meanwhile in Europe it is working on ways to install an ultra-fast electric vehicle charging network, the development of which it would like to share with other vehicle companies. It will have a fully autonomous vehicle – compliant with what are known as Level 4 regulations – on the market in the US by 2021. This will be based on the Ford Fusion hybrids to be made in Flat Rock, Michigan where $700m is being invested in battery and hybrid technologies.

These changes – and new mobility and vehicle sharing options – will be introduced over the next five years or so and their success will go a long way to determine how successful Ford will be as the automotive industry changes from conventional vehicles and sales models into the new world of electric powertrains and radically different sales models which the automotive industry will adopt in the next few years.

Changes in future production locationsDuring the 2016 US presidential election campaign, Ford insisted that it would not change its plans to build a new plant in San Luis Potosi, Mexico, to make the new Focus. At this time, it was planning to transferring production from Wayne, Michigan, to an all new factory which it was in the process of constructing. Within weeks of Donald Trump being elected, however, Ford changed tack and made an about-turn. Along with other major vehicle companies, Ford came under sustained attacks by Trump, especially via Twitter. Whether the resultant changes at Ford and elsewhere are in direct response to the president’s tweets is a matter for debate. What is not in doubt is that Ford has changed its manufacturing plans and these are now much more in line with what the new Commander-in-Chief wants.

In essence, Ford has decided to change the vehicle production and investment allocation for Mexico and increase investment in the US itself. Much of the investment for the US was planned anyway, but had not all been announced. Some of it is certainly new and – apart from cancellation charges for committed investment in Mexico – monies are being diverted, largely to Michigan. In particular, Ford has cancelled the new plant it was building in San Luis Potosi; the same location where BMW is continuing to build its new Mexican plant and from it still plans to import the 3-series sedan into the US. All the same, it will still transfer production of the Focus from Michigan to Mexico; the new Focus will instead be built at Ford’s existing Mexican plant at Hermosillo rather than at San Luis Potosi.

Supporting Trump’s economic policiesOn the international front, Ford’s CEO Mark Fields has also welcomed President Trump’s decision to withdraw from the Trans-Pacific Partnership (TPP); Ford was especially critical of the TPP’s failure to deal with what it saw as the iniquities of currency manipulation by various Asian countries. Despite the end of TTIP, Ford will undoubtedly be concerned about the state of relations between the new administration and China, given the recent growth in the Chinese market and the profits which China has generated, for Ford and indeed GM. Interestingly, Ford had been more enthused with the idea of enhanced co-operation between the US and Europe through the proposed TTIP (Transatlantic Trade and Investment Partnership); this too seems likely to fall by the wayside with the new president’s predilection for his “America First” protectionist approach to trade and economic development.

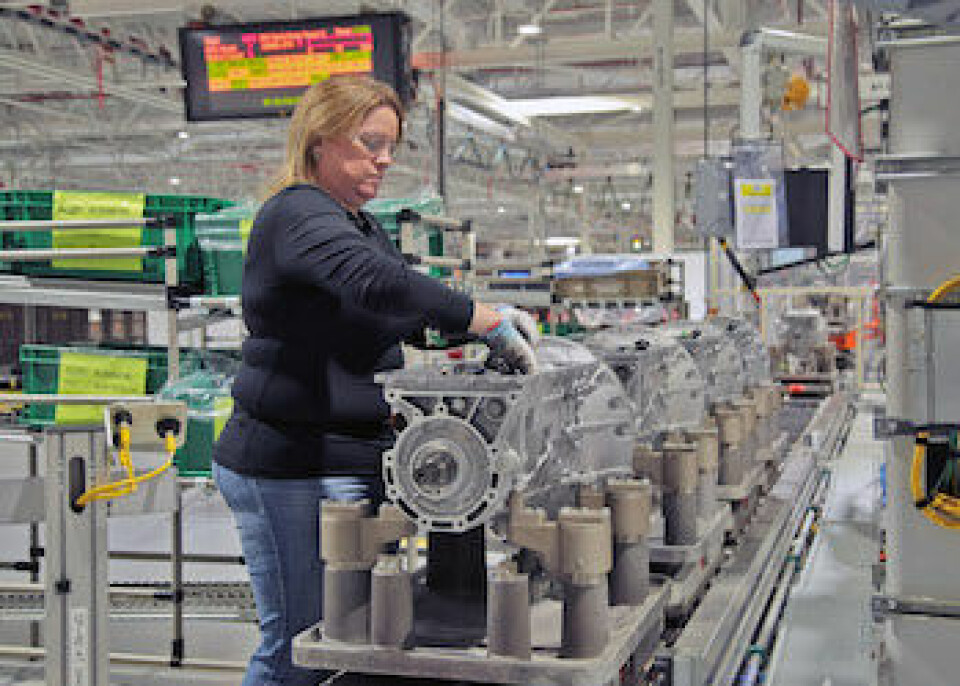

EV production ramped upIn terms of Ford’s US investment, this will see larger and higher value – and crucially – electric and hybrid production take place in Michigan, at the Flat Rock and Wayne factories. While the C-segment/compact Focus will be made in Mexico at the existing factory in Hermosillo, production of the larger D-segment Fusion will switch to Wayne (volumes at each plant are projected to be broadly similar at around 150,000 a year). The Wayne plant will also benefit from production of the next Ford Ranger pick-up and revived Bronco mid-size SUV, both of which are returning to US production – the Ranger has been made in recent times in a joint venture plant with Mazda in Thailand, while the Bronco nameplate has been absent from Ford’s line-up for many years.

