In what may be a portentous move for the industry, Hyundai has chosen to try to revive its domestic fortunes by opening the first new car factory to be built in Korea for over 20 years; what is intriguing about this move is that the workers in this plant will be paid 40% of the wages paid to workers in other Hyundai factories.

In what may be a portentous move for the industry, Hyundai has chosen to try to revive its domestic fortunes by opening the first new car factory to be built in Korea for over 20 years; what is intriguing about this move is that the workers in this plant will be paid 40% of the wages paid to workers in other Hyundai factories.

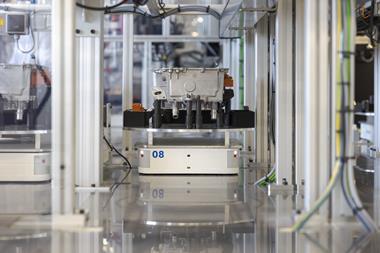

The new plant, in the city of Gwangju, 330kms south of Seoul, is due to open in 2021, with a capacity of 100,000 units a year; the factory will make mini-SUVs, marking Hyundai’s return to the mini-car market which it left when it stopped making the Atoz more than a decade ago. Its sister company, Kia, will be somewhat perturbed by this, having had the Korean A-segment to itself since then; Kia also has a plant of its own in Gwangju which makes the Soul and Sportage among other models.

The new factory is approved by the national government and will involve investment by the local government, which will take a 21% stake; Hyundai itself will take a 19% stake, while the balance will be taken by local investors, from both the private and public sectors. A total of 700bn Korean won (US630m) will be raised for this, with the scheme dependent on the whole sum being raised at the outset.

This project was first reported some time back. Towards the end of 2018 it looked as though it was not going ahead, but union agreement was, surprisingly perhaps, reached. The low wages agreement will last until at least 350,000 units have been made, or up to five years into the project. Workers in the meantime will have their low pay ameliorated by other benefits, namely subsidies housing, education and healthcare provisions.

Korea’s powerful trade unions had not been in favour of this development but appeared to have been won over as a means of creating jobs, addressing rising unemployment and because the scheme has been partly promoted as a way of repatriating jobs to Korea, reducing the threat of rising vehicle imports. The factory is expected to generate up to 12,000 jobs across the regional economy, in the factory itself, the supply chain and supporting industries.

More significantly, from a political angle, the Korean government intends to promote at least two similar schemes in other cities, namely: Gunsan (where GM operates its only remaining Korean factory where employment has been cut significantly in recent years) and Gumi, another major industrial city, home to component suppliers such as LG and Elring Klinger.

Korea’s economy has been suffering from the export of manufacturing jobs to lower cost economies in recent years; for example, Hyundai had moved production of its A-segment i10 to India (and later Turkey) to make these vehicles more competitive in their export markets. The decision to try to revive declining domestic industrial regions by establishing new factories with effectively state-subsidised jobs is an interesting take on central government supported economic revival strategies. Could this be the forerunner of similar moves in other developed world economies which have seen huge swathes of traditional economic activity and employment sacrificed at the altar of sourcing from the lowest cost location, globally?

The idea of repatriating low cost jobs is certainly a novel solution, but whether that would be allowed or deemed acceptable in Europe or the US is an interesting question.