Meanwhile the Flat Rock, Michigan plant will take over production of the Fusion mid-size sedan, at a planned rate of 150,000 units a year; this plant, which currently makes only the low-volume Mustang and Lincoln Continental, will also be expanded to produce several of Ford’s planned wider range of electrified vehicles. Interestingly these plans were first announced at the 2017 Las Vegas Consumer Electronics Show (CES) – rather than at the Detroit Motor Show. At the same time, Ford announced 13 new electric and autonomous vehicles, seven of which will be introduced within five years.

Many of these will be built at the Flat Rock, Michigan plant which is slated to become Ford’s electric vehicle centre of competence in North America; vehicles to be made there will include hybrid-electric versions of the F-150 pick-up and Mustang sports car, a plug-in hybrid version of the Transit Connect and a full battery electric SUV. In addition, a revised version of the electric Focus will be launched in 2017, alongside the global launch of the new Fiesta and EcoSport small vehicles and the revised F-150.

Impact of Mexico and pensionsOn a worldwide basis, Ford reported a loss in Q4/2016 much of which it attributed to changes to pension accounting, the costs involved in cancelling the Mexican factory ($199m) and closing operations in Japan and Indonesia ($80m). Even so, the company generated a $10.4bn pre-tax profit for the year, a slight fall on the record figures for 2015. Net profit was $4.6bn, down by $2.6bn, but this still represented an operating margin of 6.7%. It also made a special gain of $150m from the IPO of the casting company Nemak in which Ford had held a stake. The fourth quarter results also included a $3bn charge for pensions). The $200m charge for the cancelled Mexican factory is expected to be the only charge to accounts for this decision.

As in past years, the company’s earnings were strongly driven by its North American operations, where it achieved a 9.7% operating margin, due to strong pricing for its F-Series pick-up and its largest SUVs. And it will be the US market which will largely determine how the new Ford will do, in terms of sales volumes and financial results. In that regard, being able to produce vehicles inside the US profitably for the US market will be crucial; it should not be forgotten that it was the rising costs of US labour, and the refusal of the United Auto Workers union to cut these costs which, in part at least, led Ford – and other vehicle companies – to move vehicle production across the border into Mexico. Moving production back into the US will likely come at a price but whether it is a price US consumers will want or be able to afford is another question.

In Europe, where its operations had long been loss-making, Ford managed to turn in a profit for 2016. In part, this reflects the efficiency and cost-saving programmes which have been implemented and the rationalisation of the production network, notably closing the Genk factory and transferring production of the Mondeo, S-Max and Galaxy to Valencia in Spain. However, no sooner had Ford announced a profit in Europe for 2016 than it was warning that its 2017 earnings would be hit by a currency loss of $600m and possibly more. This is being attributed to the consequences of the UK voting to leave the EU.

Ford says it was fully hedged for Q1/2017, but thereafter it would be fully exposed to the impact of weaker sterling. While warning of currency losses, the company also intimated that it expected Europe to be profitable in 2017, albeit with weaker numbers than in 2016. The new Fiesta (made in Germany) and EcoSport (soon to be made in Romania) will both play crucial roles in maintaining European profitability.

In attempting to explain the currency losses which it now expects, the company highlights how its UK operations focus on making diesel and petrol engines for use in vehicles made outside the UK; significantly, the core engine block and head castings and most of the other components for these engines come from outside the UK, so the fall in sterling translates into a direct increase in costs for the UK operations. There is limited scope to switch quickly to UK sourcing owing to a lack of suitable capacity amongst UK suppliers; and in the current political uncertainty following the Brexit vote, convincing suppliers to invest in new UK production facilities is far from an easy sell.

Ford Romania – a more positive future?For many years the Ford Romania plant in Craiova has been operating well below capacity. Despite many rumours and claims of imminent investment and expansion, until last year’s confirmation that the Ecosport would be added to the plant’s existing portfolio, none of these rumours had come to life. Ahead of the Ecosport going into production on a new assembly line by the end of 2017, production of the B-Max will actually rise, although possibly only on a short-term basis. B-Max output will rise from 250 to 280 units a day from March. Moreover, the increase in B-Max production will mean there are now no planned short time working periods for this factory; such periods had been commonplace in the last few years; and, in even better news, the Ecosport going into production in Romania will mean another 1000 jobs at the factory. European EcoSport models are currently supplied from India.

Ford is investing €130m in the plant for Ecosport production which is scheduled to remain in production there through to 2025 at least. Along with Romanian state aid of €75m, total investment by Ford in Craiova will have reached nearly €870m by the time Ecosport investment is complete. Of the €130m new investment, €100m is for the car production line, with €30m for the engine facility. The Romanian government expects cumulative production by the end of 2017 reaching 1.5m engine and 810,000 cars.

Recall problems cast a shadow over ValenciaWhile Ford Valencia has done well in recent times and benefited from the transfer of production of the S-Max, Galaxy and Mondeo from Belgium, one of the other models made there – the Kuga SUV – has recently been subjected to a recall in South Africa owing to engine compartment fires on the 1.6 litre version, specifically on models made between December 2012 and February 2014; this affects just 4,000 vehicles for now, a volume which pales into insignificance compared to the 400,000 Escape models recalled in the US (the Kuga is sold as the Escape in North America). The Spanish built models will have a new cooling system fitted and receive updates to the engine software.

Investment in artificial intelligence takes Ford in a new directionLike all other major car companies, Ford is looking at a range of new technologies, especially in autonomous driving. As part of its growing presence in these new technologies, it will invest $1bn in artificial intelligence company, Argo AI. This investment will be used to develop a virtual driver system for Ford to use in its first autonomous vehicle which is due to be launched in 2021. Argo AI is a new company, founded by former Google and Uber executives and will have more than 200 engineers working on this topic by the end of the year, spread across sites in California, Michigan and Pennsylvania. In the long run, Argo AI will most likely license its technology to other vehicle companies, but for now Ford has exclusive access to the Argo AI systems.